Bundles13 July 2018

In case you missed it: The trade war is on

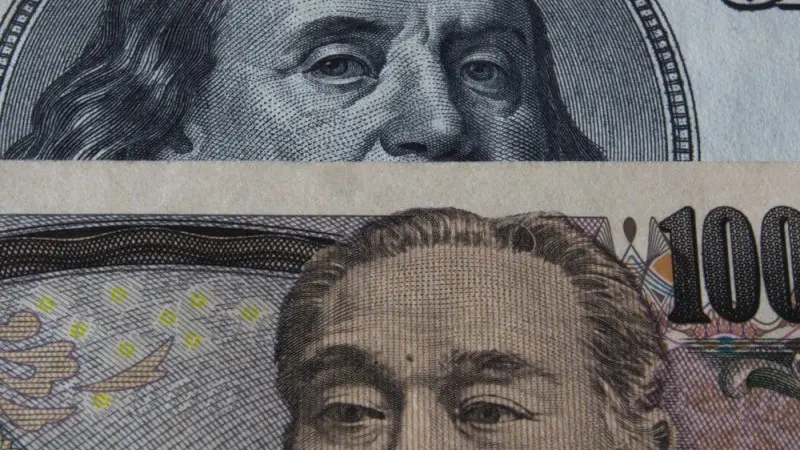

Metals have been hit hard, the world’s favourite safe haven currency – the yen drifts towards its lowest levels of the year, and China potentially considers 'qualitative' retaliation as the trade war escalates. Here's everything else we've been thinking about