Key events in EMEA and Latam next week

Inflation data from Romania and Poland, retail sales from the Czech Republic and a sovereign debt review on Hungary top this week's economic agenda

Romania: Higher inflation and at least two more rate hikes

In Romania, we expect February inflation to grind another 0.3% higher month-on-month, similar to the National Bank of Romania's (NBR) forecast. Due to base effects, we expect annual inflation to jump to 4.7% year-on-year from 4.3% in January as the elimination of some indirect taxes in February drop out of the statistical base. Nevertheless, we expect the NBR to deliver two more hikes of 25bps each at the following two rate-setting meetings on 4 April and 7 May and then take a pause for the rest of the year. As the NBR seems reluctant to tighten the liquidity control, we see risks for a third hike at the 4 July meeting, as it has to contain inflation expectations as long as inflation readings remain on an uptrend.

Czech Republic: January retail sales and industrial production to come in strong

A tight labour market and accelerating wage dynamics are supporting household confidence and consumption, which should be reflected in strong January retail sales. We have more uncertainty with industry. The number of cars produced stagnated in year-on-year terms in January, according to the preliminary figures. However, despite the strong production of cars in December, industrial production disappointed and was below our expectations. Therefore, we believe that lower December industrial production growth will be reflected in stronger January figures and we see IP accelerating close to 6% year-on-year.

Hungary: no change in Fitch sovereign debt review

In Hungary, we have one notable event to mention this week. However, we see the Fitch sovereign debt review on Friday as a non-event given that we are close to the general election (8 April 2018). Next week will be quiet, as the main event will be the MIRS tender, where we don’t expect any change in conditions.

Poland: rise in wages unlikely to translate into increase in core inflation

The detailed data of the March National Bank of Poland's (NBP) projections (published on Monday with the NBP inflation report) should confirm that the rise in wages failed to translate into a meaningful increase in core inflation. Such conclusions are likely to be supported by February inflation data. We expect a further deceleration from 1.9% year-on-year to 1.6% year-on-year amid a drop in food prices, disappointing core inflation (ING estimates stable 1% year-on-year), and likely negative statistical effects (basket weight revisions). Wage growth should remain close to 7% year-on-year.

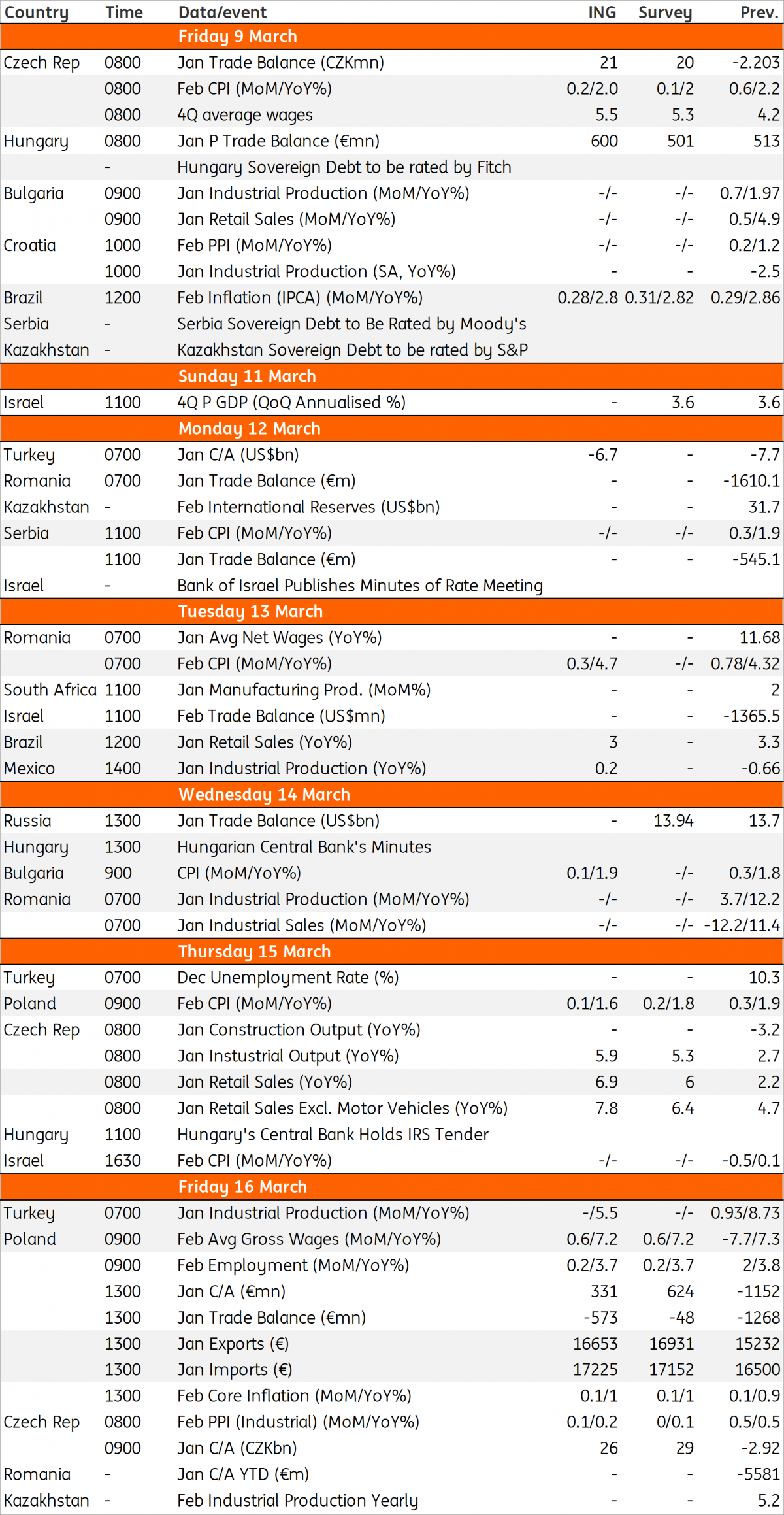

EMEA and Latam Economic Calendar

Download

Download article9 March 2018

Week Ahead: Our view on the key economic events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more