Key events in developed markets next week

Key US data next week could confirm whether expectations for aggressive interest rate cuts are justified while business surveys and inflation data from Europe may offer clues about the ECB's next steps

Testing the Fed’s “patience”

With the Federal Reserve sounding more relaxed on inflation and re-affirming its patient strategy with regards to interest rate policy, financial markets have already shifted to pricing in an 80% chance of a 25 basis point rate cut this year, with two full 25bp rate cuts priced in for the end of next year. We think this is too aggressive with the coming week set to see some respectable US economic figures, which should help to ease fears of a marked slowdown in activity. The scheduled reports include retail sales, the ISM business surveys and the March employment report.

Retail sales should post another respectable gain, given household incomes are growing nicely and confidence is healthy. Rising gasoline prices may also contribute to a stronger headline value sales figure. Meanwhile, we would expect the ISM indices to show that the US economy continues to expand at a decent pace based on regional indices.

However, after the disappointing 20,000 figure from February, the highlight will be the jobs report. Coming after a massive 311,000 rise in payrolls in January, we suspect there may be some data quality issues and suggest that the labour market story is more nuanced. Reports from employment surveys - such as the NFIB report, indicate that the appetite to hire workers remains strong, but the problem is finding suitable applicants at a time when unemployment is so low. As such, firms are competing for labour and this is pushing up worker pay. We therefore expect to see payrolls growth of around 160,000 for March, with average earnings rising 0.3% month-on-month and the unemployment rate staying at 3.8%.

Germany: Economic recovery? To be determined...

It will be a crucial week for our call of a bottoming out, followed by a gradual rebound, of the entire German economy. Industrial production data for February will show whether the downward trend of the entire manufacturing sector will continue or could be brought to a halt. Elsewhere, the European Central Bank will release the minutes of its March policy meeting. Watch out for any signs on how to alleviate some of the negative rate pressure on banks.

All eyes on Brexit indicative votes if PM May’s deal fails

If Prime Minister Theresa May is unable to gather enough support to get her deal approved by Parliament, the so-called 'indicative votes' process will go to the next stage on Monday. The exact process has not been confirmed, but ultimately it’s likely to see the options of a permanent customs union pitted against a second referendum – or possibly even the two options combined.

The big question is whether any option can command a stable majority. Don't forget that if the Prime Minister returns to Brussels and renegotiates her deal, there will need to be a reliable majority of MPs who will be prepared to formally back the revised agreement (or more accurately, a reworked political declaration). There is also a raft of legislation that will need to be passed before the UK can actually leave the EU with a deal.

In the end, we still think a tweaked version of the current deal to include a customs union is the most likely option to gain majority support. This begs the question of whether the Conservative eurosceptics decide ‘enough is enough’ and vote against the government in another no-confidence motion – or indeed whether the Prime Minister herself decides to call an election as a more palatable alternative to Parliament’s wishes. An election isn’t our central scenario, but it’s definitely getting more likely.

For more info on the latest scenarios, see our latest piece

Canada: Labour market should give us a reason to be positive

One of the only areas that appears to have been pretty consistent in providing good news recently is the strength of the labour market, and we suspect this won’t change in March. With some recent figures showing that job vacancies increased in the final quarter of last year (the ninth consecutive increase in the annual figure) our view- that the underlying positive momentum will continue- is reinforced.

Firms across both provinces and sectors and finding they need to take on extra workers. The unemployment rate is likely to sit around its current level though because – although jobs are available, the participation rate is being kept under pressure (partly attributable to the increase in immigration).

Nonetheless, unless we start to see some material translation of labour market strength into household activity, the Bank of Canada will still be firmly in wait-and-see mode.

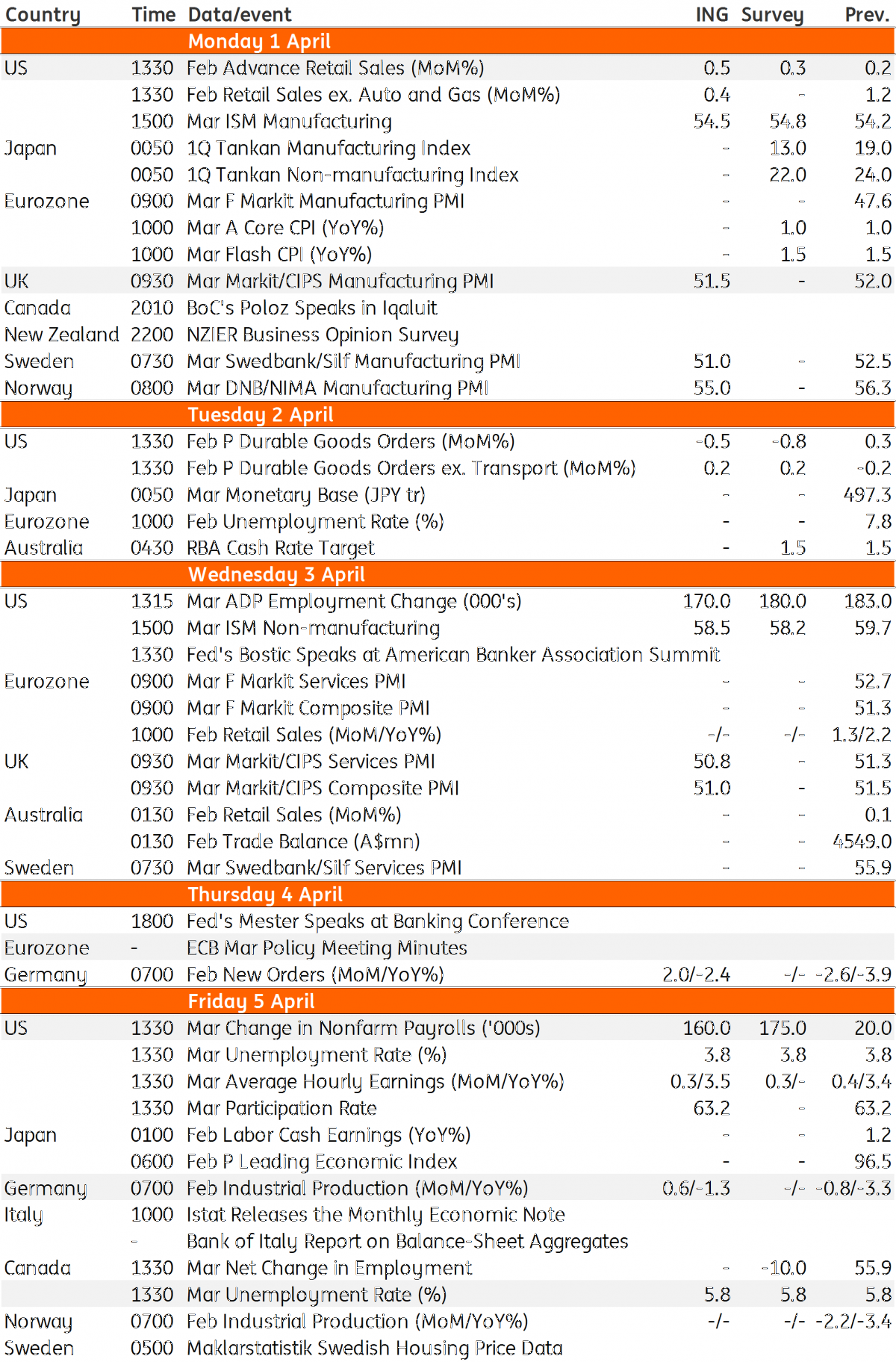

Developed Markets Economic Calendar

Download

Download article29 March 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more