Malaysia: Mahathir returns, uncertainty lingers

The lingering political and economic uncertainty ahead leads us to revise our end-2018 USD/MYR forecast to 4.05 from 3.84 previously

| 4.05 |

ING forecast of USD/MYR at end-2018Revised up from 3.84 |

The best of MYR appreciation may be over

The markets were counting on the return of the former government of Najib Razak for continued economic and political stability. So, an initial negative market reaction to the surprising election results seems probable, though that will not be until Monday, 14 May when the market opens after the election holiday. But that’s not all.

The lingering political and economic risks as we outline below will weigh on investor confidence and performance of local markets, especially the Malaysian ringgit (MYR) for some time, probably through the end of this year. The MYR has lost 2.2% of its value against the US dollar since early April. Besides the increase in political noise since the announcement of elections in early April, the return of the USD’s strength was also responsible as reflected in across-the-board weakness in Asian currencies since. We now see USD/MYR breaching the 4.00 level within the next three months and ending the year above that level. Accordingly, our end-2018 USD/MYR forecast is revised to 4.05 from 3.84 earlier (spot 3.95, consensus 3.81, market forward 4.00).

| 113 |

Parliamentary seats for Pakatan Harapan coalitionOut of total 222, a clear win |

| Better than expected | |

A clear victory but muddled future

A decisive victory by the Pakatan Harapan (PH) coalition led by Mahathir Mohamad may not mean an end to election-related political uncertainty. On the contrary, we can think of more political jitters, if the former ruling coalition Barisan Nasional (BN) and their supporters fail to digest the election defeat that ended over six decades of BN rule. An absence of any untoward incidences in coming days and a smooth transition of power from BN to PH may be positive for markets in the near term. But it doesn’t end there.

This election result was one of the three possible scenarios we painted in our election preview note, where we also noted that a new government of Mahathir inherits a strong economy, which he will use to consolidate his power for the future, possibly paving the way for his son, Mukhriz Mahathir, to be his successor.

Having ruled the country for two decades under the BN banner, Mahathir may provide strong leadership, to begin with. However, Mahathir’s old age (92 years) and potential political cracks with key allies, especially his former foe Anwar Ibrahim, whose Peoples Justice Party (PKR) is the dominant member of the PH coalition, could cast a shadow on the stability of the Mahathir administration. The test of this will be as early as June, when Anwar is expected to be released from jail on a royal amnesty.

And more economic risks ahead

The Malaysian economy has been doing well and local financial markets have been outperforming their emerging market counterparts since last year. The sustainability of these trends hinges on the continuity of current economic policies under the new administration.

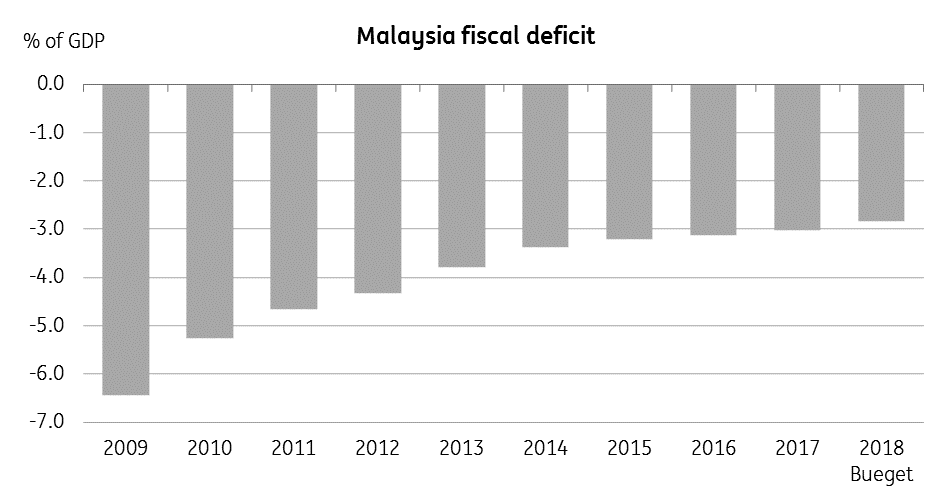

Among Mahathir’s main elections promises were a scrapping of the 6% Goods and Services Tax introduced by the previous administration in April 2015. The fiscal reforms including the launch of GST and dismantling of fuel subsidies were instrumental in the consolidation of Malaysia’s public finances, evident in a more than halving of the budget deficit from over 6% of GDP in 2009 to about 3% in the last year (see chart). Any reversal of these reforms by the new administration will be a setback for investors. No wonder, Moody’s was quick to react to the election outcome by painting a credit negative scenario. Moody’s rates sovereign at A3, on par with S&P and Fitch, with stable outlook.

Some campaign promises, if implemented without any other adjustments, would be credit negative for Malaysia’s sovereign bonds. –Moody’s statement.

Among other economic risks, one could anticipate Mahathir reassessing a multitude of foreign investment projects launched by the previous administration, as well as reopening the investigation of the 1MDB corruption scandal in which former PM Najib was allegedly involved. Moreover, the previous Mahathir regime was known for restrictive economic policies, prohibiting free flow of capital to and from Malaysia in the aftermath of the 1997 Asian crisis.

Steady fiscal consolidation

But some positives

The economy has been doing well since last year and local financial markets have outperformed relative to their emerging market counterparts, for which we credit a positive terms of trade shock from rising global commodity prices, particularly the price of oil. Considering recent geopolitical developments, the upward oil price trend is your friend.

Barring any unfriendly policy shifts, Malaysia’s sound economic fundamentals should sustain as the main positive for investors and markets. We reiterate our forecast of only a modest slowdown in Malaysia’s GDP growth this year to 5.5% from 5.9% in 2017 (consensus 5.4%, government 5.5-6.0%). The test of this will be the release of GDP data for the first quarter next week (17 May), for which our forecast is 5.6% year-on-year growth.

However, likely negative sentiment toward the MYR strengthens our conviction that the Malaysian central bank (BNM) will continue on the normalisation path for monetary policy with one more 25bp hike in the overnight policy rate in the third quarter.

Download

Download article11 May 2018

In case you missed it: Over-reaction and under-performance This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).