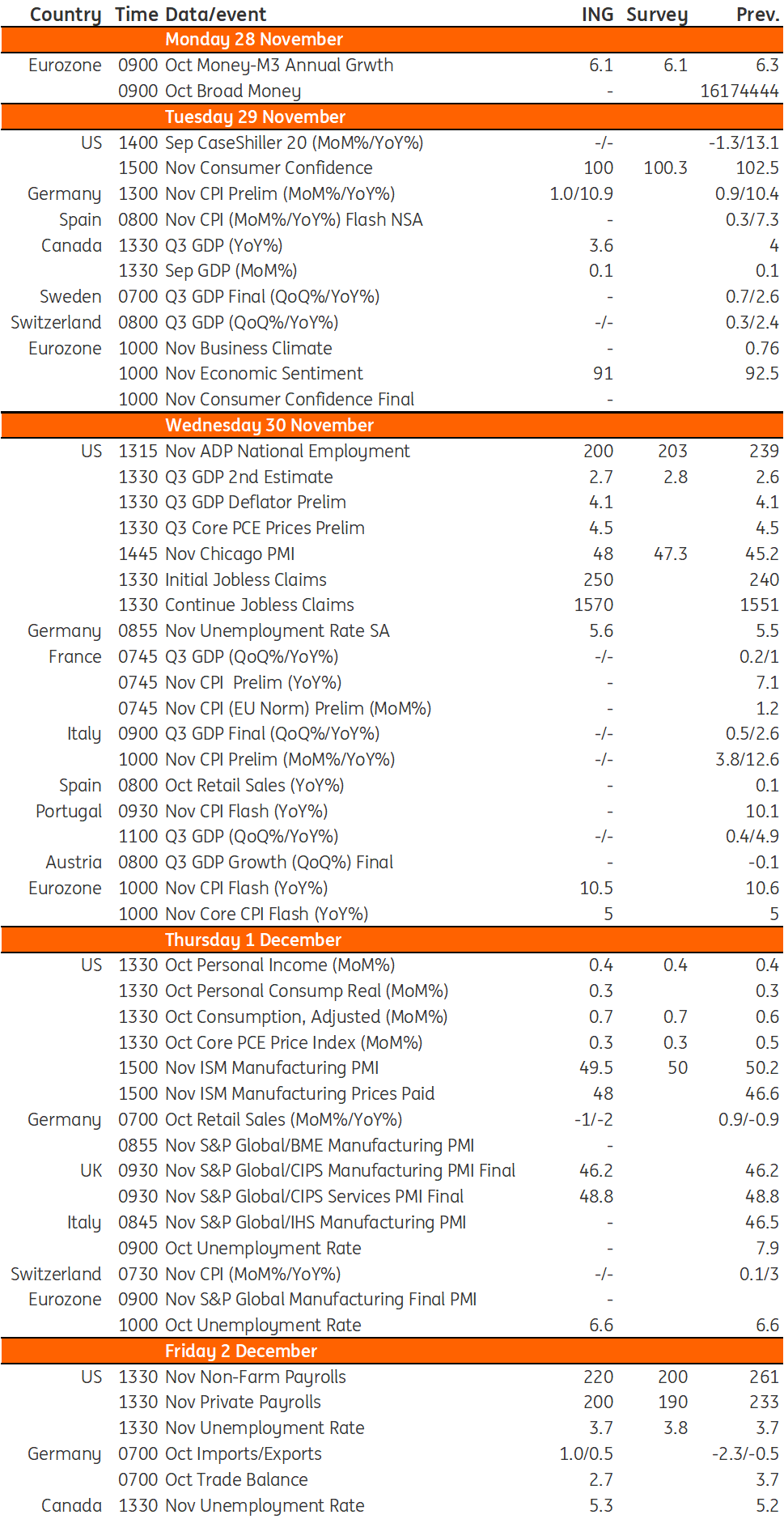

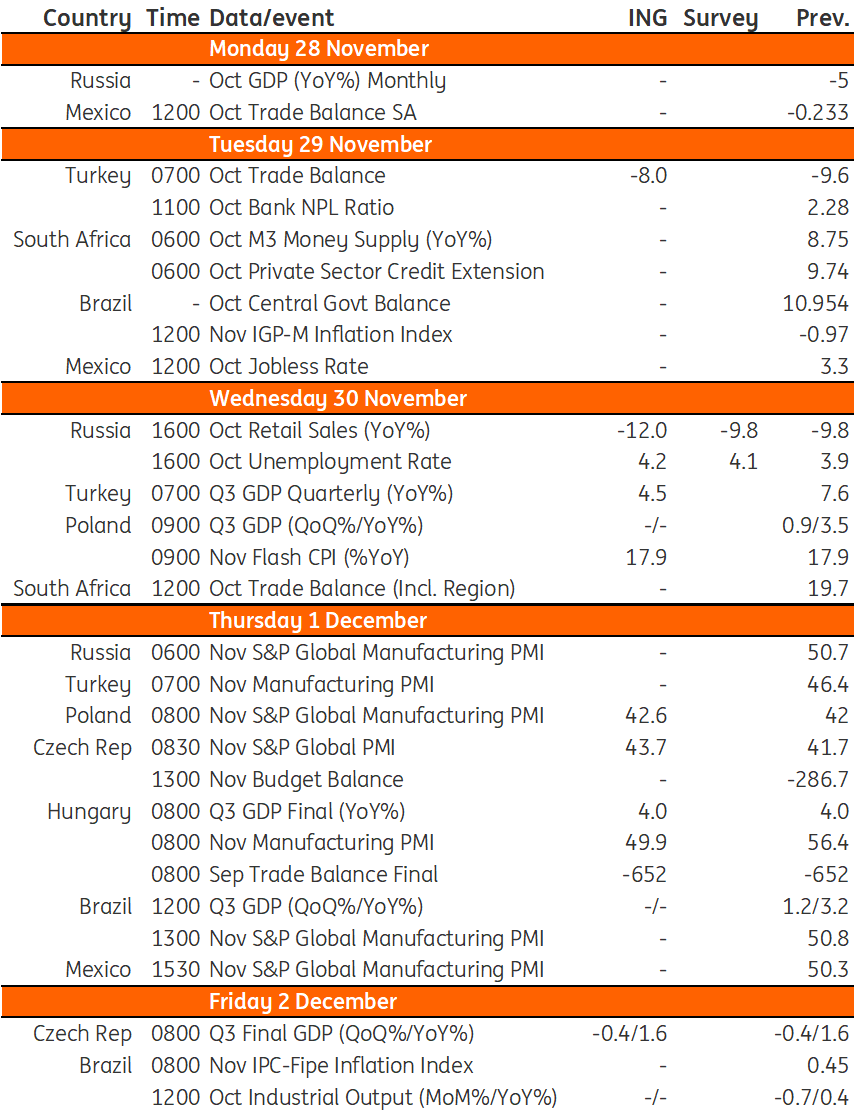

Key events in developed markets and EMEA next week

The market is firmly backing a 50bp hike from the Fed in December, and with US economic data so far proving to be resilient, all eyes are on next Friday's jobs report and the core personal consumer expenditure deflator. We expect the number of vacancies to exceed unemployed people by a ratio of 1.9:1 and for the PCE price index to be at 0.3% month-on-month

US: Fed may need to toughen its stance

The market remains firmly behind the view that the Federal Reserve will raise interest rates by 50bp on 14 December given Fed speakers have indicated the likelihood of less aggressive step increases in interest rates after four consecutive 75bp hikes. However, the economic data is proving to be pretty resilient and we are a little nervous that a 7% fall in the US dollar against the currencies of its main trading partners, and the 45bp drop in the 10Y Treasury yield, is leading to a significant loosening of financial conditions – the exact opposite of what the Fed wants to see as it battles inflation. Consequently, we wouldn't be surprised to see the Fed language become more aggressive over the coming week, talking about higher terminal interest rates – with some of the more hawkish members perhaps even opening the door to a potential fifth consecutive 75bp hike in December (although we don’t think they would actually do it) to ensure the market gets the message. Currently, only three officials are scheduled to speak, but we wouldn’t be surprised to see more make sudden appearances in the media.

Data-wise, the jobs report on Friday will be the focus, but there will also be interest in the ISM manufacturing index and the Fed’s favoured measure of inflation – the core personal consumer expenditure deflator – both of which are published on Thursday. The ISM is likely to drift just below the break-even 50 level given the softening trend seen in regional manufacturing indicators. The PCE deflator could be interesting too since it doesn’t always match what happens in core CPI. If you remember, that rose “only” 0.3% month-on-month versus expectations of a 0.5% increase and was the catalyst for the recent drop in Treasury yields, as expectations for Fed rate hikes were scaled back. A 0.4%+ print for MoM core PCE deflator could generate quite a sizeable reverse reaction. Meanwhile, the jobs numbers should hold around 200,000 given the number of vacancies continues to exceed the number of unemployed people by a ratio of 1.9:1. Nonetheless, there are more firings going on in the tech sector and the increase in initial claims also points to softer employment growth in the coming months.

Eurozone: All eyes on inflation

Has a eurozone inflation figure ever been more important than the November reading that is due out on Wednesday? With the ECB focusing more on current inflation developments for determining when to move to smaller rate hikes, the November inflation figure will be very relevant for the December rate hike decision. While energy prices have been moderating and other supply shocks are fading, the question is how quickly this impacts consumer prices. Also keep an eye out for unemployment on Thursday. Any sign of the labour market slowing will also be taken into account at the next policy meeting.

Hungary: Third-quarter GDP supported by industrial and services sectors

Next week’s events calendar for Hungary is focused on one day. On the first day of December, we are going to see detailed GDP data from the third quarter. Here we expect that industrial production will show a better-than-expected performance, giving support to the net export which has suffered under the pressure of the energy crisis. Along with industry, the services sector is expected to be a key driver, which was able to limit the quarter-on-quarter drop in GDP. The manufacturing PMI has shown significant monthly volatility recently thus we see a down month in November after a significant upside surprise in October.

Key events in developed markets next week

Key events in EMEA next week

Download

Download article25 November 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more