Key events in developed markets next week

3Q GDP data releases both in the US and Europe are likely to show record rebound numbers from the second-quarter slump, but who will be really cheering when second wave concerns are becoming pressing by the week

Eurozone: GDP, inflation and jobs data to show the recovery is headed

A very busy week for the Eurozone as GDP, inflation and unemployment data will give a strong sense of where things are headed in terms of the recovery. Perhaps more accurately: where things were headed ahead of the second wave and new restrictions that have made the outlook all the more uncertain.

Inflation for October is likely to remain in the negative territory although the timing of the sales period in certain countries could cause an upside surprise.

With short-time work schemes still in place, unemployment is likely to have increased in September. GDP data released on Friday will look back at 3Q and will likely be stellar due to the bounce-back effect from the lockdown.

US: Fiscal stimulus talks continue and 3Q GDP will reflect the rebound

They will... they won’t.. they will… debate over whether the Democrats, the White House and the Republican Senators can finally hammer out an agreement on another fiscal stimulus will remain a key theme. The case for fiscal stimulus is strong in an environment where unemployment benefits are being tapered and Covid-19 cases are rising, causing anxiety for households and businesses with the nagging concern that some form of containment measures could yet be introduced in the US. Yet Senate Republicans are wary to deliver ahead of the election – partly on concerns of the level of national debt and partly because of the sense that the White House is caving into Democrat demands. We have doubts that there will be a deal before the election, but a fiscal stimulus is coming.

The key data release will be 3Q GDP growth and we expect it to be a record 34.5% annualised growth thanks to consumer spending rebounding on pent up demand after lockdowns and the support for household incomes coming from increased unemployment benefits, which saw upwards of 70% of recipients receive higher incomes than when they were actually working. Residential fixed investment will also be a big growth driver given the strength in housing numbers, fueled by record-low mortgage rates. Inventories have also been rebuilt and will provide a further boost to headline growth. Business investment is likely to provide more muted upside given plenty of spare capacity while net trade will be a drag. Even after this impressive figure we should note that economic output will still be 3.2% below that of the end of 4Q19.

Canada: Central bank policy to remain unchanged

The Bank of Canada policy meeting will deliver no additional stimulus with the policy rate left at 0.25%.

The economy likely expanded at an annualised rate in excess of 40% in 3Q20 having contracted 38.7% in 2Q20 while the labour market has seen nearly 2.3 million of the 3 million jobs lost in March and April recovered. Inflation remains low though and like the US Federal Reserve, we expect Canada's central bank communique to stress there is little prospect of any policy tightening anytime soon.

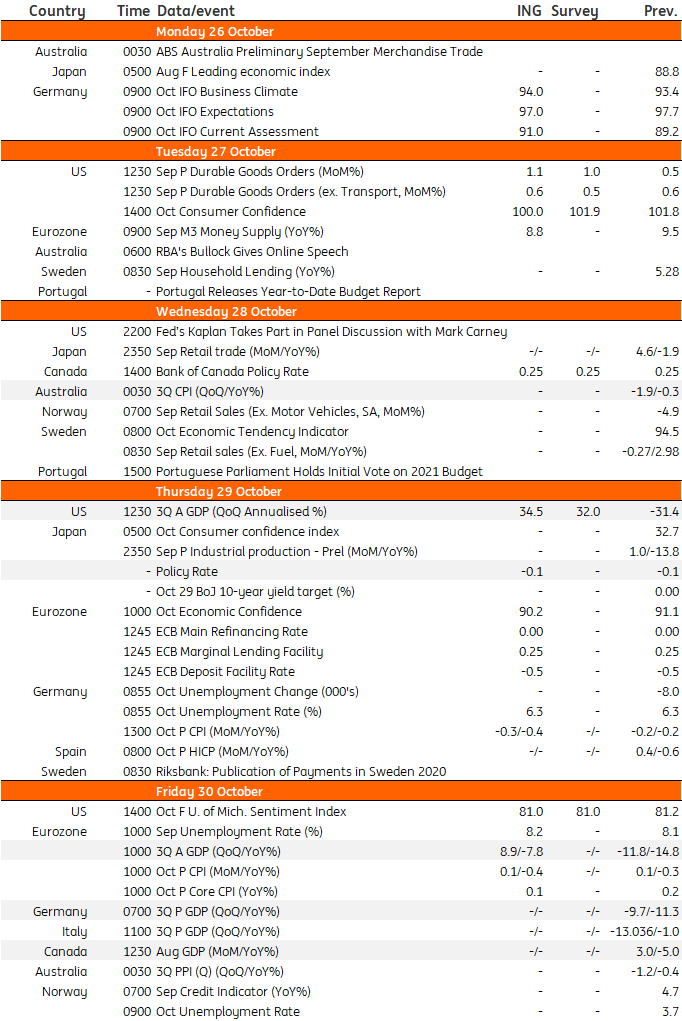

Developed Markets Economic Calendar

Download

Download article23 October 2020

Our view on next week’s events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more