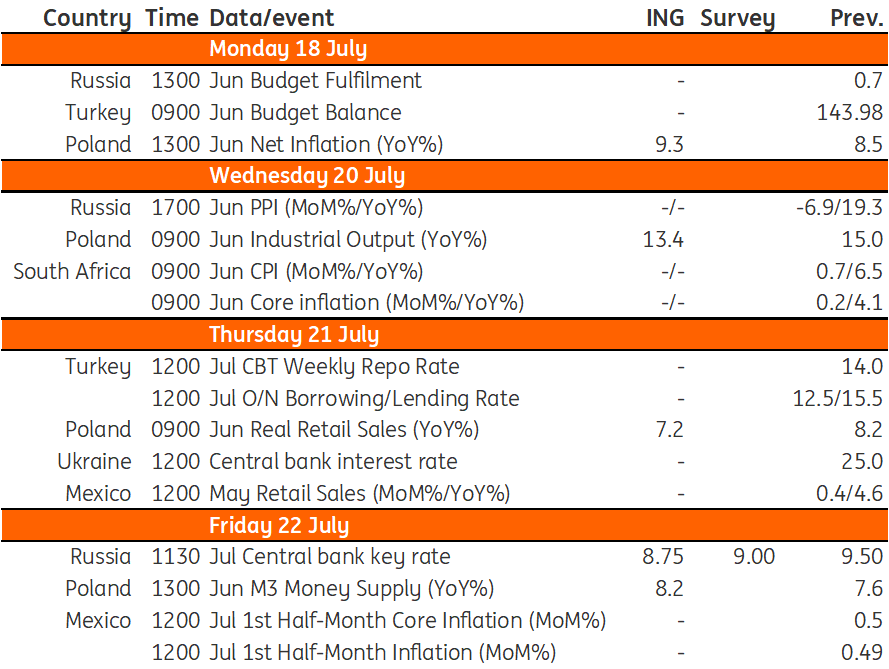

Key events in EMEA next week

In Poland, we expect to see a further slowdown in the second half of 2022, as the energy crisis and supply-side constraints loom over the horizon

Poland: Sharp deterioration in outlook and subdued demand for durable goods

The first cracks in industrial sector performance were already visible in May as output declined for the second consecutive month in quarter-on-quarter, seasonally-adjusted terms, but annual readings remain high. July brought a sharp deterioration in manufacturing PMI, which suggests a further slowdown ahead. Risks from the energy crisis (potential shortages of gas in Germany) and supply-side constraints (zero-Covid policy in China) loom over the horizon and point to a sharp deterioration in the outlook for the second half of 2022. We forecast next week's industrial output reading will be 13.4% year-on-year.

Although high inflation bites into real disposable income and rising interest rates translate into higher debt servicing costs of loans, fiscal expansion and spending by refugees from Ukraine support consumer outlays. The structure of retail sales is tilted towards necessities (clothing and footwear, pharmaceuticals and cosmetics, food and beverages), whereas demand for durable goods (cars, furniture, consumer electronics, house appliances) is subdued amid soft consumer confidence. We forecast next week's retail sales figure will be 7.2% year-on-year.

EMEA Economic Calendar

Download

Download article15 July 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more