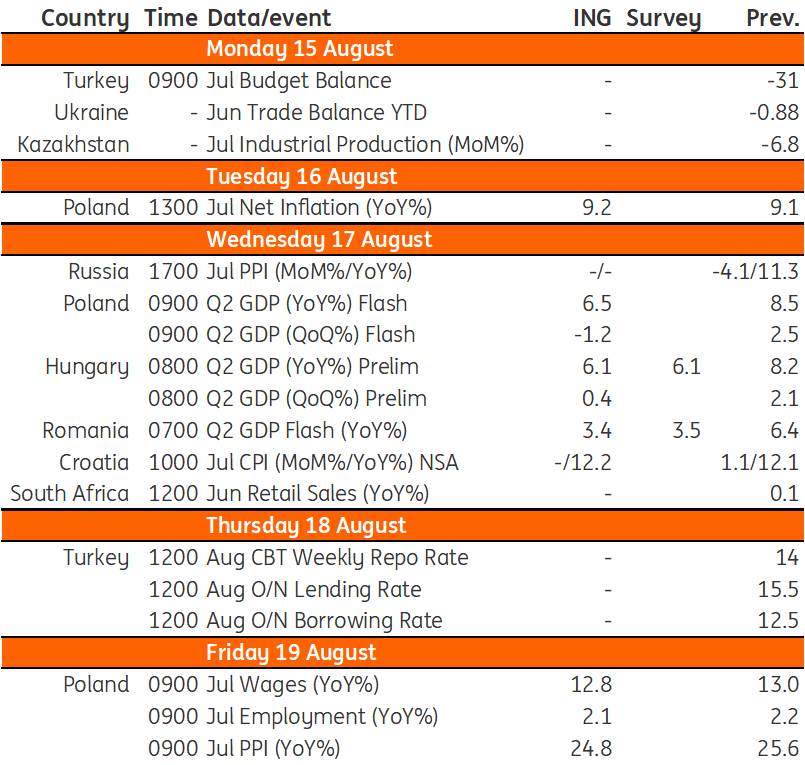

Key events in EMEA next week

A busy week next week for Poland with inflation and GDP readings. In Hungary, we expect the 2Q GDP reading to be the last quarter-on-quarter reading this year to not show a reduction in economic performance, as we see a technical recession in the next couple of quarters

Poland: Our analysis of next week's key releases

Second-quarter GDP: Despite initial signs of an economic slowdown in the second quarter, we expect that economic activity was still some 6.5% higher than in 2Q21 on the back of strong consumer demand and further restocking. However, the latter was at a smaller scale than in 1Q22 in terms of its contribution to annual GDP growth. Strong domestic demand was accompanied by a negative contribution of net exports as imports growth outpaced sluggish exports.

July Wages: Wages and salaries in the enterprise sector continued expanding at a double-digit pace in July, but probably fell short of inflation for the third consecutive month despite one-off payments in mining that were supposed to compensate for the higher price of consumer goods. A substantial increase in the minimum wage planned from the beginning of 2023 may somewhat reduce wage demands in the coming months.

July Employment: Employment growth remains slow as the number of potential workers is thin and official data do not include refugees from Ukraine employed according to simplified employment procedures. Official employment continues to expand in trade and services, whereas manufacturing reported month-on-month declines in the last two months. Yet the labour market still remains tight and heavily reliant on immigration.

July PPI: Upward pressure on producers’ prices eased recently amid declines in wholesale gasoline prices and a downward correction in prices of many industrial commodities as global recession fears intensified. Still, July prices were nearly one-fourth higher than in the corresponding month of 2021. Given lags between PPI and CPI, it may continue driving core inflation upwards in the coming quarters.

Hungary: 2Q22 will be the last QoQ reading to not show a reduction in economic performance

The only top-tier release next week in Hungary is second-quarter GDP data. We expect a significant slowdown in economic activity both in quarterly and yearly terms. However, we believe that Hungary was able to avoid a drop in the volume of GDP versus the previous quarter, as industry was able to shake off the supply-side issues by the end of the quarter. In the meantime, retail sales suggest that consumption has started its soft landing, but we are not ready to call a drop yet in the second quarter. In all, we see consumption and investment activity doing enough to counterbalance the negative impact of net exports. However, this will probably be the last quarter-on-quarter reading in 2022 not to show a reduction in economic performance, as we see a technical recession in the next couple of quarters.

Romania: 2Q22 growth estimated to be 3.4% year-on-year

After a very strong first quarter, the economy seems to have entered a phase of quasi-stagnation. We estimate 2Q22 growth at +0.4% versus 1Q22 (+3.4% year-on-year), though we might be a touch on the optimistic side here. However, the high-frequency data does seem to support our call, with retail sales expanding by 2.9% versus 1Q22, a quasi-flat construction activity, while the weak link remains industrial production which has probably contracted in the second quarter. External trade remained vibrant and will probably contribute negatively to growth, with the trade balance deficit expanding by 15.0% versus the previous quarter. We do stress that the numbers for the first quarter have been influenced by methodological changes as well and we cannot exclude statistical data revisions.

Faced with rising living costs, higher interest rates, and a gloomy informational environment, consumers are likely to turn more cautious in the second half of 2022 and stay that way throughout the winter. However, the latest wage data confirms that the labour market remains a strong argument for the soft-landing camp against a grimmer outlook. Should inflation confirm the estimated downward profile starting in 4Q22, Romania could get away without a technical recession throughout this soft landing phase. All things considered, we estimate full-year growth at 5.0%, based on the very strong first quarter and almost flat quarterly growth afterwards.

EMEA Economic Calendar

Download

Download article12 August 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more