Key events in developed markets next week

Will the new Fed Chair, Jerome Powell, lead the Fed to increase its interest rate hike forecast for this year?

US: how will Powell's tone determine the number of Fed hikes this year?

The key event next week will be new Fed Chair, Jerome Powell, testifying to the House Financial Services Committee following the release of the semi-annual monetary policy report this Friday. The tone he strikes will be key to determining whether the Fed will hike rates at the March FOMC, which looks probable, and whether the Fed will increase its forecast for the number of hikes it expects to implement this year from three to four. The downside risks to inflation have certainly faded with wages showing some signs of life and CPI in January coming in above expectations. With core inflation likely to rise above 2% in coming months we think the Fed will choose to take a more aggressive course of action.

As for the data, manufacturing numbers will be in focus. Durable goods orders will be dragged lower due to the volatility in Boeing aircraft orders, but excluding transportation the order book for US manufacturers looks very strong. This should be reflected in another robust reading for the ISM manufacturing index. The one area of potential data disappointment may be consumer confidence with the potential for slightly softer readings due to recent equity market volatility and higher mortgage borrowing costs. However, both the Conference Board and the University of Michigan surveys will remain incredibly strong by historical standards given robust employment and rising wages.

Eurozone: insights into the inflation puzzle

For the Eurozone, next week will bring more insight into the inflation puzzle. The Eurozone PMI revealed somewhat softening price pressures in February, confirming that the pipeline pressures to inflation remain relatively mild. As energy price effects will likely subdue inflation further, not much is to be expected of the February HICP release. Meanwhile, the unemployment rate could have ticked lower again in January as the labour market continues to show more signs of tightening.

Germany: will the SPD join a grand coalition with Merkel's CDU?

Being the first inflation data for February in the entire Eurozone, German CPI data on Tuesday should trigger most market attention. With the latest drop in oil prices and the stronger euro, German headline inflation should have remained stable, at best. For the rest, Germany will be warming up to the results of the SPD members’ vote on whether or not to join a grand coalition with Merkel’s CDU. This result is due on Sunday, 4 March.

Sweden: expect a softening of growth

In Sweden, 4Q GDP figures are due on Wednesday. We expect a solid end to the year at 0.8% quarter-on-quarter. But indicators for 1Q18 so far suggest a softening in growth, which may be confirmed by further data this week: Economic Tendency Survey, Retail Sales, and Manufacturing PMIs will all be released.

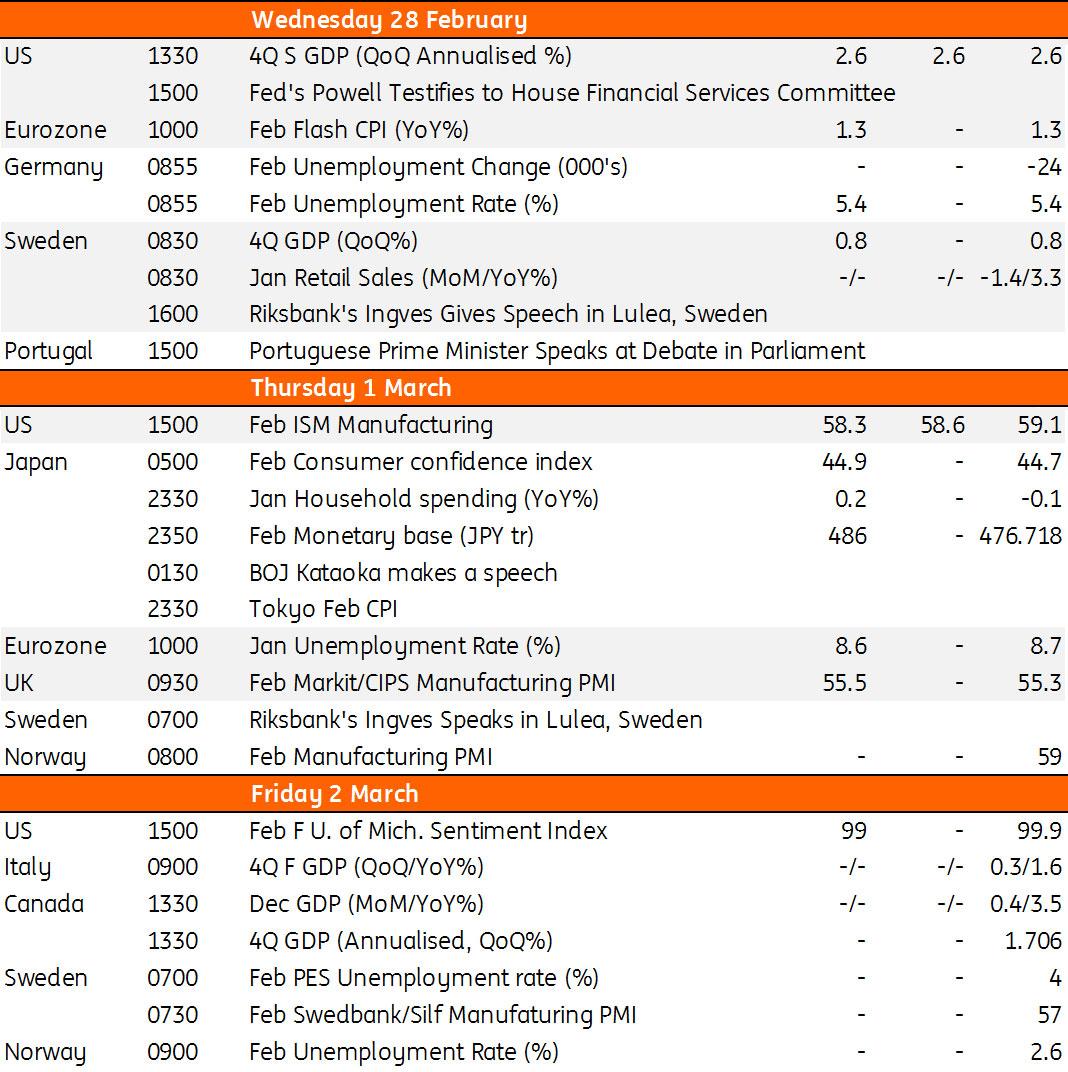

Developed Markets Economic Calendar

Download

Download article23 February 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more