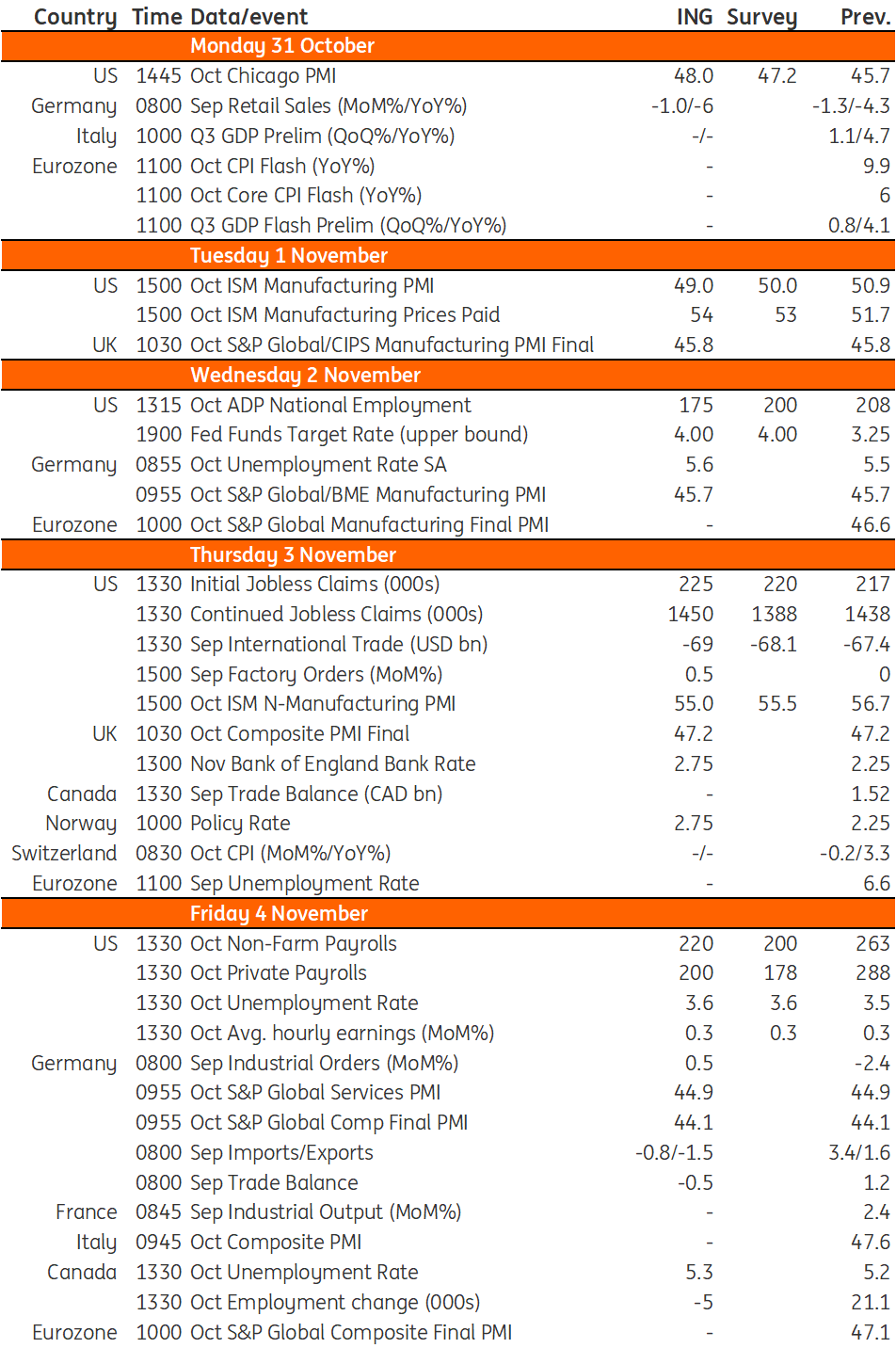

Key events in developed markets next week

A busy week ahead filled with central bank meetings. The Federal Reserve's FOMC meeting is set to result in a 75bp rate hike given that annual rates of core inflation are heading higher. On the other hand, we believe that for the Bank of England, a 50bp rate hike is narrowly more likely than the 75bp most are expecting, due to policy U-turns in recent weeks

US: fourth consecutive 75bp hike incoming

Markets will have a broad range of US data and events to digest over the next couple of weeks. Wednesday’s Federal Reserve FOMC meeting is set to result in the fourth consecutive 75bp rate hike given that annual rates of core inflation are heading higher rather than lower, the economy has returned to growth with a decent third-quarter GDP report, and the labour market remains robust with job vacancies exceeding the number of unemployed Americans by four million.

The tone of the press conference and the outcome of next Friday’s jobs report will then help markets firm up expectations for what the Fed may do in December. There have been hints that officials could open the door to a slower pace of rate hikes, and after 375bp of interest rate increases (after next Wednesday) there is a strong argument for taking stock of the situation.

Unfortunately, the data hasn’t been moving in the right direction and we would probably need to see a noticeable slowdown in the month-on-month rates of core CPI increases from 0.5/0.6%MoM towards 0.2/0.3% to give the Fed the confidence to moderate the pace meaningfully. At this stage, we just aren’t confident that this will happen in time for the December FOMC meeting so there remains the strong possibility that we get a fifth consecutive 75bp hike versus our current 50bp view.

Attention will then switch to the midterm elections that will be held on 8 November. In our preview, we set out different scenarios and potential impacts. The polls seem to be shifting in the direction of a Republican-controlled Congress, which will greatly limit what President Joe Biden can achieve in the second half of his presidential term. This means less government influence on the economy and will put more pressure on the Fed to cut rates in the second half of 2023 to support the economy, as nothing will come from the fiscal side.

UK: Bank of England could surprise markets with a smaller rate hike

It was unthinkable only a few weeks ago, but we now think a 50bp rate hike is narrowly more likely than the 75bp Bank of England rate hike markets and most economists appear to be expecting.

It’s undeniably a close call, and whatever happens, the committee is likely to be heavily divided. But in recent speeches, policymakers have been signalling that markets are overestimating the amount of tightening left to come. Meanwhile, following the various policy U-turns of recent weeks, the expected boost from fiscal policy now looks similar to what was expected before September’s meeting, when it opted against a 75bp move. With the latest data not providing a clear justification for a faster hike, and sterling now stronger than it was before September’s meeting, we think there is a good chance now that the Bank will underdeliver on market/economist expectations. Read our full preview here.

Norway: Norges Bank to deliver one final 50bp rate hike

Having opted for multiple 50bp rate hikes through the summer, Norway’s central bank hinted it could slow the pace back to 25bp for its final few moves. The question for next week is whether it instead decides to continue to front-load tightening, and we think it will. Higher overseas rate expectations and another massive upside surprise on inflation suggest we should expect another 50bp hike on Thursday. However that would take the central bank close to the end of its hiking cycle, and we are pencilling in one (or perhaps two) more 25bp moves before it pauses.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 October 2022

Our view on next week’s key events This bundle contains 3 Articles