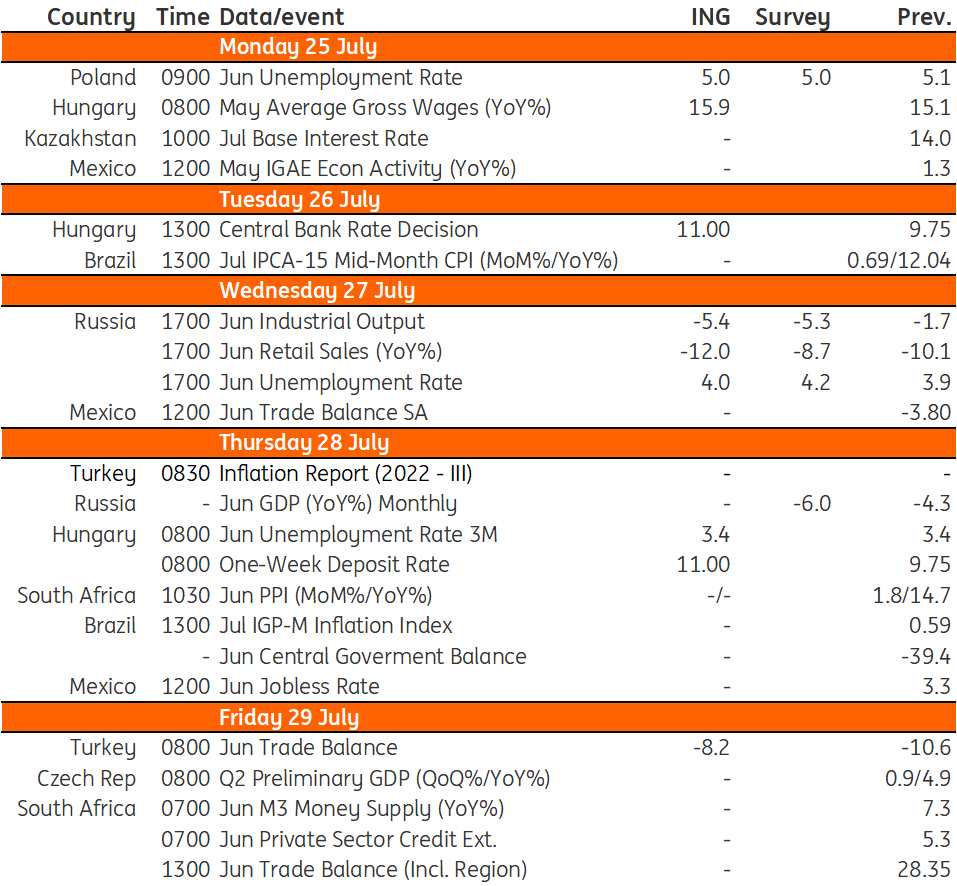

Key events in EMEA next week

As the National Bank of Hungary remains committed to its decisive tightening cycle, we expect both the base rate and the one-week deposit rate to rise by 125bp to 11.00%

Poland: June's registered unemployment rate forecast at 5%

We forecast that the registered unemployment rate moderated to 5.0% in June down from 5.2% in May. According to the Ministry of Family and Social Policy, initial estimates for the unemployment rate fell to 5.1% last month, but the estimated decline in the number of unemployed people was broadly in line with our forecast, so we stick to our initial projection. It all comes down to the change in the number of people active in the labour market (denominator of the unemployment rate).

Hungry: 125bp rate hike likely to combat rampant inflation, with more hikes potentially to come

We expect the National Bank of Hungary to remain committed to its decisive tightening cycle and we see both the base rate and the one-week deposit rate rising by 125bp to 11.00%. The forward guidance will remain hawkish, suggesting further rate hikes as we are still waiting for inflation to peak in Hungary. Whether this will be enough to give support to the forint remains to be seen. Market expectations regarding tightening are extremely elevated but we see the bar for the market to be disappointed as low. When it comes to data releases, we will get the latest labour market data, which will flag further price pressure in the pipeline with remarkably high wage growth and a near-record low unemployment rate.

EMEA Economic Calendar

Tags

EMEADownload

Download article22 July 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more