At a glance: The world right now

From faster Fed tapering to zero-Covid policies in Asia, we look at the latest developments in the global economy and what they mean for our forecasts

US: Fed on its way to faster taper

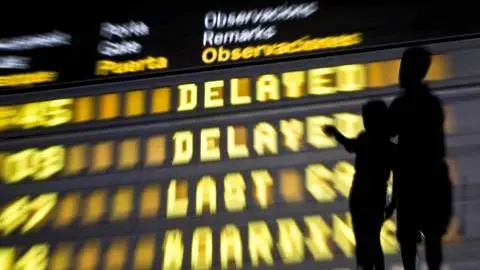

On the back of new virus fears with the Omicron variant, some consumer caution is likely even if there are no plans at this stage for new government restrictions. Assuming this is a scare rather than a more serious lockdown story, rising incomes and wealth should facilitate strong consumer spending while business surveys and government infrastructure plans point to an improving investment outlook. Easing supply chain strains should also allow firms to ramp up production.

Reopening price pressures are giving way to more entrenched inflation with tight labour markets prompting sharp rises in employment costs. In an environment of strong demand, companies have pricing power so can pass cost increases onto customers with relative ease.

Assuming Omicron fears start to fade, the growth and inflation backdrop justifies the Federal Reserve bringing QE tapering to an early conclusion, increasing the likelihood of three rate hikes in 2022.

China: Zero Covid to remain a key theme

The recent deluge of policy announcements from the Chinese government has at least slowed. These continue to affect a wide range of areas, including new rules for deleveraging the real estate sector and data compliance on technology companies. Meanwhile, China's tough 'zero-Covid' approach to the pandemic will continue, spurred on by the discovery of the Omicron variant. This approach limits people's movements even during the long holidays. Both inbound and outbound tourism will continue to be curtailed. Strict local lockdowns where any outbreak is concentrated will continue.

The government will rely on investment to support growth, partially filling the gap left by investment previously undertaken by real estate developers. Consumption too will play a major role while manufacturing will depend on export demand, freight rates, and the availability of semiconductors.

Eurozone: Another difficult winter

Even before the appearance of the Omicron variant, the number of Covid-19 infections in the eurozone was rising rapidly, pushing several member states to reintroduce containment measures, with Austria even returning into full lockdown. As we expect more countries to tighten measures, growth is likely to slow significantly in 4Q and 1Q 2022, with a negative growth figure in one quarter not impossible. But on the back of booster shots and antiviral drugs, a strong recovery might follow, potentially leading to 3.8% growth in 2022.

Inflation is expected to drop below 2% towards the end of 2022, with the average for the entire year staying above the ECB’s target. As the medium-term inflation outlook has become more uncertain, the ECB is likely to be more cautious in its forward guidance. The Pandemic Emergency Purchase Programme will end in March, but a small transitional programme could be introduced to smooth the tapering process. We now see a first rate hike at the end of the first quarter of 2023.

Rest of Asia: No trouble-free return to normality

The biggest improvement to the outlook for non-China Asia is in the progress being made with vaccinations. Only the Philippines and Indonesia still lag with less than 50% of the population at least partially vaccinated. 2022 should see all economies of the region rising to internationally comparable levels of vaccination.

However, as Singapore has shown, even very high levels of vaccination do not offer complete protection. And that may be lessened further if the new omicron variant proves vaccine resistant. With overseas rates of Covid infection often lower than those in Asia, some further progress in re-opening international travel is possible, though this view could be heavily challenged by the characteristics of the latest variant. Any recovery in tourism we do see would go a long way to reviving SE Asia’s economies. A slower China remains a concern for NE Asia’s industrial economies.

Domestic recovery could also bring complications. Current accounts are likely to worsen as imports rise faster than tourism receipts rebound. Increased demand for credit may also clash with rising inflationary pressures and less supportive central banks. A return of ratings pressure may also mean that a return to normality, if that is what we get in 2022, is not trouble-free for Asia.

UK: A December delay for the Bank of England

Omicron’s arrival and all the associated uncertainty look set to delay the Bank of England’s December rate rise into the new year. November’s surprise pause showed policymakers are happy to wait a bit longer, even if economic data has been reasonably encouraging. Redundancies have not increased following the end of the furlough scheme in September, while inflation has continued to surprise to the upside.

The economic recovery has slowed, but decent retail figures and a gradual increase in transport usage as offices return shows it hasn’t ground to a complete halt. Cost of living increases and tighter fiscal policy will keep growth in check into 2022, though investment looks like a bright spot for next year - virus-depending of course. The UK government has stepped back from the brink of triggering Article 16 of the Northern Ireland agreement, at least for now. The UK-EU row is far from over though, and relations could yet deteriorate further next year.

CEE caught between a rock and a hard place

Growth prospects in the Central and Eastern European countries (CEE) remain sound but dependent on easing global supply chain disruptions - these affecting more the automobile-based Czech Republic and Hungary rather than the more diversified Polish economy. At the same time, record-high inflation will dent households’ real incomes and consumption. CEE consumers will have to get used to elevated energy prices, while their central banks will have to get rising inflation expectations back under control. That is why we see terminal rates in the CE3 region at 3-3.5%, with upside potential given that the risk of second-round effects is higher than in developed markets.

The region also has to bear higher import bills and weaker external balances, which will make their exchange rates vulnerable. Protecting incomes against accelerating inflation via social transfers (Poland) or huge minimum wage hikes (Romania, Hungary) may add oil to the fire. Given low vaccination rates, Delta and possibly Omicron variants will make CEE policy choices even more complicated.

Rates: Still waiting for the push

More ups than downs were seen for market rates through 2021. The overall 60bp rise in the US 10yr has re-positioned it close to the 1.5% area, well clear of the 1% area that had been briefly considered earlier in the summer. The move in the eurozone 10yr, while not as marked, has arguably been more dramatic. At the start of the year it was deeply negative, at -30bp. It’s now around (plus) 15bp, a negative to positive flip.

For 2022, we expect market rates to push higher still. The US 10yr should target a 2% handle, and for the eurozone, the 50bp level should be breached. Also, expect a bigger uplift from front end rates, in recognition of the rate hiking job to be done by the Fed. Even with the ECB on hold, eurozone front rates will push higher, too. Curves will be pulled up from both ends.

FX: Omicron deflates dollar

Omicron’s re-pricing of global growth prospects has not spared currency markets. The unpopular funding currencies of the Japanese yen, Swiss franc and the euro have found new friends, while the pro-growth commodity currencies have all suffered in line with flatter yield curves. The net effect has been to knock trade-weighted measures of the dollar roughly 1% off their highs of the year.

That the dollar is net down on the news of a new variant is a function of the re-pricing of Fed policy. Uncertainty around Omicron and the easing of balance sheet adjustment pressures could keep the dollar soft into year-end. Into 2022, however, and assuming that the Omicron news follows the more benign path in our baseline, the dollar should be rallying again, and we retain a year-end 2022 EUR/USD target of 1.10.

Download

Download article

2 December 2021

ING global outlook 2022 This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more