Key events in EMEA and Latam next week

June rate hike for the Czech National Bank, softening Turkish growth and strong Romanian inflation. But what else is going on in EMEA and Latam?

Romania inflation at 5.2% YoY

We expect May CPI to accelerate by 0.3% month on month as the increase in fuel prices was partially offset by the stronger Romanian leu and by a cut in mobile phone bills, as requested by the regulator. Due to the relatively high base effect, we see annual inflation remaining flat at 5.2%, which is the highest level since June 2013.

We forecast year-end inflation at 3.6% but the risk balance is tilted to the upside due to the recent rise in oil prices.

Fitch to maintain Poland's A-rating

We expect Fitch to maintain its A- rating with a stable outlook for Poland. We think the main problem preventing the agency from giving Poland an upgrade is their strong negative net international investment position (nearly -60% of GDP).

The final CPI reading should confirm the 1.7% year-on-year figure, with another soft core inflation reading at 0.6% year on year.

June rate hike for the Czech National Bank

May inflation should come back above the 2% target given current oil prices, where fuel prices accelerated by more than 4% month on month in May, and given preliminary data which has suggested that food prices might have also accelerated slightly after falling over the last three months.

Taking into account the weak Czech koruna lagging behind the Czech National Bank's expectations, strong wage dynamics and inflation hitting back above the target, a June hike is becoming a likely scenario.

Turkish growth to soften in 1Q18

After a strong growth performance last year, we see some softening in early 2018 as pointed out by industrial production, and thus we forecast 6.7% GDP growth in 1Q18.

Given the impact of theTurkish lira depreciation on the corporate sector balance sheet, with repercussions on the investment demand and of rising borrowing costs on the credit demand, the rebalancing will further accelerate in the period ahead.

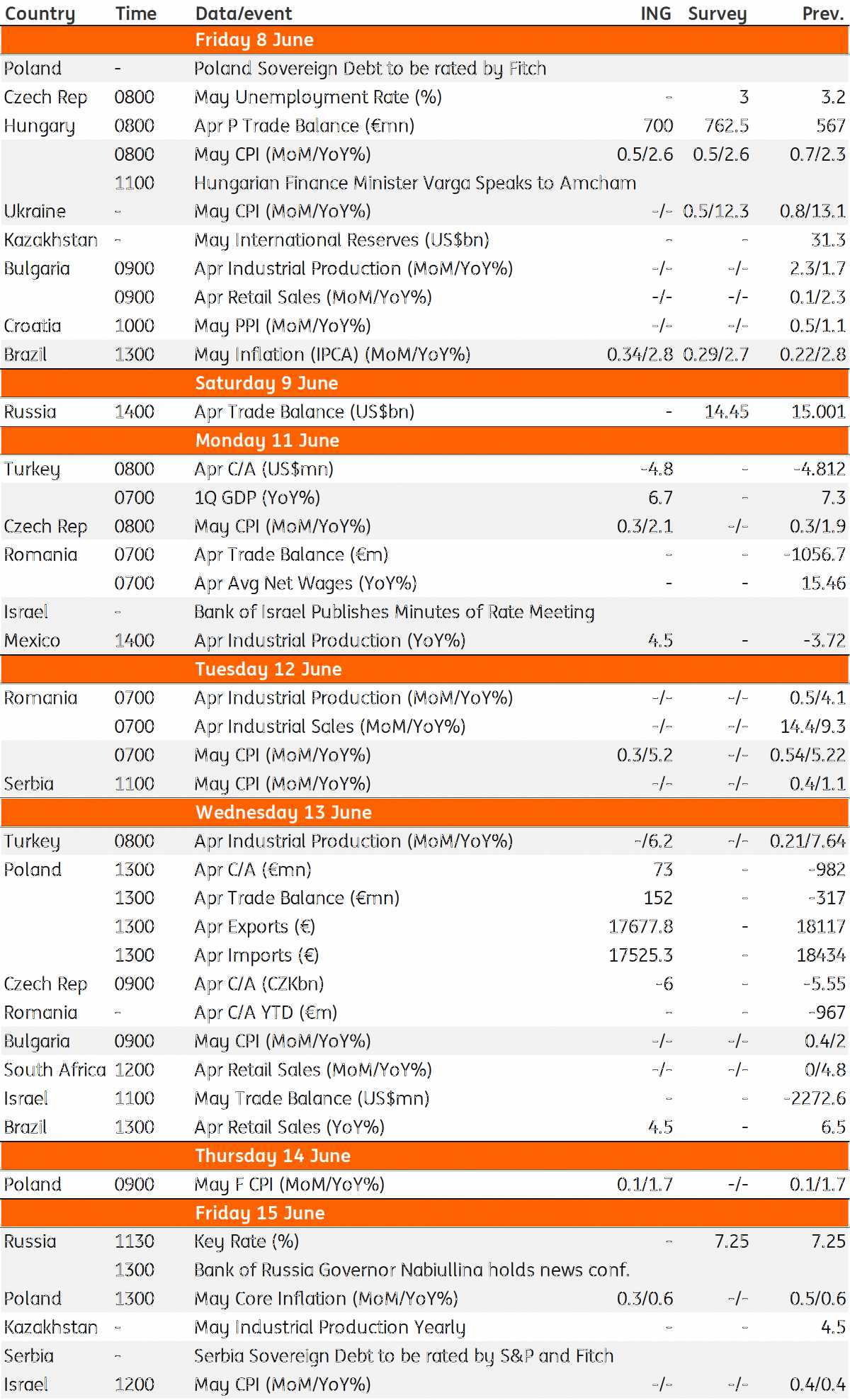

EMEA and Latam Economic Calendar

Download

Download article8 June 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more