Key events in developed markets next week

The US jobs report will be the key focus next week as we expect labour supply issues to continue, however, we also have GDP numbers from Canada, Eurozone inflation readings and key PMI data

US: Labour supply issues may resonate in jobs report, but ISM surveys should be strong

The US jobs report is the undoubted highlight next week after the disappointing outcome of “only” 266,000 jobs created in April. There seems to be little problem with demand given the robust economic data and surveys, such as the NFIB’s, indicating that businesses are struggling to find labour. Instead, the problem is supply – firms cannot fill vacancies.

Firstly, a significant number of children continue with homeschooling, so parents are having to stay home. Secondly, there is some hesitancy from some quarters about returning to work, given the pandemic isn't over. Thirdly, older workers who may have lost their jobs may have chosen to take early retirement and leave the workforce. Finally, extended and uprated unemployment benefits may have diminished the financial attractiveness of taking a low paid job, particularly when you factor in commuting, lunch, childcare etc.

The school situation will end in September, while 23 states have already announced they are ending the payment of the $300 weekly unemployment benefit next month (with it ending elsewhere in September). Consequently, we should see labour supply come back, but we may face a window of perhaps 2-4 months where businesses struggle to fill their vacancies and employment disappoints. However, it also means that companies that do need to open and expand end up paying more for workers as competition for staff heats up. As such, we expect to see a softer than consensus 500k in jobs in May, with wage rates showing signs of picking up a touch.

Other than that, we have the ISM business surveys, which will be strong but also highlight the supply bottlenecks that are leading to shortages and higher prices.

Canada’s GDP will rebound sharply on the back of a good performing vaccine programme and economic resilience that has even surprised the central bank. A decent jobs figure is also likely, and this could fuel expectations of a third quantitative easing taper announcement from the central bank in July.

Eurozone: Inflation and unemployment data in focus

Eurozone inflation will be a key figure for next week because it’s the last major data point ahead of the closely watched European Central Bank meeting on 10 June. Expect it to rise further on base effects but also look for the reopening impact on services inflation and input shortages working their way through to goods inflation figures. Selling price expectations among manufacturing businesses are at an all-time high, meaning that some passthrough can be expected over the coming months.

Also relevant will be the unemployment numbers for April. This will provide a good snapshot of the labour market recovery and will be relevant for the ECB's medium-term outlook.

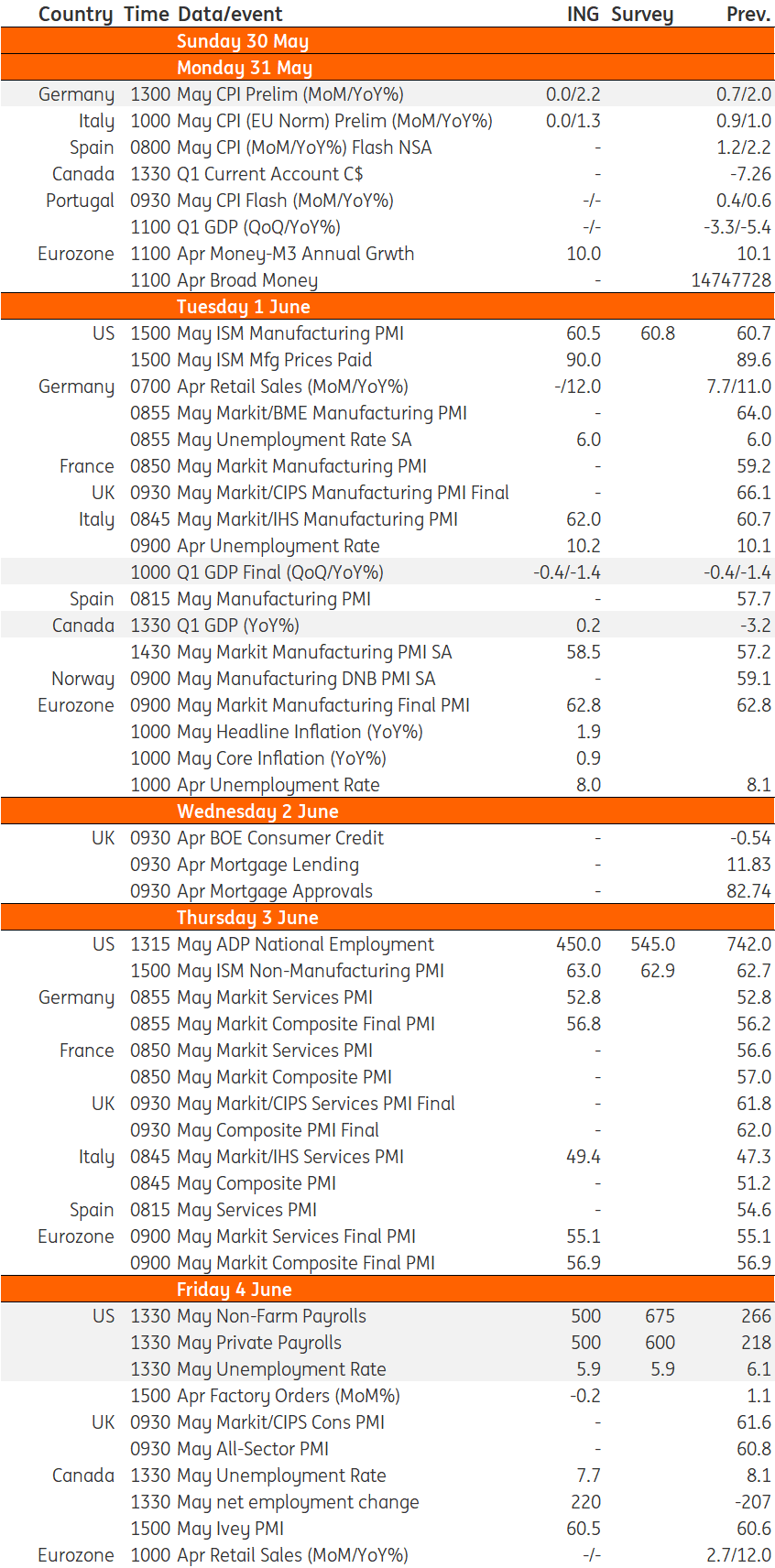

Developed Markets Economic Calendar

Download

Download article

28 May 2021

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more