Key events in EMEA and Latam next week

PMI surveys next week are likely to show that weakness in the eurozone and Germany is feeding through to sentiment in eastern Europe. But Hungary could well be an exception, with next week's data likely to add to the case for strong 1Q19 growth

Turkey: High inflation and sticky expectations will concern policymakers

Headline and core inflation decelerated in February. In March, we're looking for a reading of 1.1%, pulling the annual figure up slightly to 19.8% from 19.6%. Despite some stabilisation in the outlook, high levels of inflation and sticky expectations will likely remain one of the main concerns for the Central Bank of Turkey.

Hungary: More arguments for strong growth in 1Q

We'll get more clues next week about Hungary's economic activity in the first quarter. So far, the picture has been promising.

The manufacturing PMI has recently shown a decoupling from eurozone figures, which suggests we might see further improvement in Hungary. Industrial data was surprisingly strong in January and we think the positive momentum could roll over into February. The same could be true for the retail sector as well.

Overall, we anticipate that 1Q19 GDP will be robust - despite concerns about a slowdown in the rest of Europe.

National Bank of Romania: A long pause

We expect no change from the National Bank of Romania next week. The CPI has recently surprised on the upside but the central bank will need more time to assess the changes to the bank levy and spillovers from weaker eurozone data. The NBR is likely to continue to use liquidity management, and eventually FX interventions, to deter the depreciation of the Romanian leu - at least for a while.

Czech Republic: PMI under pressure

The recent fall in Germany's manufacturing PMI (below the 45 threshold) together with weaker Czech industrial confidence in March suggest that the Czech manufacturing PMI will remain in contraction territory and will most likely deteriorate further.

February retail sales should remain solid although new car registrations have continued to fall annually. Still, annual declines were much stronger in previous months so the figures are signalling some stabilisation.

Poland: Dovish signals delivered as PMI expected to undergo yet another drop

We expect Poland's Monetary Policy Committee to maintain its forward guidance, signalling no rate changes until the end of 2020. That said, recent comments of some centrist members, e.g. Grażyna Ancyparowicz or Jerzy Osiatyński, suggest the possibility of hikes in the coming year to prevent fiscal stimulus-related inflation growth.

However, the propensity to hike is likely to fade in the coming months given worsening external conditions and a dovish shift in policy from the European Central Bank (as well as other central and eastern European central banks).

A dovish signal should be delivered next week via the manufacturing PMI. Following a deterioration in German and eurozone manufacturing data, we are expecting yet another drop in the index.

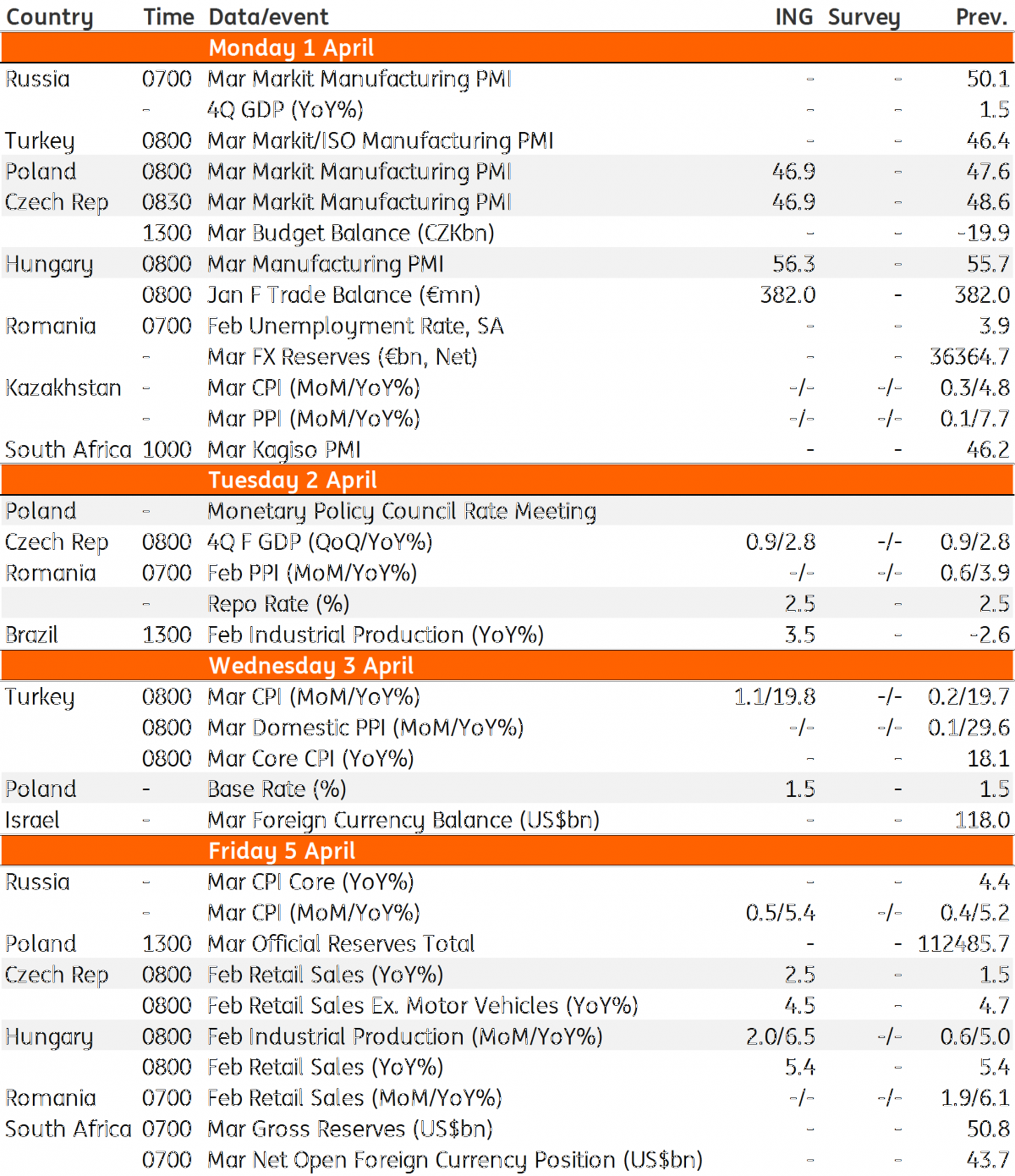

EMEA and Latam Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

29 March 2019

Our view on next week’s key events This bundle contains 3 Articles