Key events in developed markets next week

It's back to the Brexit drawing board for Theresa May next week as she heads to Europe for more talks. But with the EU standing firm, is there any chance for a deal that parliament can agree on? Elsewhere, a backlog of delayed US data is due over the next few weeks following the end of the government shutdown

US: Back to reality

Now that the government shutdown has

We have of course continued to get jobs numbers, which show the labour market remains tight. This, in turn, is pushing up wages as companies hunt desperately for workers with the right skills. With households seeing rising incomes and feeling secure in their jobs, consumers have the cash and the confidence to keep spending. Unfortunately, the different government departments haven’t formally given us the dates and timings of their respective releases, but the general tone should be constructive with our base case - that decent economic activity and rising inflation pressures will trigger two further interest rate hikes from the Federal Reserve this year.

UK: May seeks concessions for smooth exit

The Brexit saga continues next week, as Theresa May heads to Europe to seek concessions that could convince members of parliament to vote for a deal, allowing a smooth exit from the EU on 29 March. Unsurprisingly, the EU is steadfast in its view that there won’t be any renegotiation, leaving 14 February as the next key date when parliament could flex its muscle and try to prevent a potentially economically damaging hard Brexit. The Bank of England also meets this week, but given the lack of clarity on where the UK is heading, a “no change” scenario for interest rates

Germany: Just enough

Next week’s industrial data will bring an end to a disappointing second half of the year for the German economy. Any rebound is likely to be too weak to push industrial activity back into expansion territory, but private consumption and government expenditures should have been enough to prevent the entire economy from falling into a technical recession.

Canada: Labour market to stay healthy, but will wages respond?

There was a slower pace of job gains in December (+9,300) compared with November's hiring flurry (+94,100), and this theme is likely to run into January

This is still a relatively low unemployment rate, and on face value paints a positive picture. But beneath the figure lies the growing concern of sluggish wage growth. Average wage growth for full-time workers remained at 1.5% in December, far from its 2018 peak of 3.9% in May. As the economy is operating close to full capacity, it is expected firms will be required to invest in the workforce to sustain high levels of demand. We see it as just a matter of time before wages go up, as companies search for labour.

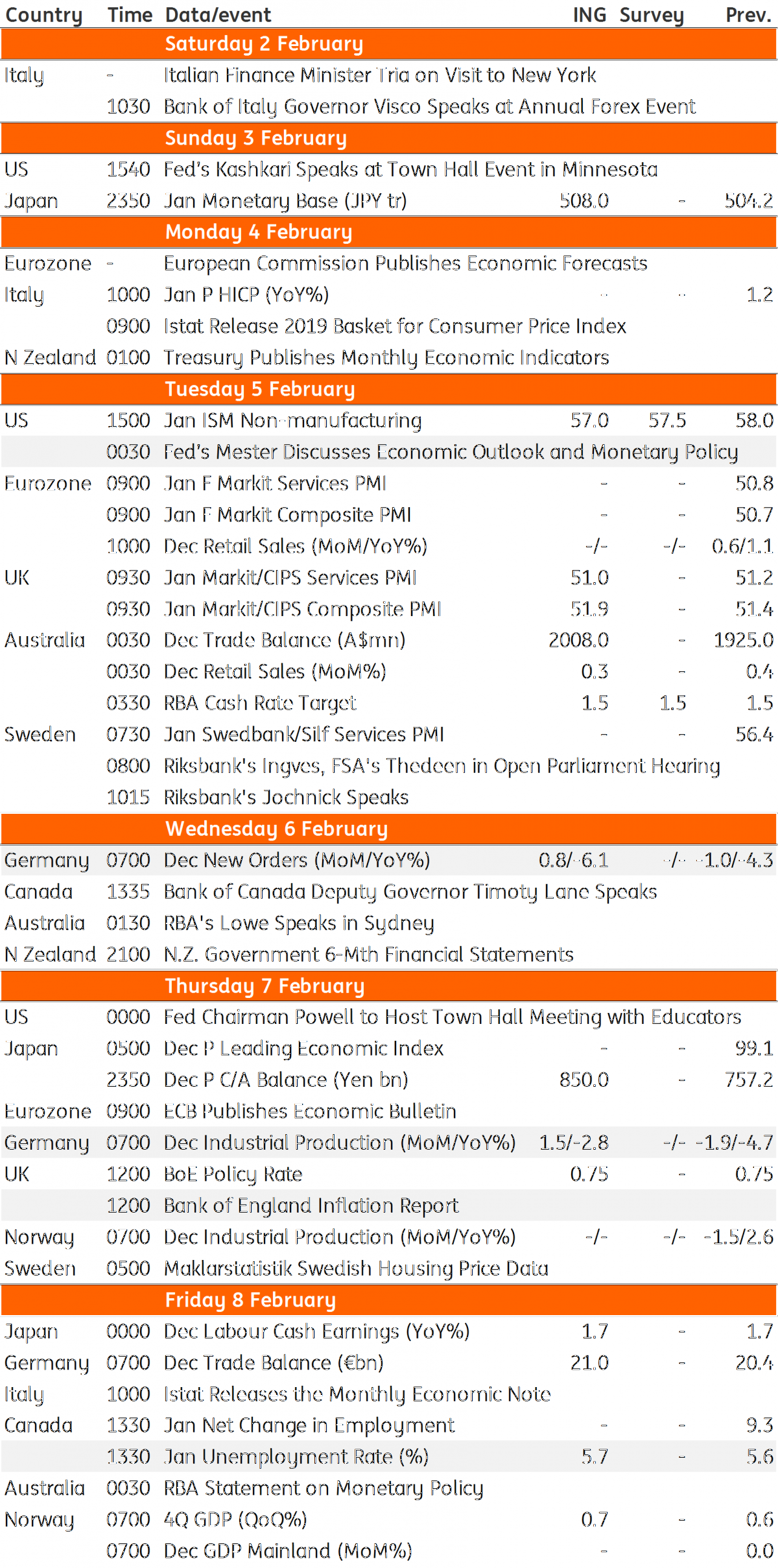

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 February 2019

Our view on next week’s key events This bundle contains 3 Articles