Key events in developed markets this week

All European eyes will be on the EU summit next week where the Recovery fund proposal will be discussed. The Bank of England meets too and we expect policymakers to further increase the QE target next week. In the US, expect a surge in US retail sales as lockdown measures ease.

US: Re-opening rebound

The US focus will be on how high retail sales and industrial production bounce following the ending of lockdowns across many states. Given car sales numbers have rebounded strongly we expect robust retail sales, but significant pent-up demand means we see upside for spending more broadly especially given that the uprating of unemployment benefits has boosted incomes.

Factory re-starts should also mean robust manufacturing activity, but oil and gas extraction will be a drag on industrial production overall. However, social distancing, consumer caution and the fact employment remains nearly 20 million below the levels of February means gains after this initial re-opening surge will be more challenging to come by.

Bank of England to expand QE amid slow recovery

The Bank of England expanded its quantitative easing programme back in March to give it room to expand its balance sheet by £200bn. Since then, the Bank has bought around £140bn worth of government bonds, and at the current rate of buying looks set to hit the limit over the next couple of months.

But with the economic recovery still in its very early stages, we’d expect policymakers to further increase the QE target next week. A couple of MPC members voted for a £100bn increase at the last meeting, but according to our Rates Strategy team, this kind of expansion may only just see policymakers through to the September meeting.

To avoid premature discussion about ending the policy or of tapering, we’re inclined to say the Bank will go for something in the region of a £150bn increase next week.

Brexit leaders set to inject talks with political lease of life

It’s fair to say Brexit talks haven’t really gone anywhere over the past few rounds. In theory that might change, with UK prime minister Boris Johnson and EU Commission President Von der Leyen set to hold talks. But while this might help revive hopes of a free-trade deal later this year – something that we still narrowly think is most likely – the reality is that the ball is firmly in the UK’s court.

Britain faces a decision on whether to align with EU state aid rules if it wants tariff-free access. Still, for the economy, the main thing to remember that even with a deal, the UK is leaving the single market and customs union at the end of this year, and this is where the bulk of the costs and disruption are likely to come from.

Eurozone: Recovery Fund discussions begin

Next week, all European eyes will be on the EU summit where the Recovery fund proposal by the European Commission will be discussed.

Positions have been taken with the countries usually critical of burden-sharing demanding a smaller size and not grants but loans to be distributed to the harder hit member states and sectors. We view the Commission proposal mainly as a starting point for the negotiations and think it is by no means a certainty that a deal will be struck this week.

It could well be summer – when Germany takes over the EU presidency – before a decision on a possible recovery fund is made.

Norway: Rates at zero for longer

The Norges Bank meets on Thursday, having cut rates in May to zero percent. We don’t expect any major changes this change, and Governor Olsen has been clear that there’s little appetite for negative rates or quantitative easing, given neither are particularly viable options for the Norwegian economy. We expect rates to remain on hold for at least the remainder of 2020 and 2021. Sure, the situation for oil prices and NOK have somewhat improved, but it remains the case that the relatively low oil prices could have long-lasting effects on oil investment. Meanwhile in comparison to its Swedish neighbours, a stricter lockdown policy will have created a serious dent in second quarter GDP.

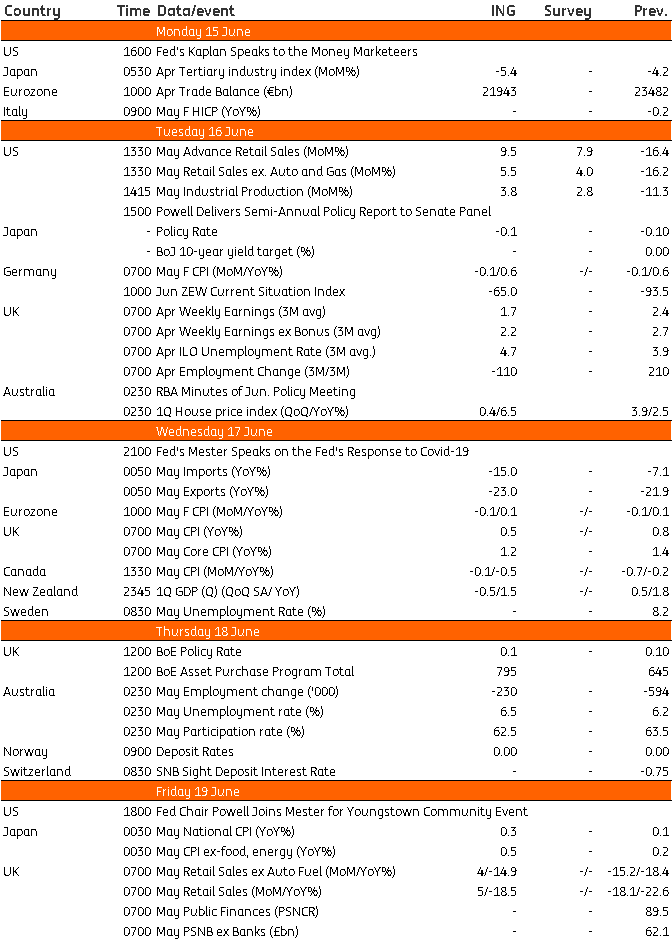

Developed Markets Economic Calendar

Download

Download article12 June 2020

Ou view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more