A last hurrah for Asian inflation

The US is not alone in seeing an unwelcome acceleration in inflation in January – a number of Asian economies have seen something similar. But for many of Asia's economies, this is likely to be the peak, or if not, close to it

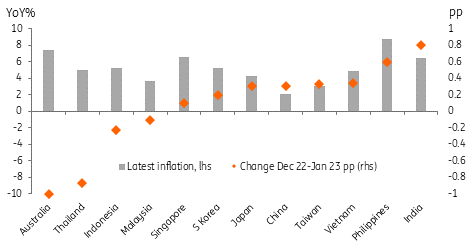

It has been a bad start to the year for inflation in Asia

As well as the unwelcome resilience of inflation in the US and Europe, a number of Asian economies have provided upside misses to consensus inflation forecasts in the last month or two.

The biggest upset was in Australia, where monthly inflation rates in December jumped up to 8.4% year-on-year from 7.3% previously, a gain of more than a full percentage point. This has proved short-lived, with the January inflation figures already retreating back to 7.4%. There were also big increases in inflation in India and the Philippines.

Besides the reversal in Australian inflation, most other economies in the region have seen at least some small increase in the inflation rate between December 2022 and January 2023, and only in Thailand were the declines also particularly substantial with the year-on-year inflation rate dropping to 5.02% from 5.89%.

Inflation is still rising in most Asian economies

A mixed bag of reasons for stubborn inflation

Exactly why inflation across most of the region staged a further increase in January seems to differ from economy to economy. Doing a lot of the damage to the Australian numbers in December was an eye-popping 30% increase in the costs of holidays – as reopening collided with seasonal holidays. That dropped out again in January, but it doesn't tell us much about the months ahead.

In India, food, as is often the case, was the main culprit. Rising wheat prices coupled with smaller declines in vegetable prices than in the previous month were responsible for much of the increase in the year-on-year rate, though base effects also played their role.

Japan's inflation, as the Bank of Japan has been keen to point out as it sticks to its ultra-easy monetary policy, remains largely driven by supply-side factors. Exclude food and energy, and the core rate is only 1.9% YoY even as headline inflation rose to 4.2% in January from 4.0% in December.

The Philippines is a slightly different story, with contributions from almost all categories, presenting Bangko Sentral ng Pilipinas (BSP) – the central bank of the Philippines – with more of a price-taming headache than many of its Asian peers. And inflation rates also continued to push higher in Vietnam, Taiwan, South Korea and Singapore in January.

Policy prognosis equally mixed

With a mixed bag of reasons for the persistence of inflation across the region, there is no single policy remedy or likely outcome as we head further into the year. For some economies, the January figures do look like the last hurrah of earlier price increases. And with last year's price levels strongly affected from February onwards by the Russian invasion of Ukraine, year-on-year comparisons should help to bring year-on-year inflation rates down, absent any further positive price-level shocks, which against the backdrop of tense geopolitics and increasingly frequent climate change-related extreme weather events, is not a caveat you can lightly make these days.

Certainly, there are some economies in Asia where the inflation-taming struggle is not yet won, and the backdrop of a Federal Reserve also hard at work squeezing inflation out of the US economy will keep central banks of the more inflation-challenged economies in tightening mode.

For others, it has felt for a few months now that the worst of the inflation crisis has passed. And while it may not be the right time to start talking about an Asian pivot, if inflation rates do begin to ease lower over the middle of the year, the monetary tightening already put in place across the region could begin to look not only adequate but perhaps a little excessive, raising the prospect of some paring of rates further down the line. For now, though, such thoughts are not even on the long-range radar, though it would probably only take a month of benign price data to bring such thoughts back into view.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 March 2023

ING’s March Monthly: The search for a new equilibrium This bundle contains 13 Articles