Key events in EMEA and Latam next week

Policymakers in EMEA find themselves with a tough trade-off. While the global economy looks more uncertain, domestic pressures argue for higher interest rates. The National Bank of Hungary is likely to take its first hawkish step since 2011. And while the Czech National Bank is a little more cautious - we'll probably see the first rate hike arriving in May

Hungary: Tiptoeing towards hawkish territory

The National Bank of Hungary is set to make its first hawkish step since 2011. We expect the central bank to start its policy normalisation with a ten basis point increase in the overnight deposit rate and a reduction in FX swaps worth HUF 200-300 billion. Due to the rather gloomy outlook in the global environment, we expect the central bank to emphasise the downside risks to domestic inflation in the monetary policy horizon (five to eight quarters) and highlight its cautious and gradual approach. Elsewhere, we see the 4Q18 current account balance posting a deficit for the first time since 2014.

Poland: March inflation, back on track?

We expect CPI to return back to the National Bank of Poland's target boundaries in March. Our initial forecasts point towards another increase from 1.2% to 1.6-1.7% YoY, due to food and fuel prices. Core inflation should remain stable - close to 1.0% YoY. The Polish statistical office will only provide information - allowing for a more precise estimate - next Monday, after our calendar release.

Czech National Bank: De ja vu?

We could easily copy and paste our Czech National Bank preview from the February meeting. The uncertain global environment remains the main driver for policymakers, pushing the Board towards a more wait-and-see approach. As such, we expect the CNB to stay on hold next Thursday. We expect the board to wait for a new QIR forecast (in May) before any policy reaction. This should outweigh the weaker-than-expected Czech koruna and higher core inflation.

We still see scope for two rate hikes this year with the first being delivered in May, though an improvement in the global economic outlook is now a necessary condition. We don’t think the dovish Federal Reserve and European Central Bank takes away the prospects of a hike in 2019. The Bank might be more independent now, given the lower sensitivity of the Czech koruna to interest rates abroad.

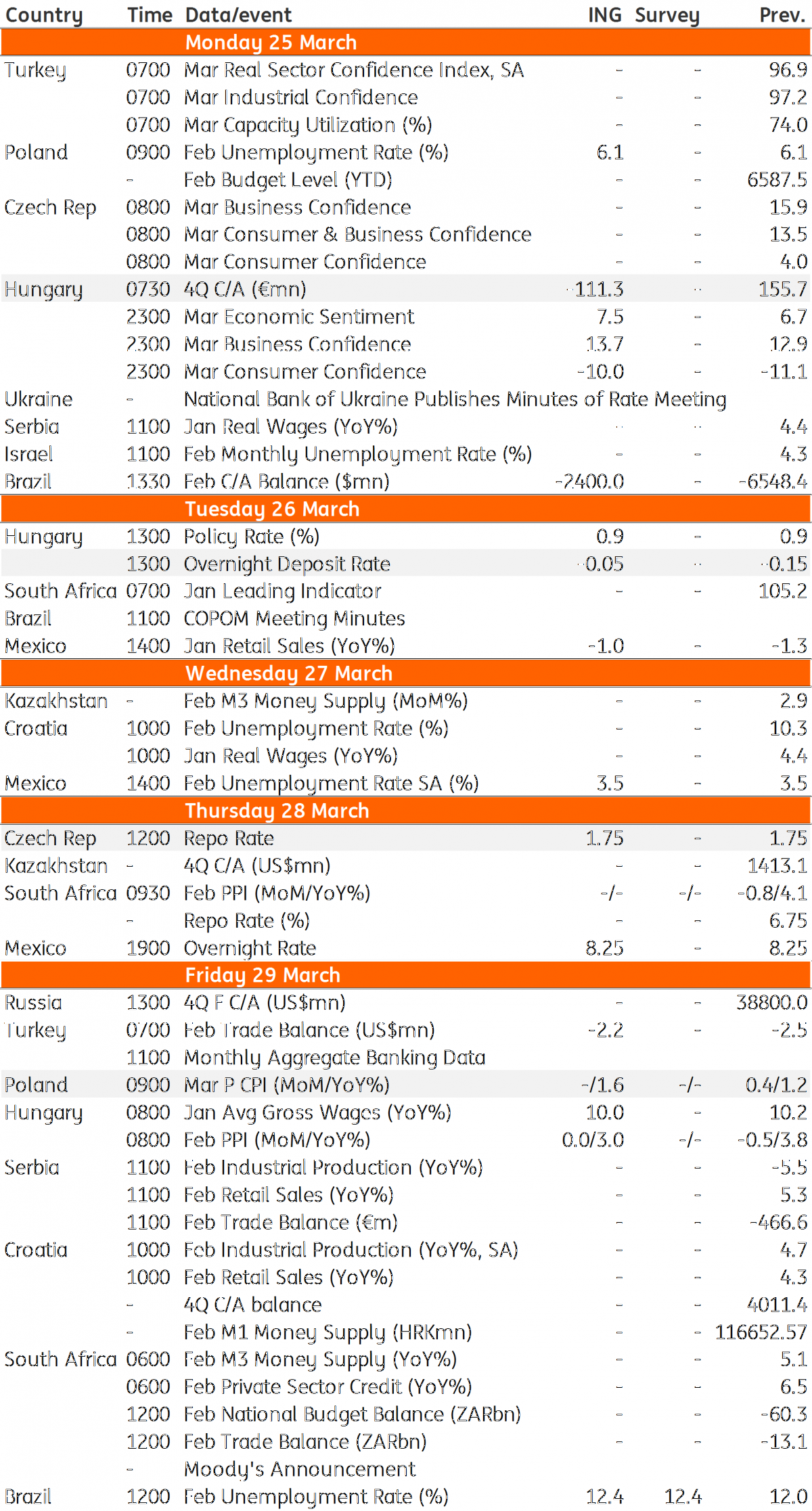

EMEA and Latam Economic Calendar

Download

Download article22 March 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more