Key events in developed markets next week

We agree with the market consensus that the Federal Reserve will probably deliver a 75bp hike this month and we expect the Bank of Canada to do the same, as the economy is growing strongly. Improvements in supply chains will help eurozone industry, however, the outlook remains difficult

Inflation well above target, consumer sentiment at all-time low

The market is favouring a 75bp rate hike from the Federal Reserve on 27 July and we agree given the tight jobs market and inflation running at more than four times the 2% targeted rate. In fact, inflation is likely to move even further above target this coming week as gasoline, food, shelter and airline fares continue to rise apace. Core inflation may slow marginally to 5.8% from 6%, but this too is well above target.

We will also be looking out for the University of Michigan consumer confidence index. It recently fell to an all-time low as the rising cost of living and plunging stock markets weighed on sentiment. This obviously is not encouraging for consumer spending growth, and we will also be closely following the inflation expectations series. It spiked last month (subsequently revised lower) and this was seen by many as the trigger for the Fed to signal it was going to hike by 75bp in June rather than the 50bp it had laid the groundwork for. Another strong reading for inflation expectations should all but confirm a second consecutive 75bp move later this month.

Canada's housing market provides strong resilience against spikes in price

We expect the Bank of Canada to implement a 75bp move at its July 13 meeting. The economy is growing strongly, is at record employment levels and its inflation rate is running at 7.7%, the fastest rate since January 1983. The housing market is also red hot while Canada’s strong commodity-producing sectors mean it is far more resilient than most major economies to the spike in prices.

Weakening demand and negative trade balance

Eurozone industry continues to struggle with supply chain problems, while signs of weakening demand have also become more apparent. Both are bad news for a recovery in production although we do see some improvements in supply chains that may help production to catch up in the months ahead. Backlogs of work are still sizable, so don’t expect a sudden drop in May production figures due to weaker demand just yet. Nevertheless, the outlook for industry remains soft at the moment. Also, look out for the trade balance, which is set to be negative again on the back of high energy prices and a difficult export environment.

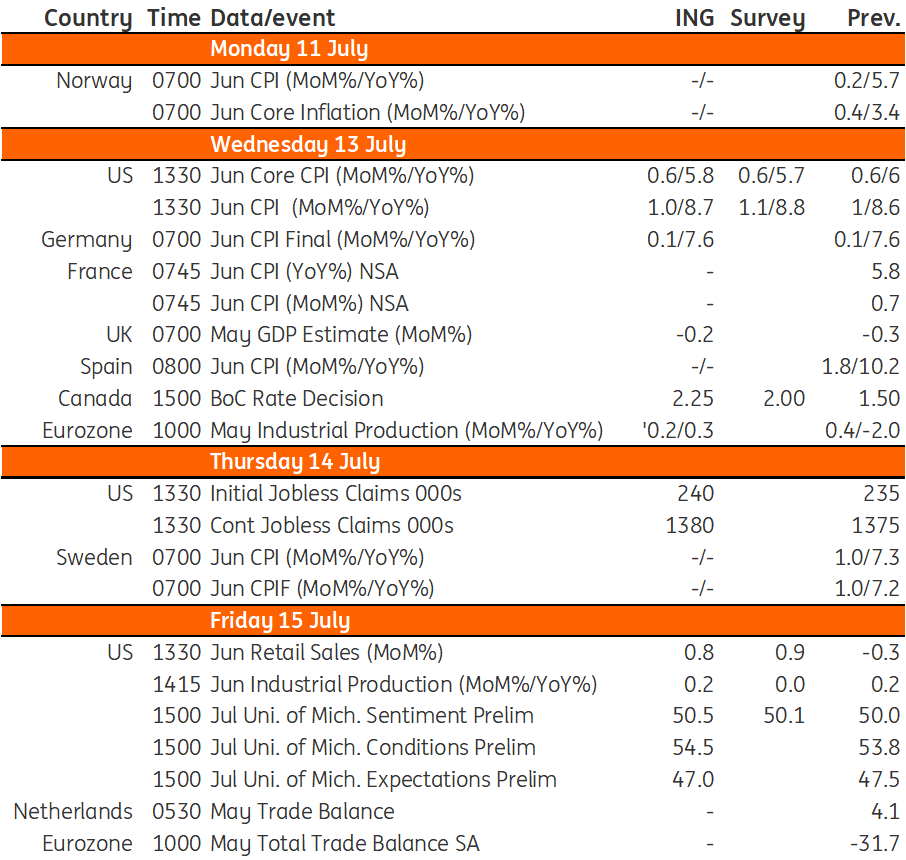

Developed Markets Economic Calendar

Download

Download article8 July 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more