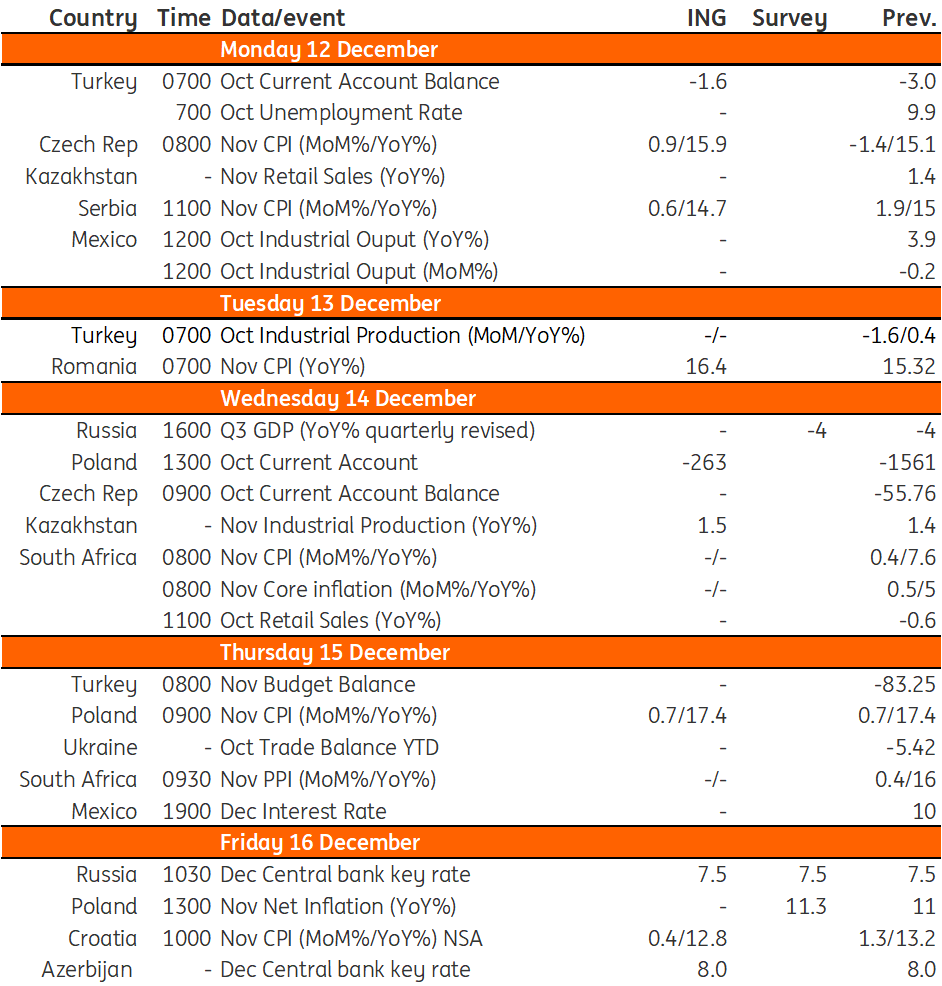

Key events in EMEA next week

Inflation data is in focus next week. In the Czech Republic, surveys suggest food prices continue to rise, and we believe fuel will be the only item to show deflation in November. Thus, we expect inflation to accelerate to 0.9% month-on-month. In Poland, core CPI grew to 11.3% year-on-year, and we see it peaking above 20% in February 2023

Poland: No turnaround in inflation yet

Current account (€-263mn)

We forecast that the current account deficit narrowed substantially in October even though the trade deficit in goods was at a similar level as in the previous month. The main improvement is projected to come from an improvement in the primary income balance. For 2022 as a whole, we project a current account deficit of about 4% of GDP, declining further to 3.2% in 2023 on the back of weak domestic demand and a moderate increase in foreign sales.

CPI (17.4%YoY)

According to the flash estimate, CPI declined to 17.4% year-on-year in November from 17.9%YoY in October, as an expected month-on-month drop in gasoline prices was accompanied by an unexpected fall in energy prices due to cheaper coal. Still, core CPI grew to 11.3%YoY from 11.0%YoY in the previous month. Lower inflation in November is not yet a sign of a turnaround in the inflation trend. We see consumer inflation peaking above 20%YoY in February 2023 before declining to around 10%YoY in the fourth quarter of next year. You can read more in our 2023 economic outlook here.

Czech Republic: Inflation accelerates again

Surveys suggest that food prices in the Czech Republic continue to rise rapidly. While they rose by 3.0% in October, we expect a 2.1% month-on-month jump for November, which is still significantly higher than in the months leading up to October. On the other hand, we expect fuel prices to have fallen (1.7%). However, we believe this is the only item in the consumer basket that shows deflation in November. The main issue, as always, is energy prices. In October, the statistics office surprised with its aggressive approach to including the energy-saving tariff in the CPI, which led to a massive drop in inflation. This effect will last until December and will be replaced in January by the price cap, which we believe will have a similar effect on inflation. Unlike the price cap, the savings tariff allows energy prices to rise further. Therefore, we expect a slight increase in energy prices in November, but again, this is the main CPI item that may surprise. Thus, overall, we expect inflation to accelerate from -1.4% to 0.9% month-on-month, which should translate into a headline number rising from 15.1% to 15.9% year-on-year.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 December 2022

Our view on next week’s key events This bundle contains 3 Articles