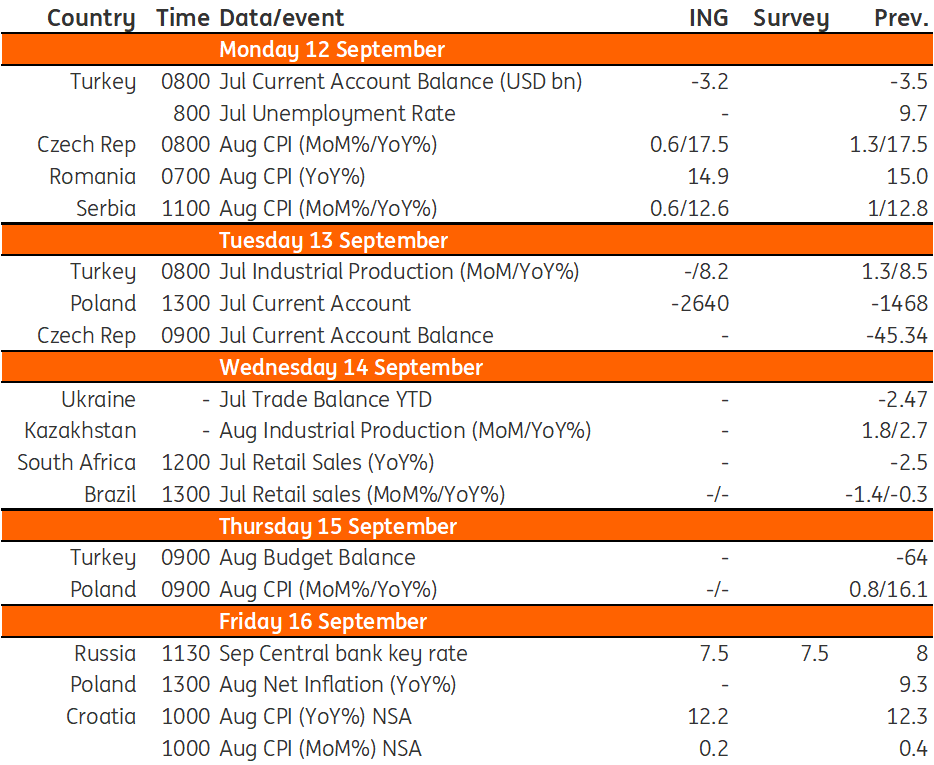

Key events in EMEA next week

We are anticipating a 25-50bp cut at the Central Bank of Russia meeting next Friday, as there's still growing inflationary pressure led by uncertainties around fiscal policies and the recovery in lending activities. For the Czech Republic, we are expecting the lowest month-on-month inflation rate this year at 0.6%, due to a drop in fuel and food prices

Russia: Rate cut cycle to continue

The current inflation trends seem to be tracing the lower border of the Central Bank of Russia’s (CBR's) forecast range for 2022 (12.0-15.0%) and 2023 (5.0-7.0%). This inflation trajectory, according to the CBR’s recent medium-term forecast, corresponds to an average key rate of 7.4% for August-December 2022 and 6.5% for 2023. Following this guidance, the key rate, currently at 8.0%, could be cut by 100bp until year-end, and by another 100bp next year. Our base case for the 16 September meeting is a restrained 25-50bp cut, reflecting growing seasonally-adjusted inflationary pressures, persistent elevated inflationary expectations by households, some recovery in lending activity, and ongoing uncertainties surrounding future fiscal policy (prospects of stimulus). At the same time, a more decisive 75-100bp cut, though less likely, is also not excluded – signalling the monetary authority's confidence in achieving longer-term inflationary targets.

Poland: exports deteriorate and inflationary pressure continues

Current account balance: We project that the current account deficit widened to some €2.6bn in July as the trade deficit increased towards €1.6bn amid easing exports and robust imports boosted by high prices of energy commodities. On a 12-month cumulative basis, the external imbalance increased above 4% of GDP and is expected to stabilise around 5% of GDP later this year as the outlook for European manufacturing and hence Polish exports deteriorate.

CPI: The August flash estimate of 16.1% year-on-year is expected to be confirmed. Inflationary pressures continue and price growth is broad-based. Monthly increases in food and energy prices turned out higher than expected. What is more, core inflation, excluding food and energy prices, accelerated towards 10%YoY from 9.3%YoY in July. In the wake of the new 2022 CPI inflation high, the National Bank of Poland will continue its rate hikes in the short term.

Czech Republic: Energy prices remain the main uncertainty for the CPI

July inflation surprised with the lowest energy price rise this year despite the biggest price hike for households being announced. Further energy price rises are announced for August, however, the ratio of fix-float contracts and the approach of the CZSO remains unclear. Even so, we believe that energy price hikes will be reflected to some extent sooner or later.

On the other hand, the massive 10% month-on-month drop in fuel prices, as well as the first food price decline this year indicated by surveys, are working to the downside. Overall, we expect the lowest month-on-month inflation rate this year at 0.6% from 1.3% last year, which should keep the annual rate steady at 17.5% YoY. However, this does not mean we have peaked. On the contrary, the effect of the drop in fuel is rather a one-off effect and energy prices should pass through to CPI in the coming months. The risk for this month is that energy prices from July will be reflected in August's number and inflation will surprise with a significant jump upwards.

Key events in EMEA next week

Download

Download article9 September 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more