Key takeaways from the International Copper Conference

After attending the 31st Metal Bulletin International Copper Conference, we are more bullish than ever. The higher prices are coming, just not in 2018

Key Themes

1) Copper concentrate markets are entering structural deficits. Mine supply growth has lagged demand, and wide gaps could especially emerge after 2020.

2) Refined markets are not yet tight. Traders spoke of dull and flat premiums, even with supportive curves for financing. The seasonal tightness of Q2/Q3 will see an uptrend.

3) Labour contract renewals this year could make markets exceptionally tight if they result in strikes, but not all contracts are high risk.

4) Smelter expansions in China are pushing the market into overcapacity, and the industry wants to see an aluminium style response to limiting expansions and increasing utilisation.

5) Scrap will be key in determining the balances over the next two years. The true effect of the Chinese import restrictions is a relative unknown.

6) Expect volatility as labour negotiations, and scrap restrictions are sure to make this a bumpy ride.

7) Consensus sees demand slowing this year amid a Chinese property cool down, but stable growth is expected with good prospects for RoW total usage however dampened by scrap.

8) The EV’s are coming. As demand from this sector surges, there is no sign of peak cathode or concentrate demand in the foreseeable future.

9) Growing demand for blister imports into China drives a new focus on pricing whilst the exchanges look to copper premiums in expectation of more floating prices in contracts.

Tight concentrates, looser refined

Traders, miner’s and smelters unanimously agreed that copper concentrate markets are tight and are set to enter into structural deficits. Last year strikes alone removed 500kt creating a shortfall of c.150kt, but aside from that, supply is simply growing too slowly.

2018 will be another year of significant concentrate shortage with mine supply only growing 1.5%. 2019 should see more growth, but past 2020 the shortage could get extreme. The International Copper Study Group (ICSG) has downgraded 2019/2020 mine capacity by almost 800ktpa on project delays. Miners were keen to stress the incremental delays in permitting and engineering, so while there is a healthy project cupboard for major new mines in Peru, Africa, Chile and North America, delays are likely to take place, no matter how attractive the price gets.

The higher prices are coming. But, if we learned one lesson from the zinc rally, it is that refined deficits can lag concentrates for some time. Indeed, we are confident to conclude that the refined market was roughly balanced last year given that refined premiums remain subdued, even as wide contango’s should be supporting stock financing.

Physical metal traders confirmed the same was true throughout the first quarter, although admittedly this is a seasonally slower period. A lack of opportunities within cathode premiums had generated an interesting in off-grade copper out of Africa. While premiums in China have picked up slightly in recent weeks, confirmation of a bull run would require levels closer to $90/mt which could still be some way away. Credit in China is gradually tightening which risks a reduction in the levels of working inventory held across the supply chain.

As we have argued previously, while we are convinced of the concentrate shortage we need to see evidence of substantially tighter refined markets before forecasting levels substantially higher than $7,000/mt in 2018. Crucially we would need to see the curve turning to backwardation. While it goes outside of our base case, mine strikes and scrap shortages do nonetheless make this a real possibility outlined in a bull case. In a still reasonably low volatility environment, exposed consumers should still consider options to protect against these scenarios.

ING forecasts higher prices, but probably after 2018

($/mt)

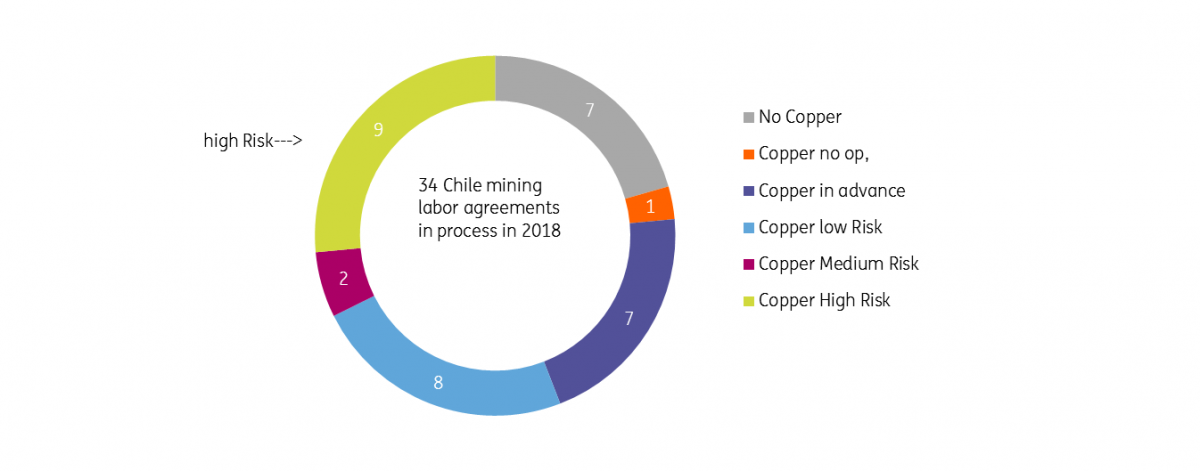

Chilean Mine Supply Risk

This week we heard the news that Los Pelambres mine workers have voted against wage offers and will likely go on strike next week unless government talks prevail. A presentation by Cochilco identified that of 34 labour contracts up for renewal this year, just nine are earmarked high risk. Last year ten high-risk projects resulted in only two disruptions: Escondida, and Quebrada Blanca. In the end, it was the sheer duration at Escondida that generated losses with QB not majorly affected. Cochilco was keen to stress that not all strikes necessarily result in supply losses and we note that at Los Pelambres the mill workers have reached an agreement so could presumably process stocks if miners strike.

Spot concentrate treatment charges are down 23% since October and executives were amazed that traders can still make money at these levels below the benchmark. We believe that there is both a degree of a pre-strike fear factor in smelters behaviour and indeed an ability for traders to finance through the contango to undercut industry rates.

We take comfort in the Cochilco analysis decision to stick to the historical 5% disruption rating in our base case while the more bullish commentators already assume 6%. Each 1% costs an additional 170kt of concentrate that certainly tips both concentrate and refined markets into substantial deficits pushing prices above $7,500 by year-end.

Still, Cochilco made a clear case for the desire by the miners to withstand higher costs. Labour costs already make up 60% of cost increases since 2000’s, and even on FX alone, a weaker dollar will mean these local costs rise 9c/lb from labour and 15c/lb (+7%) across cost inputs. New Chilean laws mean once a change is effected it cannot be reversed. Miners are therefore pushing for one-time bonus’s over wage increases as they do not want to be squeezed if copper prices fall once more.

Cochilco sees only nine of 34 negotiations at high risk of affecting production

Industry calls for China to get tough on smelting overcapacity

The ICSG identifies over 2MT of Chinese smelting capacity that could come online in the next three years. We believe that 400kt of new greenfield capacity will ramp up in 2018 but other de-bottling, expansions and a rebound from a high maintenance year last year means capacity could actually be 750kt higher by year-end. This is running ahead well ahead of actual demand for refined demand, and the over-aggressive bidding for concentrates is another reason why TC’s are trending lower.

One executive argued that “one would be mad to invest in new smelting capacity right now’’ and certainly low TC’s do not justify the capital expenditure. While environmental protection taxes have had limited effects on copper smelters, participants speculated whether China would limit expansions like steel and aluminium. Tongling had called for such a move just one week before. We would await an announcement from the government until we assume this. The Chinese copper industry does not share the same reputation for generating pollution and smelters gaining tolling licenses, LME brand listings have created a viable role in exporting cathode as well as for domestic consumption. Growing usage in EV’s and related grid upgrades being the long-term case. On the other hand, amid a lack of raw material supply utilisation rates will be the lower for the following years which might be judged poor capital investment.

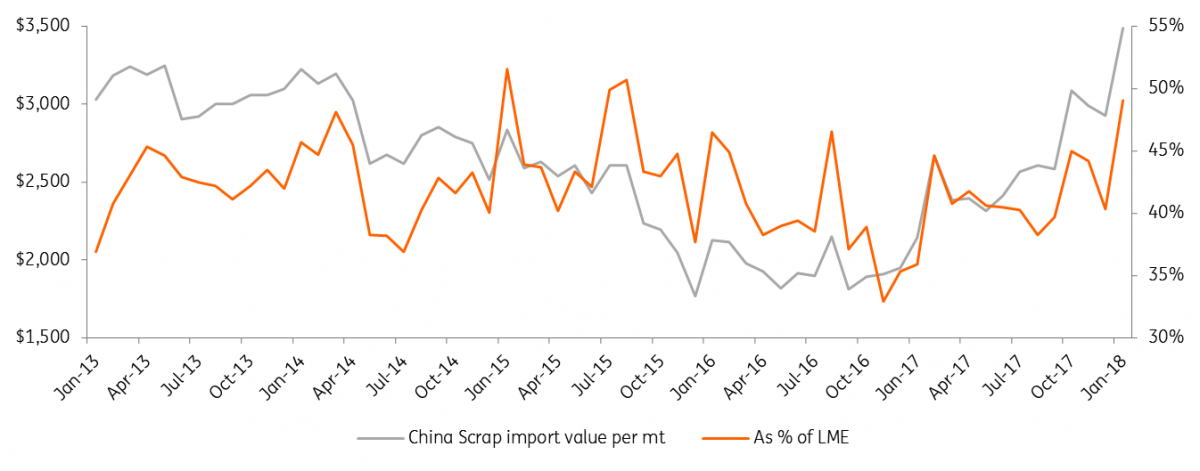

Scrap: The great unknown

Mine supply responses can lag copper prices for years, but scrap flows can react immediately. But all participants agree that scrap data is extremely hard to gauge making forecasting very tough.

Scrap enters at several points of the supply chain: secondary smelters, in refining and as direct-melt, which cannibalises refined cathode demand. Last year the ICSG believes direct scrap use grew by 10%, and German and US refined consumption was actually negative as a result. This year we expect refined and total copper usage to grow at a closer parity and think prices will stay around $7k from the evidence that at these higher prices scrap flows (ex-China) had not dramatically increased. Industry contacts agreed but cautioned that some of the tightness in Q1 has come about from constrained freight amid colder weather and a focus on higher ferrous prices.

China has this year banned traders from importing of Cat. 7-grade scrap, responsible for 60-70% of scrap imports by tonnage. Next year the ban will go across all industry. Most only see a temporary effect as investments are ongoing in South-East Asia to process the scrap into deliverable forms, but it was cautioned that a lack of confidence in the bans longevity could keep the off-shoring subdued. Western traders meanwhile are stuck with an abundance of low-grade scrap, cables etc., that they cannot process. Scrap stocks parked in Hong Kong are indeed extremely high as traders had hoped to gain import permits but failed.

While in tonnage terms the Cat.7 ban is frightening, it only grades around 14% making up 20-25% of total scrap units imported (c.1.5MT) according to Antaike. Therefore 30-40% of imports from non-Cat.7 makes up 70% of the units, so these higher grades have great potential to offset losses. Chinese trade data shows the value per tonne is indeed increasing as imports shift to higher grades. Headlines that scrap import permits had dropped 90% in January were exaggerated since the changes in waste regulation delayed the permitting process and are now starting to ease.

Jinrui estimated restrictions could cost 400-500kt of imports in 2018, but domestic supply could grow by 100kt, and Cat.6 could grow 70kt due to offshoring. These import losses seem too extreme to us. Based on Antaike estimates, losing 75% of Grade 7 costs 225kt, and China is competing with western buyers for higher grade scraps, not just offshoring processing so that real losses could look closer to 100-150kt. Jinrui also estimates 200kt of available on shore stockpiles which could offset this and then there is rising domestic collection. BGRIMM also saw domestic scrap collection rise 6.5% last year, so a similar increase this year could half our shortage. The market largely expects scrap tightness to limit direct melt rather than use by secondary smelters/refining.

China's higher value scrap imports point to higher grades

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).