Key events in developed markets next week

In the US, employment and PMI figures will be watched closely next week following the recent surprise negative GDP reading. The UK's monetary policy outlook seems much more certain with a rate hike expected on Thursday

US: Monetary policy outlook up in the air after negative GDP reading

After the surprise negative GDP print for the first quarter, all eyes will be on the Federal Reserve to see if this results in a more cautious prognosis for the outlook for monetary policy. We doubt it given that it was largely a temporary trade and inventory-led dip in activity and it certainly doesn’t alter the outlook for a 50bp rate rise on 4 May given inflation is running at 40-year highs and the unemployment rate is below 4%. Nonetheless, it may help to dampen talk of potential 75bp rate rises in June and/or July with the Fed looking less likely to openly discuss those possibilities. We expect the Fed to follow up with 50bp rate hikes in June and July before switching to 25bp as quantitative tightening gets up to speed. We see the Fed funds rate peaking at 3% in early 2023, although the risks are skewed towards the policy rate being raised more swiftly.

We will also be looking for the Fed to formally announce quantitative tightening. The minutes of the March FOMC meeting showed “all participants” felt the need to announce the “commencement of balance sheet runoff at a coming meeting”. Given the doubling of the size of the balance sheet since the last round of quantitative tightening in 2017-19, this would be done at a “faster pace” than then. “Participants generally agreed that monthly caps of about $60 billion for Treasury securities and about $35 billion for agency MBS would likely be appropriate” versus the peak total $50bn run-off seen last time around. This would be a “phased in” roll-off cap of maturing assets that could last three or more months depending on market conditions. In months when there aren't enough Treasuries or MBS maturing, Treasury bills could be redeemed to make up for any shortfall. We expect it to start at $50bn being allowed to run off each month before getting up to $95bn by September.

There are also several important data releases next week, including the April jobs report. Companies are still seeking to hire and it is a lack of available/suitable workers that is holding back employment growth. Consequently, wages are set to continue being bid higher with unemployment remaining at 3.6%. We will also be closely watching the ISM manufacturing and service sector reports. Decent outcomes here would reinforce the view that the economy will expand again in 2Q, thereby keeping the Federal Reserve in policy tightening mode.

Bank of England set for another rate hike coupled with sizable forecast revisions

The Bank of England has hiked three times so far and a fourth increase next Thursday looks like a near-certainty. But despite talk of a more aggressive 50bp move, we suspect that’s unlikely. Governor Andrew Bailey recently said the Bank is walking a ‘narrow path’ between growth and inflation, and implied that the Bank was comfortable with taking a more phased approach to tightening. New forecasts due next week are likely to show that this growth-inflation trade-off has only magnified over the past few weeks. Of course, the BoE is at a slight advantage to some other central banks in that it already has a few hikes under its belt.

It’ll also be interesting to see if any committee members join Jon Cunliffe, who last month was the sole voter for no change in rates. More likely though we’ll get another 8-1 vote in favour of the hike.

In short, we expect the rate hike on Thursday to be followed by another in June, but after that, we suspect policymakers will be inclined to pause – or at the very least slow down – the pace of rate rises. That suggests markets, which expect roughly another six hikes this year, are likely to be overestimating the amount of tightening required.

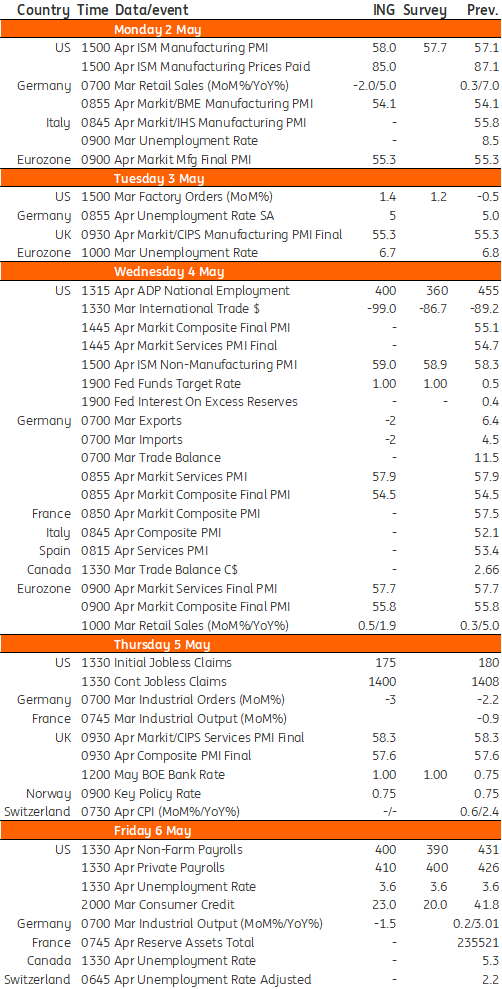

Developed Markets Economic Calendar

Download

Download article29 April 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more