Malaysia: Wider external surplus is positive for ringgit

A continued widening in external trade and current account surpluses this year is positive for the Malaysian ringgit (MYR), but the persistent global trade uncertainty is negative. The positives may outweigh the negatives to sustain the scope of the continued MYR outperformance

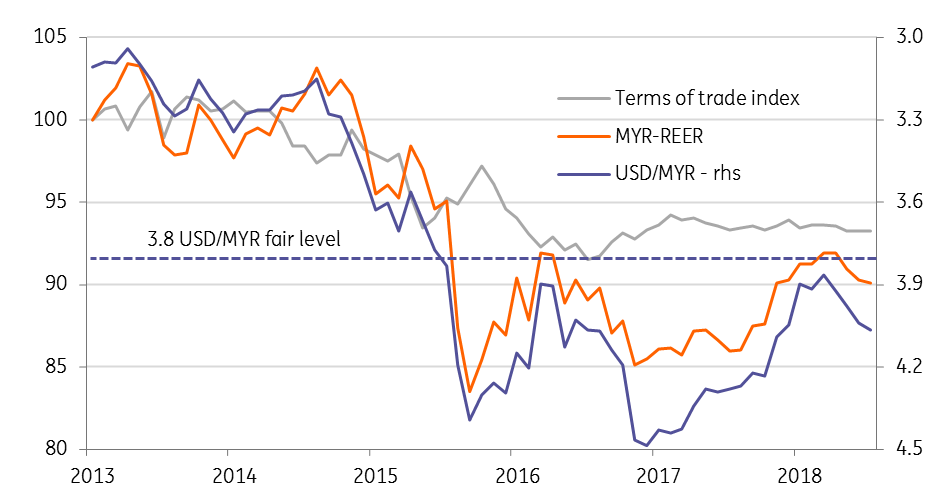

The Malaysian authorities, especially Prime Minister Mahathir, view 3.8 as the fair level for the USD/MYR exchange rate. Just as the pair was going to get there earlier in the year global trade war tensions started to escalate. That persistent uncertainty will undoubtedly remain a forceful tailwind for higher USD/MYR going forward, which is driving our view of USD/MYR trading toward 4.35 by the end of the year. However, Malaysia’s positive external payments situation sustains the scope for the currency outperformance which imparts a downside risk to our end-year USD/MYR forecast (spot rate 4.08).

| 7.6% |

Malaysia exports growth in JuneYear-on-year |

| Lower than expected | |

Downside trade surprise in June

Malaysia’s trade growth in June surprised on the downside, with MYR-denominated exports rising by 7.6% year-on-year and imports by 14.9%. While these were slower than the consensus forecasts of 10.3% and 15.3% respectively, the pace was still faster than 3.4% for export growth and 0.1% for import growth in May.

In the exports category, the commodities cluster (crude petroleum, petroleum products, liquefied natural gas, and palm oil) slowed sharply to a 3.4% YoY fall from over 10% growth in May. Acceleration in electronics exports led by the semiconductors, which was up 21% YoY from 13% in May, saved the day. Imports of electronics, most of which are processed for re-exporting, and chemicals helped the acceleration of total import growth.

| 61bn |

Malaysia trade surplus in 1H 2018 (MYR)Up by MYR 18bn from year ago |

Widening trade and current account surpluses

The outpacing of import growth over export growth was associated with a lower trade surplus in June of MYR 6.1bn than MYR 8.1bn surplus in May. Yet the cumulative trade surplus in the first half the year of MYR 60.6bn was MYR 18bn higher than the level a year ago. This came on the back of a sharp slowdown in the year-to-date export growth to 7.0% YoY and import growth to 3.4% from 21% and 23% respectively 12 months ago.

The wider trade surplus boosted the annual current account surplus to MYR 40bn in 2017 (3.0% of GDP) from MYR 30bn (2.4% of GDP) in the previous year. We forecast a further widening in the current surplus this year to about MYR 50bn (3.5% of GDP). The higher trade and current account surpluses are positive for MYR, and together with relative undervaluation (see figure) these underpin the MYR’s continued outperformance this year; the 0.7% year-to-date depreciation against the USD was the least among Asian currencies.

USD/MYR's recovery toward 3.8 fair level is stalled

Download

Download article

6 August 2018

Good MornING Asia - 6 August 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).