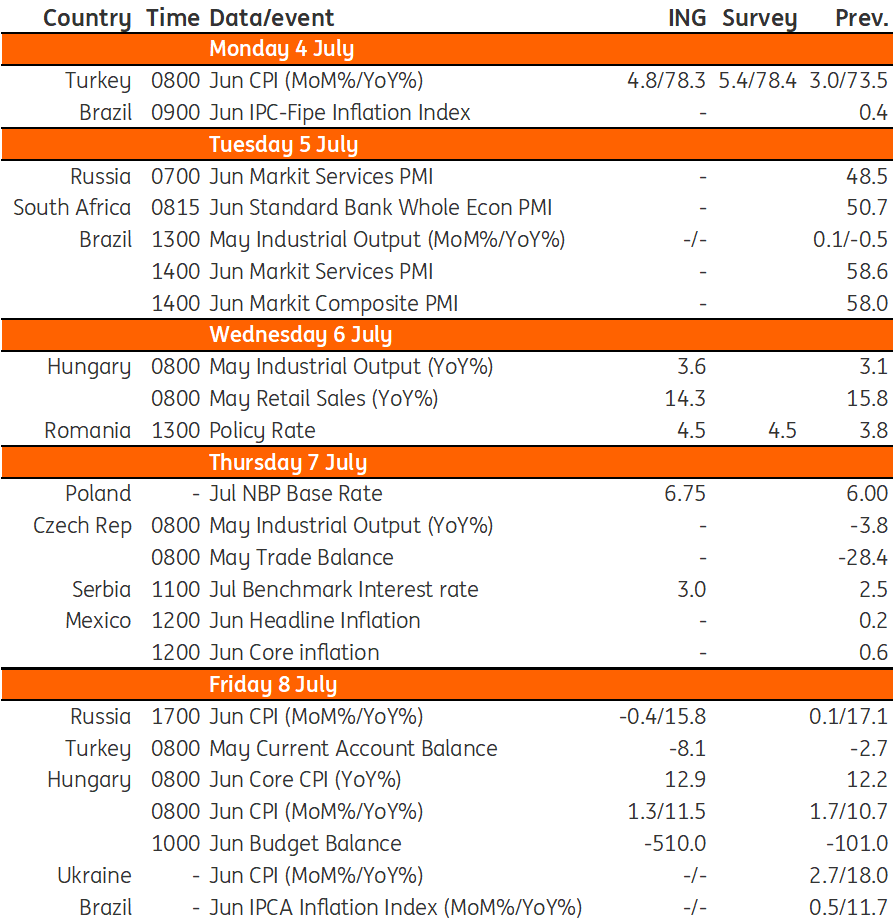

Key events in EMEA next week

In Turkey, we expect annual inflation to further increase next week, while Poland's central bank is expected to deliver a 75bp rate hike amid ongoing inflationary risks

Hungary: Higher than historical average price increase

The next week will be quite dense in terms of data in Hungary. We expect some further slowdown both in retail sales and industrial production on a monthly basis in May. This would be in line with the latest changes in soft indicators. However, the year-on-year indices will be significantly skewed by base effects. Nonetheless, we still won’t see any reason to worry about our above 5% 2022 GDP forecast. What will be even more important, than the economic activity is the June inflation print. After causing a huge upside surprise in the previous month, we expect some slowdown in the monthly inflation reading. Yet, the 1.3% MoM price increase will be much higher than historical average, showing the impact of rising producer prices, booming wages and high pricing power of companies. On a yearly basis, this will translate into a 11.5% headline figure, while core inflation (as the majority of the price caps are effective in the non-core basket) is expected to be just shy of the 13% mark. Last but not least, we see the budget balance to show further deterioration due to seasonal patterns and the country’s rising energy bill.

Turkey: Further increase in annual inflation

In June, we expect annual inflation to further increase to 78.3% (4.8% on monthly basis) from 73.5% a month ago, particularly driven by food and transportation prices, while pricing pressures will likely remain broad-based with largely supportive policy framework leading to currency weakness and external factors weighing on import prices.

Poland: Upcoming NBP decision on the rates

Although in May the NBP governor A. Glapiński suggested that monetary tightening is drawing near to its and conditions for rate cuts could arise already in 2023, price developments (CPI above 15%YoY in June) and inflationary risks call for another rate hike this month. What is more, external environment leaves little room for doubts about the need to continue tightening. In June the CNB hiked rates by 125bps and the HNB by 185bps and the NBP is again lagging behind with respect to the level of policy rate. Therefore, we expect the MPC to deliver 75bp rate hike, however markets may bet on even more decisive policy move. Anything less than 75bp would lead to PLN weakening.

EMEA Economic Calendar

Download

Download article1 July 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more