Malaysia: Trade surplus hits six-year high

Data supports expectations of strong and steady GDP growth, but nothing matters more for the markets than politics ahead of next week’s general elections

| MYR14.7bn |

March trade surplusA six-year high, above consensus |

Weak imports boost trade surplus

Malaysia’s trade surplus surged to a six-year high of 14.7bn Malaysian ringgit (MYR) in March as imports contracted more than expected by 9.6% year-on-year, while exports rose in line with consensus by 2.2%. Electronics and commodities continued to be the main drivers of Malaysia’s trade growth. The cumulative surplus in the first quarter of the year more than doubled to MYR 33.4bn from a year ago. However, the 5.8% export growth and -0.8% import growth in 1Q18 represent a sharp slowdown from 21% and 28%, respectively, from a year ago.

Still strong trade growth in USD-terms

The authorities report trade data in local currency terms. And the sharp slowdown in trade growth so far this year reflects the high base effect and the price effect from a significant currency appreciation over the year rather than any underlying weakness. The average exchange rate of the MYR against the USD appreciated 13% YoY to 3.92 in 1Q18. Offsetting some of this is the continued upswing in global commodity prices and electronics demand.

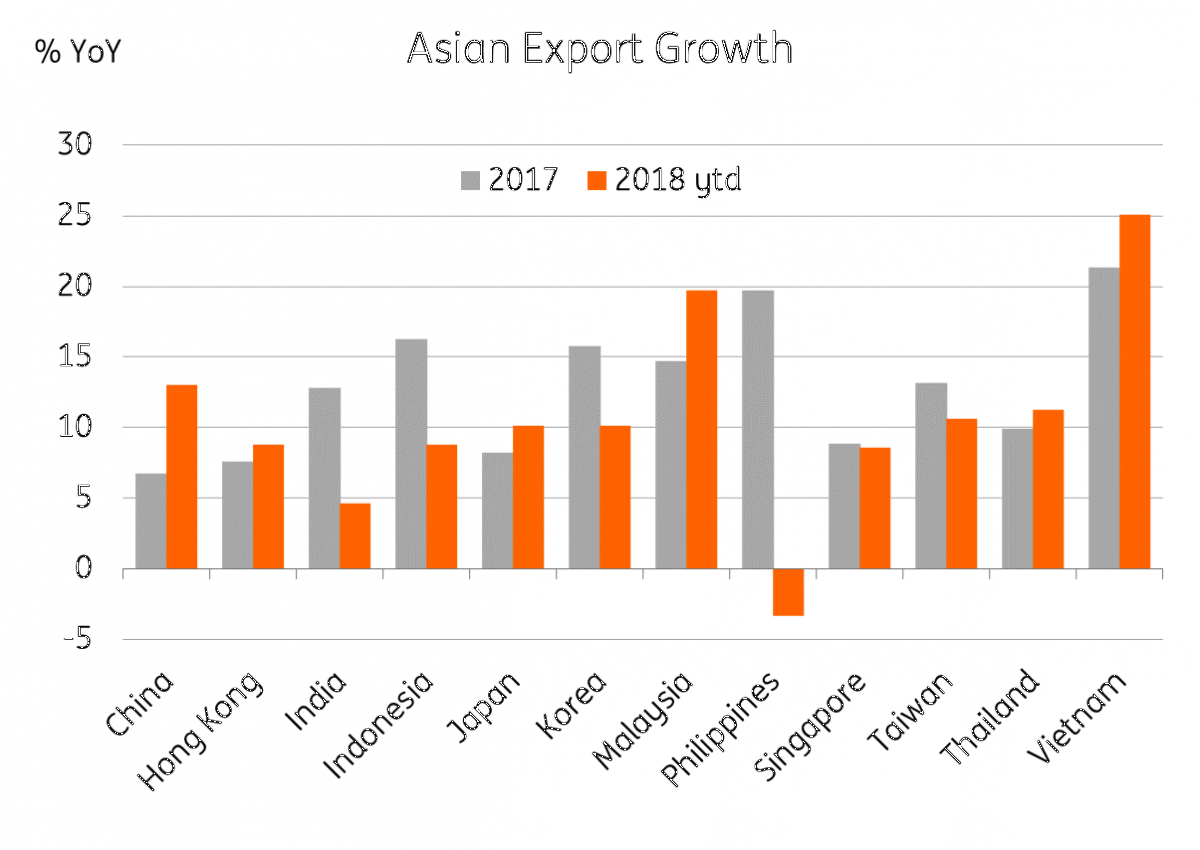

After converting to US dollars, export growth of 20% in 1Q18 was the second best in Asia (after Vietnam’s 25%, see chart), and up from 14% a year ago. Almost half of this was from electrical and electronics exports, while commodities including natural gas, crude petroleum, petroleum products, and palm oil contributed three percentage points of total export growth. Import growth in USD terms slowed to 12% from 21% over the same period, and the trade surplus doubled to $8.5bn from a year ago.

Strong economy, strong currency

The wider trade surplus indicates an improved net export contribution to GDP growth in 1Q18, while election spending continued to support domestic demand. We consider our forecast of 5.6% YoY GDP growth in 1Q18 (a slight slowdown from 5.9% due to the high base effect) subject to more upside than downside risk (data due 17 May).

| 5.6% |

GDP growth forecast for 1Q18ING |

Malaysia’s growth-inflation dynamics continue to favour a stable macroeconomic policy. Election jitters will keep the central bank (BNM) from altering policy at the next meeting on 10 May. We retain our view of monetary policy normalisation with one more 25bp BNM policy rate hike in the third quarter, once the political jitters lift. We have revised our end-2018 USD/MYR forecast higher to 3.84 from 3.72 a month ago (spot 3.93, consensus 3.81).

Tags

MalaysiaDownload

Download article

7 May 2018

Good MornING Asia - 7 May 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).