Malaysia’s June manufacturing beats forecast

Industrial production growth is still in negative territory but was far better than anyone was expecting. That said, our view of an 8.3% year-on-year GDP contraction in the second quarter remains at risk of a downside miss

| -0.4% |

June manufacturing growthYear-on-year |

| Higher than expected | |

Exports boost manufacturing in June

Following a surprising export rebound in June, Malaysia's industrial production for the month turned out to be a huge upside surprise as well.

Although still slightly negative at -0.4%, the year-on-year production growth was far ahead of -10.4% YoY consensus median and it represented a marked recovery from -21.6% in May. Export growth accelerated to +8.8% YoY from -25.5% over the same months.

The easing of the Covid-19 lockdown lifted economic activity in June. However, the base-year effect imparted more volatility to year-on-year growth rates. The base effect was favourable for exports but not so for IP. Yet, their month-on-month bounces, 26% in IP and 32% in exports weren’t far apart.

Also released with IP data, June manufacturing sales growth accelerated to +4.1% YoY from -19.8% in May. Growth of manufacturing employment and wages continued in negative territory, though at -2.2% YoY and -2.0% YoY respectively they were less negative than in May.

A steepest economic contraction since the 1998 Asian financial crisis

What does this mean for 2Q GDP?

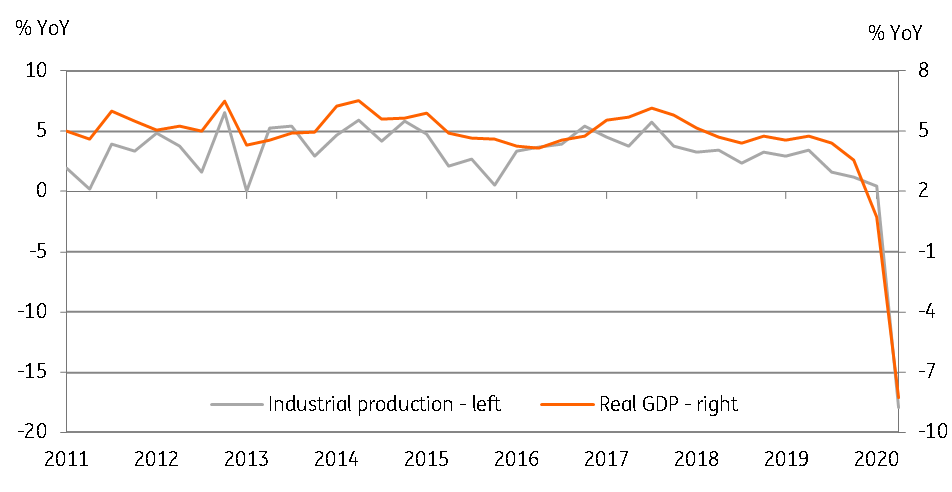

The recovery in June wasn’t enough to offset huge losses in the previous two months and the average industrial production for the quarter is still 17.9% lower than a year ago. IP growth tracks real GDP growth, as you can see in our chart below. But it’s not just manufacturing that matters for GDP growth; services probably took an even stronger beating from the Covid-19 lockdown.

As such, our view of an 8.3% YoY fall in GDP in 2Q appears to be at an asymmetric downside risk. We aren’t ruling out a double-digit GDP contraction as in some of the Southeast Asian neighbours. 2Q GDP data is due next Friday, 14 August.

The recovery in June wasn’t enough to offset huge losses in the previous two months

We think markets have almost become indifferent to downside GDP growth surprises from around the region and they are unlikely to be perturbed if Malaysia’s growth numbers follow a similar path. Rather, the focus is now shifting to what shape the recovery is going to take. And that remains uncertain as the global pandemic is showing no signs of subsiding just yet and this will weigh on key economic drivers of exports and tourism for some time to come.

We see no end to the negative GDP trend for the rest of the year. And, with inflation continuing to be negative as well, the doors will remain open for some more monetary easing from the Bank Negara Malaysia, the central bank.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article