Key events in emerging markets next week

Inflation figures will continue to rise across emerging markets such as Russia and Turkey next week. In Hungary, PMIs and retail sales figures will show increased demand

Russia: Inflation remains the key concern

October inflation is likely to disappoint again, as some pre-emptive consumption and price upticks took place ahead of recent lockdowns. We now see monthly CPI at 1.1% month-on-month, corresponding to a material spike from 7.4% year-on-year in September to 8.1% year-on-year in October. Given the deteriorating global inflationary picture, confirmed recently by the IMF, we see a high likelihood of inflation touching 8.0% this year-end, exceeding the most recent Bank of Russia forecast range of 7.4-7.9%. The monetary authorities, which have committed themselves to addressing elevated inflationary expectations and to the year-end 2022 CPI target of 4.0-4.5%, are likely to continue the key rate cycle at the December meeting. Our initial 25 basis point hike assumption now appears too low and has a high risk of upward revision.

In other news, the Finance Ministry is likely to announce an increase in the monthly FX & gold purchases from $4.5b in October to $5.7b in November, reflecting a noticeable increase in the Urals and gas price over the month, combined with a recovery in production volumes, as suggested by the most recent industrial output data. The increase in FX purchases should not be a big deal for the FX market, which is benefiting from a $10b monthly current account surplus and high real rates. That said, it may take some steam off the recent ruble rally. Combined with the end of a seasonally large tax period, continued local capital outflows, and global uncertainties surrounding the global debt and FX market, this should prevent USD/RUB from seeing material appreciation from current levels.

Hungary: Industrial output and retail sales still on the up

Despite supply side constraints, manufacturers are facing increasing demand which is keeping them in an optimistic mood, at least in the short run. This might be reflected by the manufacturing PMI, which we expect to remain above the watermark level. When it comes to hard data, Friday will bring a lot of excitement with a set of data from September. We see retail sales stabilising around 4.0% YoY as buyers are still rushing to buy goods before shortages kick in. Industrial output should rebound after a shutdown in August. While some car makers went on forced breaks again due to spare part shortages, these were shorter than the summer shutdowns and we expect a 2.3% month-on-month increase in Hungarian industry.

Turkey: Weaker exchange rate and higher energy prices will push up inflation

Annual CPI will likely go up further to 19.8% in October (2.3% on monthly basis) from 19.6% a month ago, given the accelerating pass-through from recent exchange rate developments, higher energy prices and the impact of other administrative price adjustments, with risks tilted to the upside.

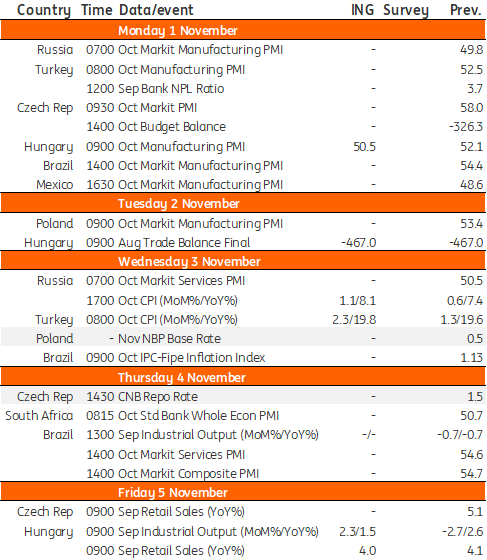

EMEA Economic Calendar

Download

Download article29 October 2021

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more