Malaysia’s GDP beats estimates

Absent a significant hit from the global trade war or a shock from commodity prices, we expect Malaysia’s GDP growth to settle in a 4-5% range on our forecasting horizon. We maintain our view of no change to central bank (BNM) policy this year

| 4.7% |

4Q18 GDP growthYear-on-year |

| Better than expected | |

Net trade boosts GDP growth in 4Q18

Malaysia’s economic growth gained some momentum from improved exports in the final quarter of 2018. GDP grew at 4.7% year-on-year in 4Q18, more than expected, and up from 4.4% growth in the previous quarter. Even as the seasonally adjusted quarter-on-quarter growth eased slightly to 1.4% from 1.6% over the period, it was still a better performance compared with the consensus estimates of 4.5% YoY and 1.3% QoQ.

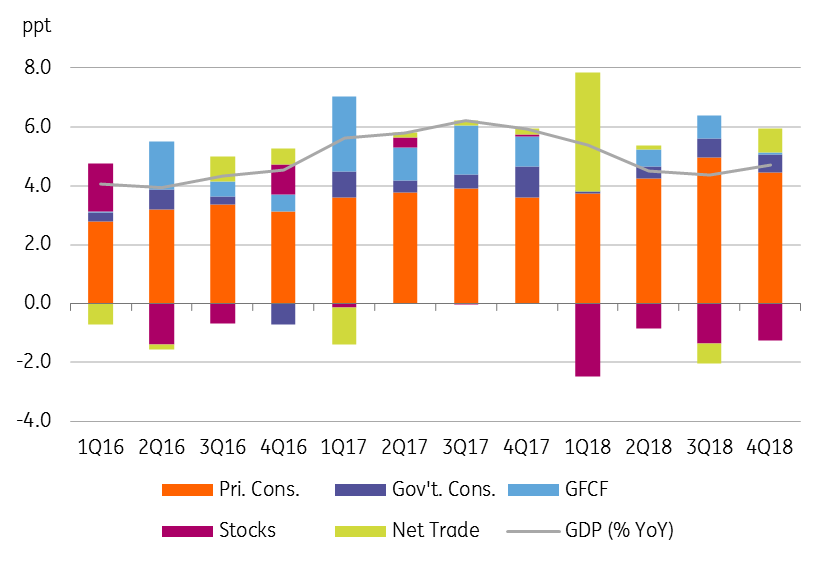

As expected, most of the uptick in GDP growth came from net trade, contributing 0.8 percentage points (ppt) to headline growth in 4Q18 - a reversal of the 0.7% drag in the previous quarter. Unsurprisingly private consumption remained the main GDP driver with a 4.5ppt contribution - slightly smaller than the 5ppt registered in the previous quarter. We credit populist policies, steady and strong wage growth as well as low inflation for strong consumer spending. That said, ongoing fiscal constraints and suspension of some big-ticket investment projects weighed down government consumption and investment spending.

On the industry side, manufacturing and services remained the main GDP drivers albeit with some moderation in growth, which was more than offset by improvements in agriculture and mining output.

Where GDP growth is coming from?

Growth and policy outlook

In response to their tighter fiscal stance and the impact of global trade tension on the economy, the government recently downgraded their GDP growth target for the remaining years of the 11th Malaysia Plan (2016-2020) by half a percentage point, from 5-6% in the original plan to 4.5-5.5%. Full-year 2018 GDP growth of 4.7% is within this range. While the slowdown from 5.9% is sharp, we view this as more of a return to a normal growth path, rather than a material slowdown. To us, Malaysia looks more like a 4-5% GDP growth economy rather than 5-6%.

Against a backdrop of expected low inflation for most of 2019, we believe the central bank (BNM) will assess economic risks as fairly balanced and will leave monetary policy on hold throughout the year. A softer US dollar after dovish comments by the US Fed Chair and firmer oil prices support the currency (MYR). We see the USD/MYR rate hovering around 4.10 for most of the year (spot rate 4.07).

Download

Download article

15 February 2019

Good MornING Asia - 15 February 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).