Malaysia: What’s happening to the ringgit?

We believe the latest selloff in Malaysian government bonds and the ringgit (MYR) is overdone. We maintain our end-2019 USD/MYR forecast of 4.05

What lies behind the latest market sell-off?

The downward pressure on Malaysian government bonds and the currency since mid-March intensified this week after a warning on Monday by FTSE Russell of the possible exclusion of Malaysian government debt from its World Government Bond Index. The index provider cited worries about market liquidity. This came on the heels of an announcement by Norway's sovereign wealth fund that it would cut its holdings of Malaysian and broader emerging market debt from its portfolio.

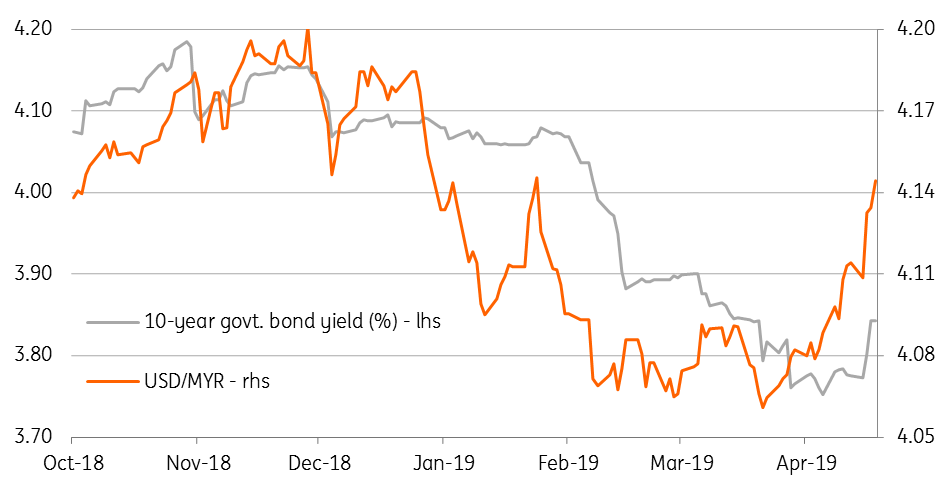

The 10-year bond yield is up seven basis points this week and the MYR has depreciated 0.9% on fears of foreigners potentially dumping most of their holdings of Malaysian government bonds.

10-year bond yield vs. USD/MYR rate

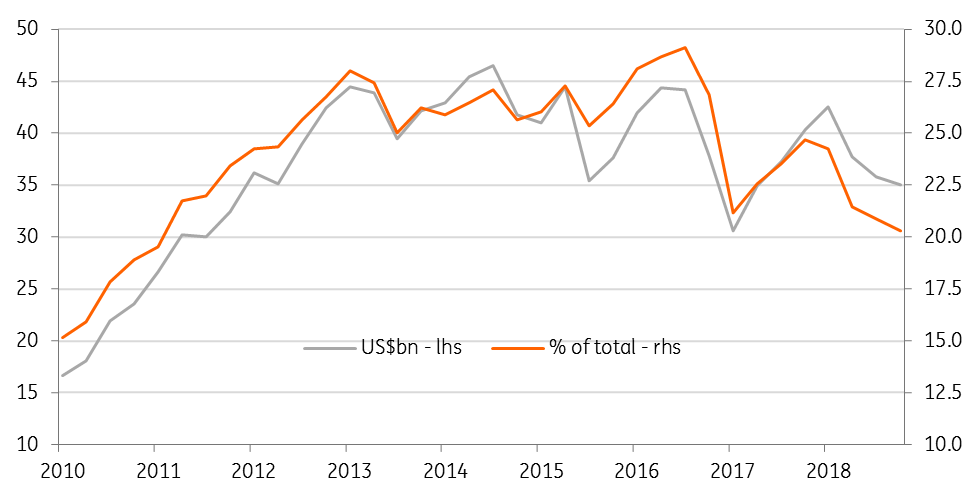

Falling foreign holdings of Malaysian debt

Based on figures from the central bank (Bank Negara Malaysia), foreigners have been steadily reducing their investments in Malaysian government debt in recent years.

As of end-2018, they owned $35 billion worth of MYR-denominated government securities or about 20% of total outstanding MYR–denominated government debt. This share has fallen from 29% in 2016.

Foreign holding of Malaysian government securities

Selloff looks to be overdone

Nothing has changed in Malaysia’s economic fundamentals to warrant such a sudden shift in investor sentiment.

Growth continues to be softer, in keeping with a broader global trend. The economy posted negative inflation in recent months (-0.7% year-on-year in January and -0.4% in February), thus paving the way for a BNM policy easing. The BNM has recently signalled continued policy accommodation. We believe a rate cut is more likely than not at the next meeting on 7 May. As such, the current economic trends have been government bond-friendly, even as weak public finances and a high level of public sector debt remain a long-term negative.

As for the currency, Malaysia’s external payment position remains sound, with a current account surplus at 2-3% of GDP sustaining the MYR's appreciation. This is further supported by the currency's prevailing undervaluation on a real effective basis. Among other things, a softer US dollar environment and rising global oil prices also help.

Such a backdrop leads us to a view that the current sell-off in both government bonds and the currency is overdone. We maintain our view of the USD/MYR trading to 4.05 by end-2018 (spot 4.15).

Speculators beware

Prime Minister Mahathir Mohamad, well-known for his erstwhile policy of capital controls, has wasted no time in warning the speculators.

Malaysia cannot allow the market and ringgit to decline and depreciate further due to attacks by currency speculators. - Dr. Mahathir

Earlier this week, local media quoted him saying, “Malaysia cannot allow the market and ringgit to decline and depreciate further due to attacks by currency speculators” and “If we are not careful, an economic crisis can recur”. We view Mahathir’s warning as mere verbal intervention, nothing heralding another round of capital controls or the fixed exchange rate regime under him. He has downplayed such a risk after assuming power a year ago.

Download

Download article18 April 2019

In case you missed it: China to the rescue? This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).