Looking for opportunities in PetroFX

Supply-driven oil price decline nearly over, opportunities in PetroFX

Shale producers to think twice about drilling new wells

The near 20% decline in crude oil prices has dominated financial markets in June - depressing inflation expectations, bond yields and Petro-FX. This has largely been a supply-driven move - raising questions as to how low oil prices have to fall before increased supply starts to ebb.

Our commodities team think that crude oil is fast-approaching levels where US shale producers will think twice about drilling new rigs - and also speculate that OPEC may start to bring Libya and Nigeria into the fold of agreed production cuts. Much more limited downside for crude prices should remove some of the pressure from key petro-FX currencies such as the NOK, CAD, RUB and COP.

US shale producers will think twice about drillling new wells

Given this has been a supply-driven move, the market will be looking for insightrs on two key sources of increased supply: i) US shale producers and ii) Libya and Nigeria - OPEC members excused from supply cuts, but now ramping up production. On the former, our commodities team think that crude is close to levels where increased shale production will slow.

The market has used the rising Baker Hughes Oil Rig count as evidence that US shale producers are ramping up production. We think these increases will start to slow soon - especially were crude WTI to fall close to $40 from levels near $42/43/barrel today.

When will the rig count slow?

OPEC less lenient

Another source of supply pressure on crude has come from OPEC members Libya and Nigeria. They had been excused from quota cuts for domestic reasons - but have been surprising with suppply increases. Libya has added another 200,000 bpd in production over the last couple of months - and could potentially add another 300,000 bpd by year-end. Nigeria could also add 300,000 bpd by year-end.

Clearly OPEC will have to address these issues if it wants to limit further supply-driven declines. It is not a consensus view yet, but our commodities team suggest that any agreement to give Libya and Nigeria a production cap - similar to Iran - could help put a floor under crude.

| $40 |

The price per barrel where US shale producers will think twice about drilling new wells |

Worst may be over for some PetroFX

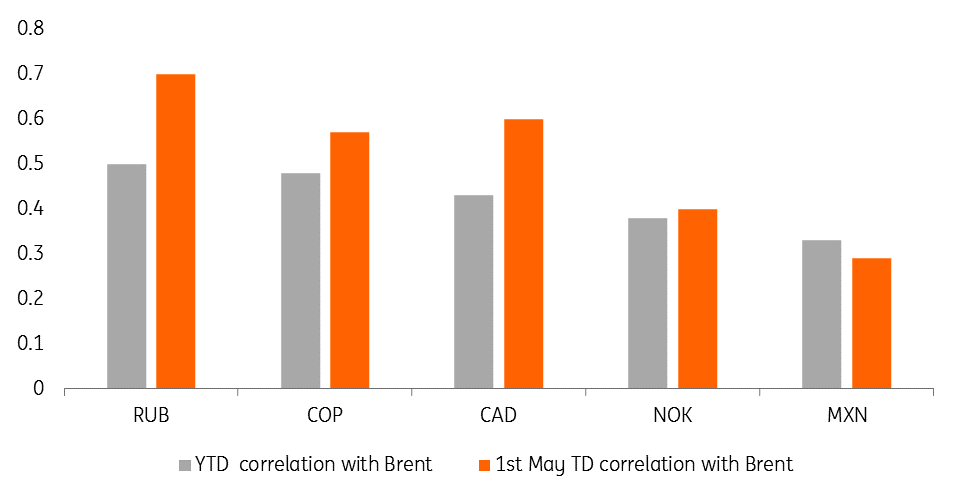

June's decline in crude has hit some petro-currencies hard. The RUB and COP have suffered the most in the EM space and the NOK in the G10 space. CAD received some surprising support from the Bank of Canada, suggesting rate hikes may not be as far away as most think.

RUB and COP have suffered the most

So if the decline in crude does start to slow/stall - what happens to PetroFX? We think RUB has a few challenges this summer, not least the prospect that the US House and then Donald Trump sign new, tougher Russian sanctions into law.

The CAD is already doing well on the BoC story - and all will be revealed at the July 12th BoC rate meeting. Of the group, we probably see NOK having the biggest potential against the dollar. We think NOK is under-valued against the EUR - and that EUR is under-valued against the dollar.

Based on our forecasts we see USD/NOK trading at 7.40 in twelve month's time - or a near 15% rally in the NOK.

PetroFX correlation with crude in 2017

| +15 |

The percentage increase in NOK against the dollar we expect in the next twelve months |

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more