Key events in EMEA and Latam next week

A heavy data week ahead in EMEA and Latam with a flurry of central bank meetings. With a common 'on hold' theme amongst the banks, it's the commentary

Turkey: Collection of downside inflation risks to weigh on annual figure

Following a broad-based disinflationary trend in December, we expect January inflation to remain relatively benign at 0.9%, pulling the annual figure down to 20.1%. This is due to to weak domestic demand, a stable currency, the government’s decision to extend tax cuts on consumer durables and price cuts in natural gas, electricity and water - though food prices could pose upside risks.

Hungary: GDP saved by the retail sector? Probably not

We think the retail sector ended 2018 on

Russia: Accelerating prices not an argument for the central bank to react - yet

We doubt that this acceleration will be an argument for the central bank to react

We’ll be looking for signals of whether the CBR is seeing risks of CPI hitting the previously

Romania: National Bank flexibility constrained by fiscal measures

With the ROBOR-linked tax apparently here to stay, the National Bank of Romania's (NBR) room for manoeuvre on rates seems

Serbia: National Bank on hold again due to external uncertainties

With year-end inflation at 2.0% - well within the 3.0% ±1.5ppt target band - and expectations well contained, the National Bank of Serbia (NBS) seems to

Czech Republic: Global economic uncertainty to encourage wait-and-see approach

The most important event, however, will be the Czech National Bank's (CNB) rate decision on 7 February. Given recent comments from CNB board members highlighting uncertainty stemming from the global economy, we expect a wait-and-see approach and thus rates on hold.

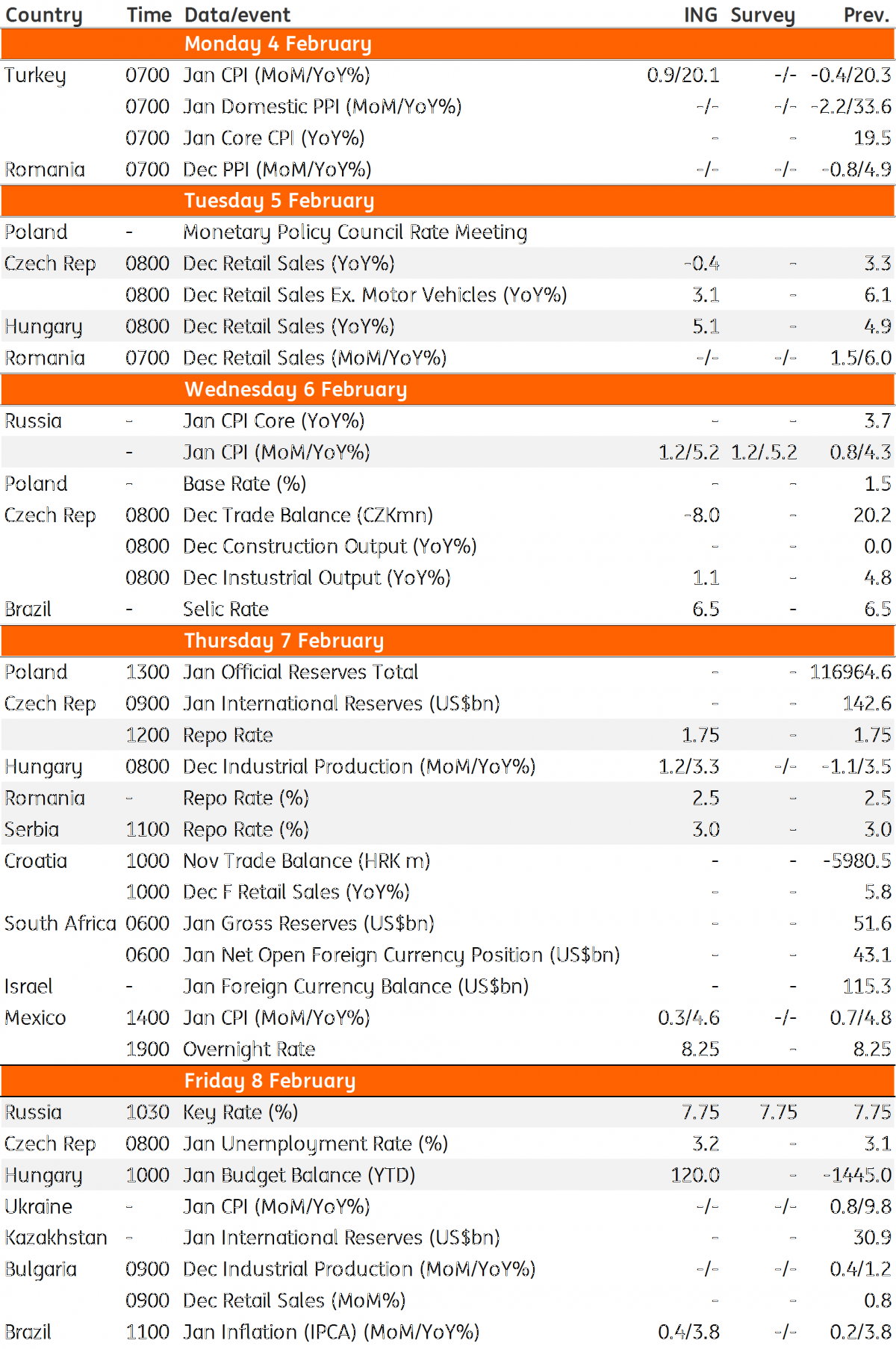

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 February 2019

Our view on next week’s key events This bundle contains 3 Articles