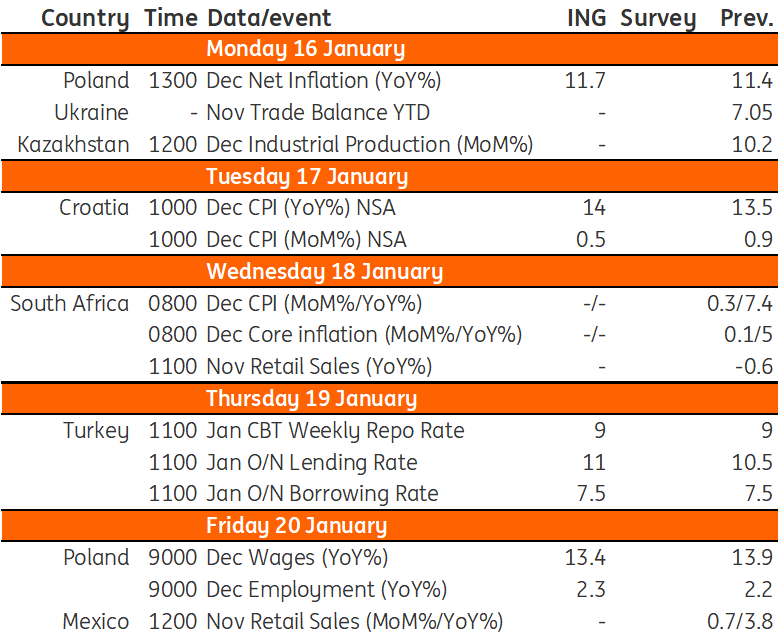

Key events in EMEA next week

For Turkey's Monetary Policy Committee meeting next Thursday, we expect the central bank to keep the policy rate unchanged at 9%, given its pursuit of 'liraisation'. In Poland, core inflation is expected to continue trending upwards to 11.7% year-on-year

Poland: Core inflation continues to trend upward despite decline in headline inflation

Poland Core inflation (Dec): 11.7% YoY

Despite the sharp decline in headline inflation in December (down to 16.6% year-on-year from 17.5% YoY in November), core inflation continues to trend upwards as businesses keep passing on higher costs to the prices of final products. We expect broad-based price adjustments to the energy shock to keep core inflation elevated in 2023. After peaking in the first quarter of this year, inflation is projected to start moderating but will remain at double-digit levels at the end of this year.

Poland wages (Dec): 13.4% YoY

Two opposite forces are shaping average wages and salaries in the enterprise sector. On the one hand, employees received one-off bonuses in December compensating for high inflation and because of the good financial results businesses achieved. On the other hand, an exceptionally high number of seasonal flu cases probably translated into an increase in staff absences that reduced working hours and therefore wages. Even though wage demands are visible in the economy, the growth of average wages has been running below inflation for some time. A substantial increase in the minimum wage is forecast to keep wages growth at double-digit levels most of this year.

Poland employment (Dec): 2.3% YoY

We forecast that the number of employees in the enterprise sector remained broadly unchanged in December vs. November, which translated into a slight increase in annual employment growth (2.4% YoY vs. 2.3% YoY in November). Although economic activity is slowing down, demand for labour remains solid, keeping in mind that refugees from Ukraine (some 800,000 people have found a job in Poland since February 2022) are generally not covered by high-frequency enterprise sector data.

Turkey: Repo rate is expected to remain at 9%

With the 2023 Monetary and Exchange Rate Report release and recent regulatory changes strengthening the current macro prudential framework, the Central Bank of Turkey maintains the policy path of keeping interest rates low, relying on selective credit policy and pursuing a ‘liraisation’ strategy. Given this backdrop, we expect the bank to keep the policy rate unchanged at 9% at the January Committee meeting.

Key events in EMEA next week

Download

Download article13 January 2023

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more