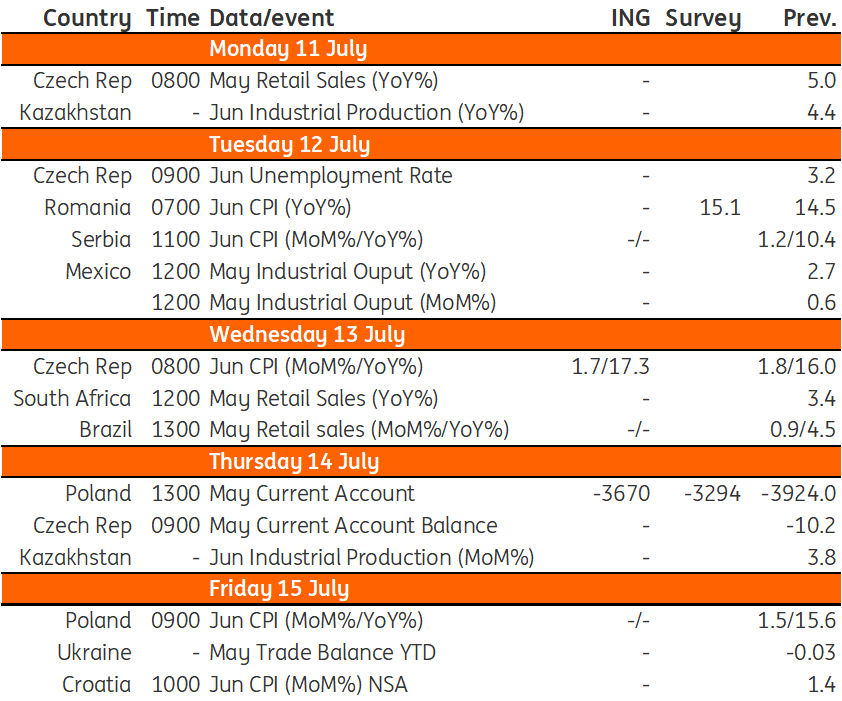

Key events in EMEA next week

Energy prices in the Czech Republic remain the main upside risk to inflation, as suppliers follow the market leader's footsteps in hiking prices

Czech Republic: Inflation in next stage, but not at peak

For June, we expect inflation to slow marginally from 1.8% to 1.7% month-on-month, which translates into a dramatic year-on-year rise from 16% to 17.3%. Like previous months, food prices continue to rise at a high rate of 2.9% MoM. Fuel prices accelerated further in June to almost double (4.1% MoM). On the other hand, no sharp price increases are announced for June from major energy suppliers. Thus, we expect a smaller increase of 3.6% MoM compared to April (4.2%), but larger than in May (1.6%). Nevertheless, energy prices remain the main upside risk and the main question for the coming months, which we believe will be more interesting than the June print.

At the end of May, the main energy supplier announced a dramatic price hike effective from July, and a week ago the price list was changed upwards again effective from August. Other suppliers can be expected to follow in the market leader's footsteps. Some of them have already announced increases from July or August, the month in which we should see the largest contribution of energy price in the CPI. But, given the mix of floating and fixed contracts, energy prices will be written gradually into the CPI until at least January next year. As we mentioned previously, we are thus more and more sceptical that there will be a slowdown in inflation in the second half of the year as expected by the Czech National Bank. On the contrary, the next prints, including the June one, may push us to levels close to 20% year-on-year.

EMEA Economic Calendar

Download

Download article8 July 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more