Malaysia: Supply shock dents GDP growth in 4Q19, though demand wasn’t a problem

It’s not going to be too long before demand takes a hit from the rapid spread of Covid-19. We cut our 2020 growth forecast to 3.5% from 4.5%. We now see an additional 50 basis points of central bank rate cuts by mid-year. The data should also expedite rollout of the fiscal stimulus

| 3.6% |

4Q19 GDP growthYear-on-year |

| Worse than expected | |

Dismal 4Q19 economic performance

In a significant downside miss, Malaysia’s GDP growth slumped to 3.6% year-on-year in the final quarter of 2019, its worst performance in almost two decades (since 2Q02). The consensus median estimate was only a modest dip to 4.1% from 4.4.% in 3Q19. We were slightly optimistic with our 4.2% estimate.

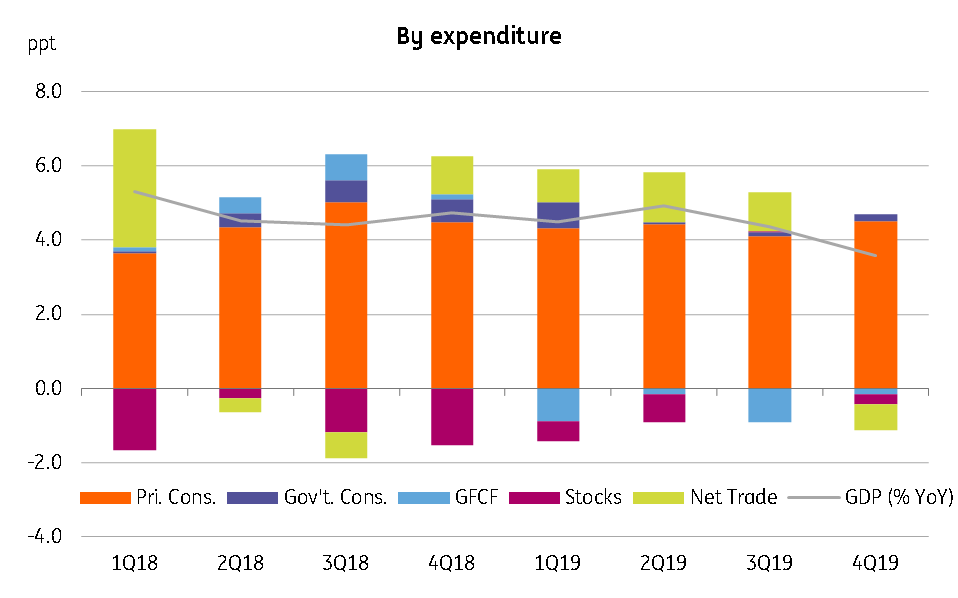

The headline, however, understates the domestic economic strength which has supported the economy over the last year in the face of global trade tensions. Growth of all three expenditure-side GDP components – private consumption, government consumption and fixed capital formation - firmed up in the last quarter. Private consumption continued to lead, with a 4.5 percentage point contribution to the headline GDP growth.

Strong domestic demand coupled with accelerated export declines made net trade the main drag on GDP growth, shaving off 0.7ppt.

Sources of GDP growth - expenditure

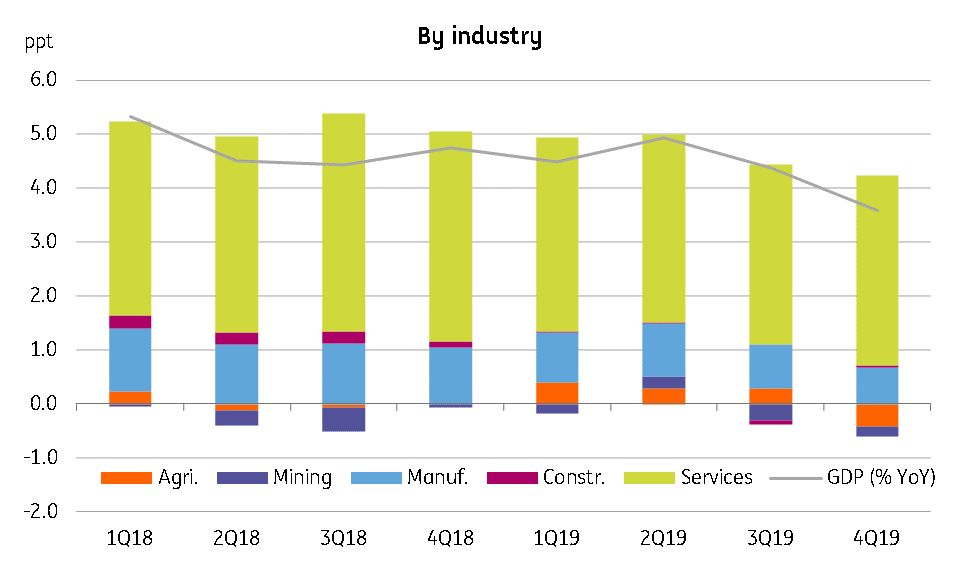

It’s rather a supply shock

Bank Negara Malaysia (BNM), the central bank, attributed the sharp fourth-quarter slowdown to supply disruption to the commodity sector. This was reflected in agriculture and mining being the main industry-side sources of GDP slowdown.

GDP growth for 2019 would have been higher at 4.7 per cent without the supply disruptions in the commodity sector. - BNM Governor Shamsiah Mohd Yunus

This brings full-year growth to 4.3% in 2019, shy of our 4.5% forecast for the year and down from 4.7% in 2018.

Sources of GDP growth - industry

Downgrade of 2020 growth outlook

It’s not going to be too long before demand takes a hit from the rapid spread of Covid-19, the virus currently causing havoc worldwide. The impact will be felt in the tourism sector, while a sharp fall in global crude prices this year also bodes ill for Malaysia’s commodity-driven export sector.

The way things are going, at least a couple more quarters of GDP slowdown looks more likely than not, possibly pushing growth below 3% by the second quarter of this year. Beyond that, and assuming that the virus threat ends, we are hopeful on proactive macroeconomic policies helping the recovery to above 4% GDP growth by the end of the year.

Accelerating stimulus

We believe today's bad report card on the economy will move the authorities to speed up economic stimulus measures.

Recognising the risk ahead of time, the BNM resumed its monetary easing cycle with a 25 basis point cut to the overnight policy rate to 2.75% at its most recent meeting on 22 January. Right then we added one more 25bp cut to our BNM policy forecast for this year. However, judging from the extent of the slowdown ahead, we don’t think the BNM will stop at that. We now see the BNM cutting twice, by 25bp at each of its March and May meetings. This would take the OPR down to 2.25%, just shy of the 2% low reached during the global financial crisis a decade ago.

Local banks have already started offering relief for borrowers suffering from the economic impact of the epidemic. The government is also mulling a fiscal stimulus package for tourism, and now probably for the broader economy.

Download

Download article

13 February 2020

Good MornING Asia - 13 February 2020 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).