Lack of Chinese tourists is hindering Asia’s economic recovery

As Asia's current account surpluses get hit by high energy prices, resurgent tourism could be one tonic to soften the blow – but there's one major issue…

It's the less developed nations that have suffered the most

The global pandemic and ensuing slump in global tourism didn't just hurt Asia, but the region certainly has its share of top global travel destinations and the collapse in tourism that accompanied the pandemic was an unwelcome additional cost to bear.

According to United Nations research, travel restrictions caused a cumulative 95.3% decline in international arrivals to Asia and the Pacific between January and July 2021 – the biggest decline in international arrivals globally – compared to the same period in 2019. Prior to this, international tourist arrivals to Asia-Pacific had risen from 208 million in 2010 to 360 million by 2019, and the sector was poised to deliver further growth before the world went into collective quarantine.

Across the region, including China, the World Travel and Tourism Council estimates that the tourism sector directly accounted for around 185 million jobs pre-pandemic, with more than 30 million of these jobs disappearing during the pandemic.

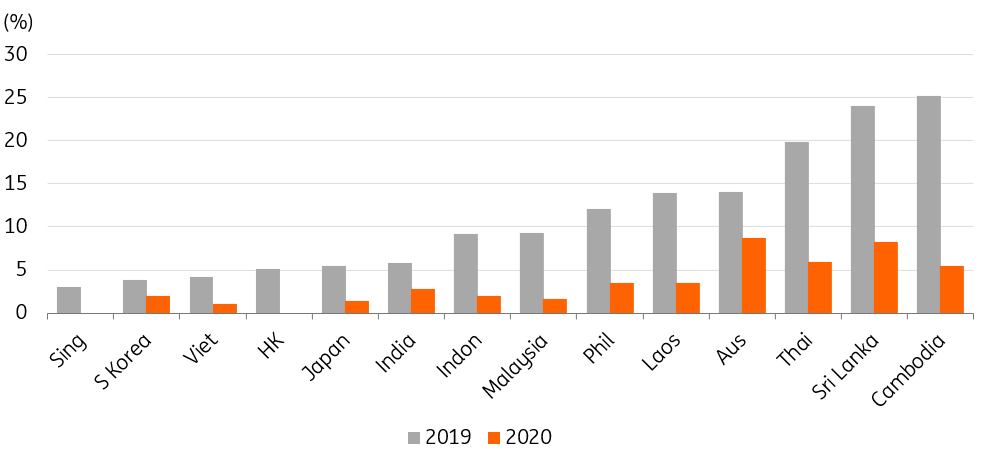

The pain has been felt disproportionately by the region's less developed economies, where alternative sources of foreign currency income are less available. As a percentage of total exports, Asia's most tourism-dependent economies in 2019 included Cambodia, Laos, and Sri Lanka. Not surprisingly, middle-income Thailand also made it into the top end of the range, with nearly 20% of 2019 exports accounted for by international tourism receipts. High-income Australia isn't too far behind.

International tourism receipts as % of total exports

Tourism revenues have plunged and haven't bounced back all that much

Tourism revenues plunged in 2020 (along with total exports), and though we are still waiting for World Bank data for 2021, this situation probably didn't improve much until this year. That improvement in tourism revenue would have been very welcome in Asia, as the Russian invasion of Ukraine and subsequent spikes in energy prices have left their mark on current accounts around the region.

For a region that has generally run large and steady current account surpluses and amassed large stocks of foreign exchange reserves, this surge in energy prices for all but a few net energy exporters (Indonesia, Malaysia, Australia) has eaten away at the external balances, leaving some economies looking at their first deficits since before the Asian financial crisis in 1997. On top of this, central bank intervention to temper currency depreciation has taken a toll on FX reserves.

So, while it may not totally eradicate the damage caused by this big terms of trade shift, and the current strength of the US dollar, some additional tourism revenues would at least help to ease the pain.

Tourist arrivals (Dec 2019=0)

Despite reopening, tourism numbers are still low

But for all that we read about "revenge spending", the statistics for tourism are quite disappointing. In the chart above, we show the foreign tourist arrivals for the region. Nowhere do the latest numbers come even close to pre-Covid levels of arrivals.

Singapore, which has seen the biggest recovery in tourism across the region, is still only seeing about 40% of the pre-Covid levels of inward tourism. And for tourism stalwarts like Thailand, the figure is 30% or less.

Hotel room rates and foreign occupancy figures add to the story. Using Thai data as a proxy for much of the rest of the region, the data shows that hotel room rates have recovered to about half of their pre-Covid levels. There is still very low foreign occupancy, which suggests that local tourism is still filling most of the gaps.

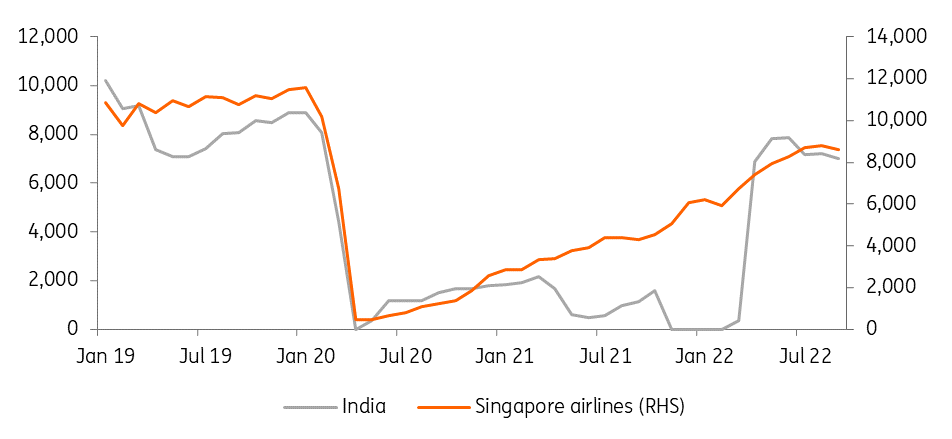

The reasons for the foreign tourist shortfall may be explained by some of the passenger seat kilometre data that is available. Both Singapore and India data on airline capacity remain at levels less than 80% of pre-Covid capacity, as (possibly) shortages in maintenance crews to re-commission mothballed aircraft, as well as shortages in cabin staff and flight crew, have curbed availability. Anecdotally, this shows up in some steep increases in airline prices, over and above any reflection of higher aviation fuel costs. Why fly to a low-cost tourism destination when the cost of getting there has soared?

Passenger seat km availability (m)

The elephant not in the room

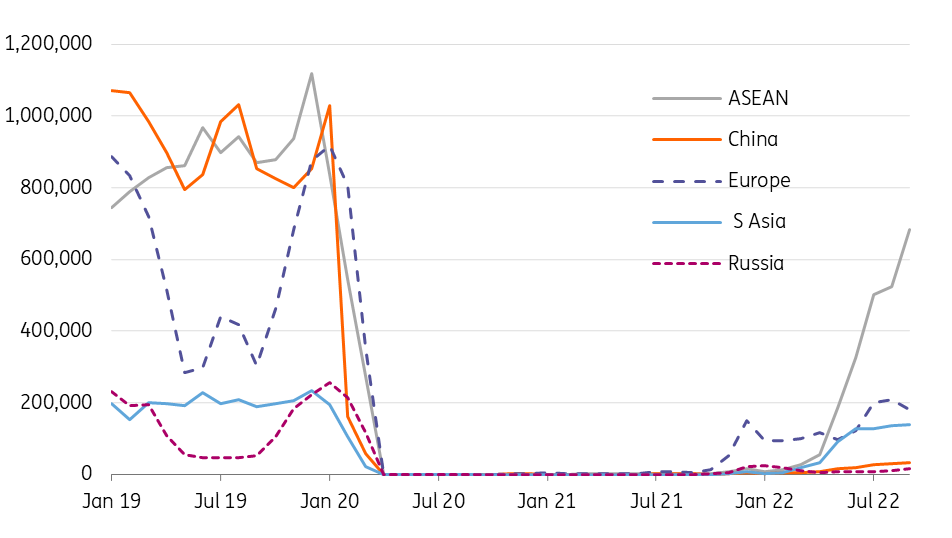

In the end, though, more than expensive plane tickets, or seat availability, Thai visitor arrivals data by nationality shows that there is one single factor that is resulting in dismal tourism numbers and revenues: the absence of China.

The chart below even understates this impact, as it is by visitor nationality, not residence, so will include Chinese nationals living outside of Mainland China. And even though we are beginning to see ASEAN visitor numbers pick up some of the slack, it is extremely unlikely that Asia-Pacific tourism can manage a full recovery without Chinese tourism returning.

Arrivals by nationality (Thailand)

On this subject, the last few weeks have delivered both disappointment and hope. The disappointment came from the re-commitment to its zero-Covid strategy by China's President Xi Jinping at the 20th Party Congress in October. Markets collectively registered their disappointment at what they surmised would mean another year of dismal Chinese demand, and this was especially bad news for Asia's tourism sector.

But despite this commitment, actions on the ground seem to be more hopeful. International travel restrictions for foreign business executives have recently been eased, and events are being trialled with fewer Covid restrictions (for example, the Shanghai expo and Beijing Marathon), potentially a precursor to some slow rewind on other travel restrictions.

Tourism in Asia is still a long way off from being able to declare recovery, and without China's tourists that prospect still seems distant. But we may at least be seeing the first stages of a slow re-opening in China.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 November 2022

ING’s November Monthly: The long wait for the pivot This bundle contains 14 Articles