Make no mistake, ECB tightening is having its desired effect

The European Central Bank's policy stance has become restrictive. To us, the impact on the economy is probably the most underestimated drag on growth for 2023. The good news is that we see no meaningful signs of fragmentation between countries, so monetary policy is not causing shocks in more vulnerable parts of the eurozone

Most channels through which higher rates work are showing tightening impact

To get a sense of how the end of the tightening of monetary policy ultimately feeds through to growth and inflation, we look at the main channels through which monetary policy transmits. These are money/credit developments, bank rates, asset prices and exchange rates. All four channels have seen sizable adjustments since last summer:

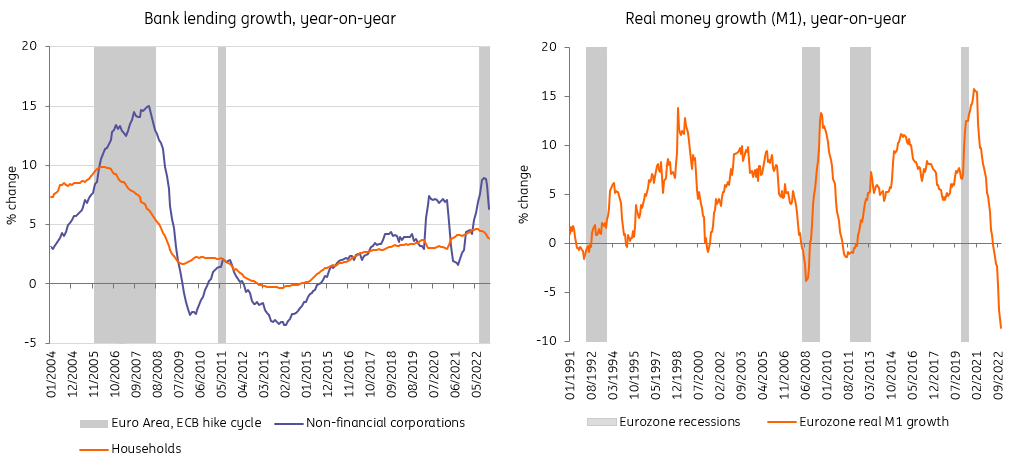

- The money supply has fallen quickly since the ECB started reducing asset purchases. In fact, growth in real money (M1) has not been so negative since the ECB's record-keeping began. This historically corresponds to a significant correction in economic activity.

- When looking at asset prices, we note that stocks and bonds saw substantial corrections in 2022 (although we have seen a bounce-back as investors are expecting a peak in rates to come soon), while real estate prices have been somewhat slower to respond but are undoubtedly starting to turn.

- Bank rates have also increased considerably since the beginning of 2022, following the increase at the longer end of the yield curve. Growth in bank lending has almost stalled for households and is negative for businesses. We expect this to have an important dampening impact on investment in the eurozone in the quarters ahead, although the recovery fund's impact on southern economies could mute the overall investment response seen in 2023.

- The euro has appreciated since the end of last year as investors are expecting more rate hikes from the ECB and because energy prices have fallen significantly from their peaks which has resulted in a fading trade deficit. This is starting to feed through to import prices, which have started to see lower year-on-year growth.

The early phase of monetary transmission is fast at work

No need for TPI as monetary transmission is not showing signs of fragmentation

When looking at the above-defined categories per country, we see that there is not that much difference in transmission. Compared to the average, we see that France is still experiencing a smaller impact on all counts, while Italy is experiencing a somewhat more significant impact. Overall though, there is no shock happening in the system for any country measured and monetary transmission is therefore not causing problems. So far, there is no reason to use the ECB’s new Transmission Protection Instrument (TPI) as fragmentation of monetary transmission in the eurozone is not happening at the moment.

The much-feared fragmentation of monetary transmission has not happened so far

Most of the impact on inflation and growth still has to feed through

While the initial boxes of monetary transmission have clearly been ticked, the timing of the actual impact of monetary policy on the real economy has always been difficult. In theory or in large macro models, it is assumed that it takes nine to 12 months before monetary policy affects the real economy most. Recently, there have been (US Federal Reserve) central bankers suggesting that the current lag could be shorter than in the past.

Still, it’s too early for the ECB to claim victory. Core inflation is still trending up and is far above the central bank's target, at 5.3%. Wage growth is also still moving up cautiously. It is therefore too early to say there has been a success on price developments. And expectations have started to feed through the monetary transmission system in the wrong way recently. As investors worry about recession and are optimistic about inflation returning to benign levels after the peak was recently reached, we see that financial conditions are loosening again.

Restrictive policy will have a significant downside impact on the economy this year

While we don’t see the impact of monetary policy on prices fully yet, we do see transmission in full force at the moment, which will eventually have a larger impact on output and prices. With uncertain delays on economic activity and prices at work, the question is how hawkish the ECB will remain over the course of the year, given the tightening of monetary policy so far. We expect the ECB to hike by another 100 basis points this year, making policy very restrictive.

For our economic outlook, we think that restrictive monetary policy will be a key factor preventing the economy from bouncing back from its current weak spell. While all eyes are on the energy crisis at the moment, higher rates will also be an important factor in dampening any meaningful recovery. While we don’t see the bulk of the impact yet, expect a eurozone economy that flirts with zero growth for most of the year as higher rates complete the transmission to demand.

Download

Download article

2 March 2023

ING’s March Monthly: The search for a new equilibrium This bundle contains 13 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more