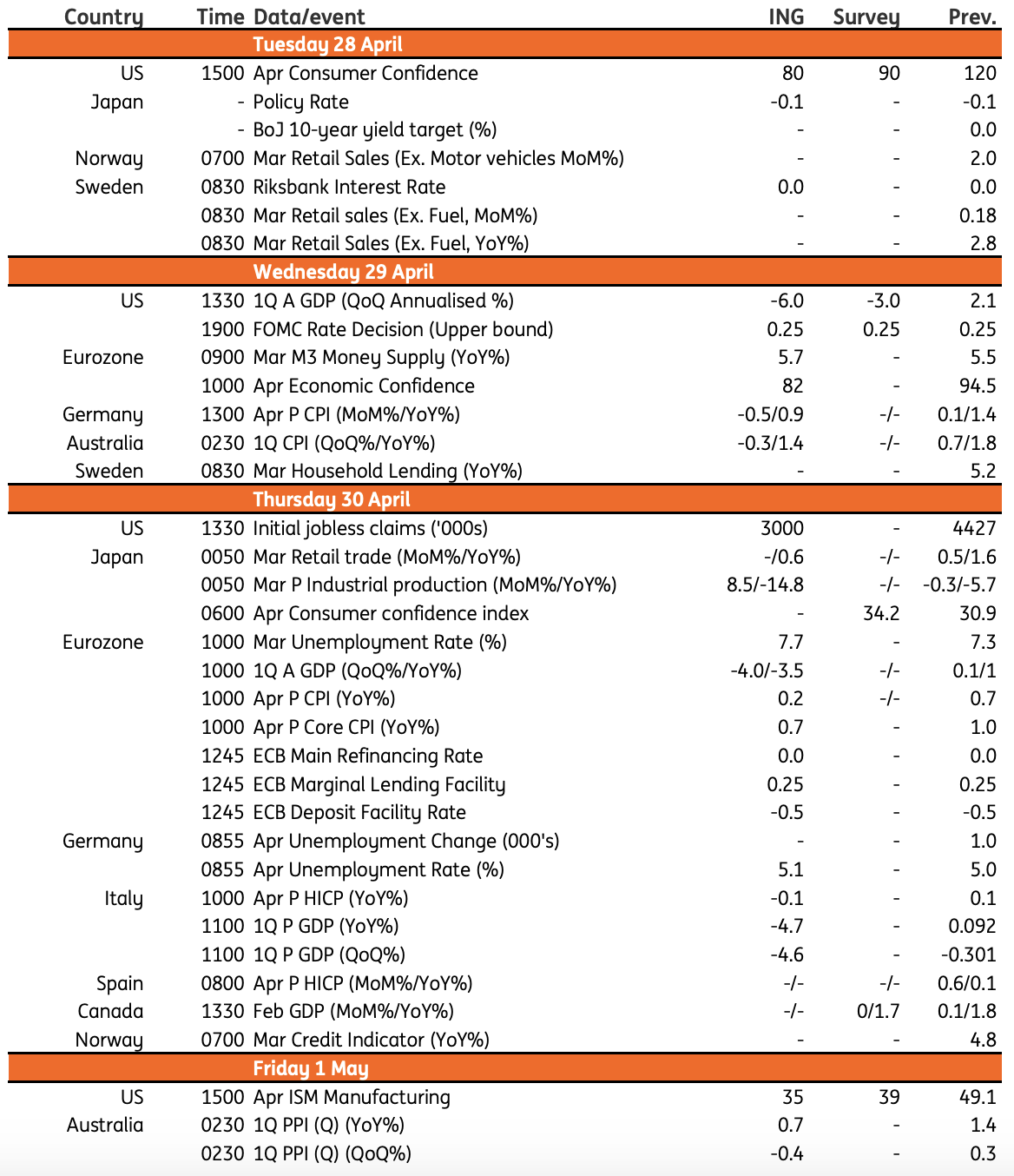

Key events in developed markets next week

US first-quarter GDP will be the headline figure to watch out next week and the real question is how badly has the economy been effected. Lots of post-corona data including inflation, GDP, unemployment and economic sentiment out from the Eurozone too

US: GDP figure to highlight the extent of the economic downturn

The first-quarter GDP will be the headline figure to watch and is likely to highlight the gravity of the economic downturn.

After a very strong January and February, activity has ground to a halt in March with the economy having lost the best part of 27 million jobs in the past five weeks. Retail activity outside of groceries has practically collapsed and manufacturing surveys have reported plummeting activity. Given this situation, we look for the economy to have contracted 6% annualised in Q1 with much worse to come in 2Q. We look for a 40% annualised fall in output between March and June even if other US states follow the lead of Georgia, Tennessee, Florida and South Carolina and start re-opening their economies in the next two to four weeks.

Other data to watch will, of course, include those jobless claims numbers. We are hoping that after three consecutive declines in jobless claims we will see a much sharper fall this week given some states are starting to re-open. However, set against that is the spreading weakness in manufacturing and business services, which are likely to see more job losses nationally. The horror show that is the jobs market means that consumer confidence will fall sharply while business activity as reported by the ISM manufacturing survey will also plunge given what we have already seen from regional indicators.

Rounding out the US schedule we also have a Federal Reserve policy meeting, but given the stabilisation in financial markets and the ongoing support, their previously announced aggressive actions are providing, we don’t expect to hear any new meaningful policy measures. They may choose to give more colour on their QE strategy given the purchases of assets have been dramatically scaled back over the past couple of weeks. We expect them to re-affirm their views that they will not reverse course on their policy stance until they are certain the economy is on the path to recovery

A massive week for Eurozone data

We get inflation, GDP, unemployment and economic sentiment and all of them will have relevant “post-corona” data. For GDP, the question will be how bad the Q1 data is.

Lockdowns were in place across the Eurozone for at least the last two work weeks, but estimates of the decline in GDP still differ significantly. For inflation, April data will provide information on prices during the lockdown, but can it really provide credible insights? How do you measure prices when stores have shut? The number will have to be taken with more than a pinch of salt for sure.

There’s no doubt that this shock’s initial impact on prices is deflationary, as oil price developments have shown. Finally, unemployment will show whether March layoffs have already pushed the unemployment rate up. Short-time work schemes and a more rigid labour market than the US will mitigate some of the impact, but how much of the economic shock can be absorbed?

As European leaders couldn’t agree on a pan-European fiscal policy reaction beyond the EIB-ESM-SURE triplet, pressure on the ECB to step up its QE programme will increase. We expect the ECB to significantly increase the PEPP programme. Whether this will already be the case next week, will mostly depend on market developments over coming days.

Swedish Riksbank – will they cut rates back into negative?

Like other central banks, the Swedish Riksbank has thrown a large amount of ammunition at this crisis. It has increased QE to account for a further SEK300bn of assets, and for the moment that gives it plenty of capacity to continue making purchases. But one thing it hasn’t done is lower the repo rate.

Of course, it was only in December 2019 that policymakers took the historic step to lift the repo rate out of the negative territory, and wary about the costs if it were to be perceived as a long-standing policy stance, the central bank has been reluctant to go back there. But the economy is taking a severe hit, even though its virus containment measures are less severe than other places.

Some board members have hinted rates could move lower again, but for now we narrowly we think the Bank will make no change next week.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more