Key events in EMEA and Latam next week

Data from Russia next week should show weakness in household income and spending- which could impact budget policy

National Bank of Hungary: Don't hold your breath

The National Bank of Hungary (NBH) meets next week to decide monetary policy - but don't expect any change. Despite the October CPI figure being surprisingly high (3.8% year-on-year), the NBH has signalled that this was driven by temporary factors and it plans to evaluate the situation in detail in December - when it prepares the next inflation report. The bottom line is, don't hold your breath for a change in policy at this meeting.

There's one other key event to watch; Moody's plans to review its sovereign debt rating. This is the only rating agency which does not have a positive outlook on the country.

Russia: Easier on the budget policy?

Russian activity data for October should show a further post-electoral deceleration in household income and consumption growth.

The weakness in consumption is driven by the low-income segment, which is dependent on the budget policy. Declining consumer optimism, combined with overall weakness in economic activity (GDP growth decelerated to 1.3% YoY in 3Q from 1.9% YoY in 2Q) as well as lower popular support in the regions, could strengthen calls in favour of easing in the budget policy in 2019-21. This is relative to a very tight draft.

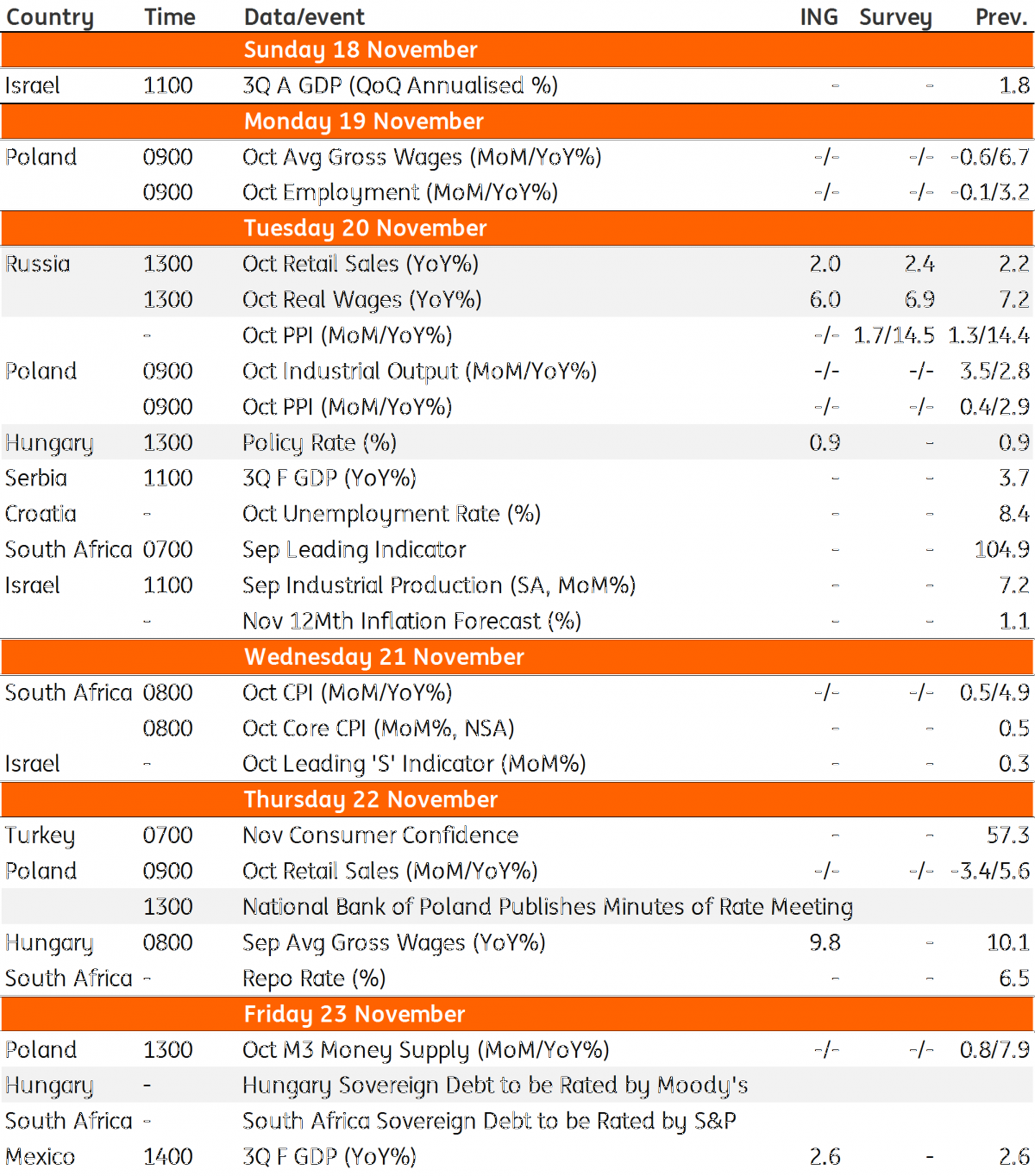

EMEA and Latam Economic Calendar

Tags

Emerging marketsDownload

Download article

16 November 2018

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more