Key events in developed markets next week

Data flow from the US is unlikely to change the Fed's lax attitude towards inflation which has shaken markets recently. Across the pond, Eurozone economic sentiment should continue to support current optimism

US: Data flow to support the Fed’s relaxed approach to inflation

Since the last Federal Reserve policy decision meeting, the data flow has pointed to ongoing strong economic activity, rising inflation pressures, and somewhat disappointing employment numbers. In general, Fed officials remain relaxed about the situation as they believe the recovery still has a long way to go and that by adopting an average inflation target, they have room to allow the economy to run hotter for longer than in previous cycles, ensuring as many people in society feel the benefits of economic growth. Nonetheless, should inflation become more of an issue, they “have the tools” to deal with the problem.

The upcoming data flow is unlikely to nudge the Fed away from this position. Durable goods orders may disappoint a touch given a big drag from the transportation sector thanks to weaker Boeing aircraft orders, coupled with supply chain strains in the auto sector that are cutting output there. Ex-transport should be better, but the global shortage of semi-conductor chips could remain a hindrance. Home sales should also be somewhat subdued, but this is due primarily to a lack of supply and high prices rather than any significant drop off in demand.

The first-quarter GDP growth numbers could potentially be revised higher on the back of stronger consumer spending after upward revisions for March. 2Q will start on a strong footing, as underscored by next Friday’s personal income and spending report. Admittedly headline incomes will plunge following the $1400 stimulus payment surge in March, but incomes from private sector sources should post another decent gain, which will reinforce the message of a strengthening economy.

Eurozone: Economic sentiment data to reinforce optimism

We're looking forward to Economic Sentiment data to be released next Friday, which is likely going to confirm continued optimism among businesses and consumers as reopenings get underway and vaccination programs pick up speed. The strong surge in April reveals a somewhat limited upside considering historical highs, but real-time data already shows quite a surge in activity over recent months. That warrants improving sentiment, which will likely result in quite a positive GDP figure for the second quarter as the rebound gets going.

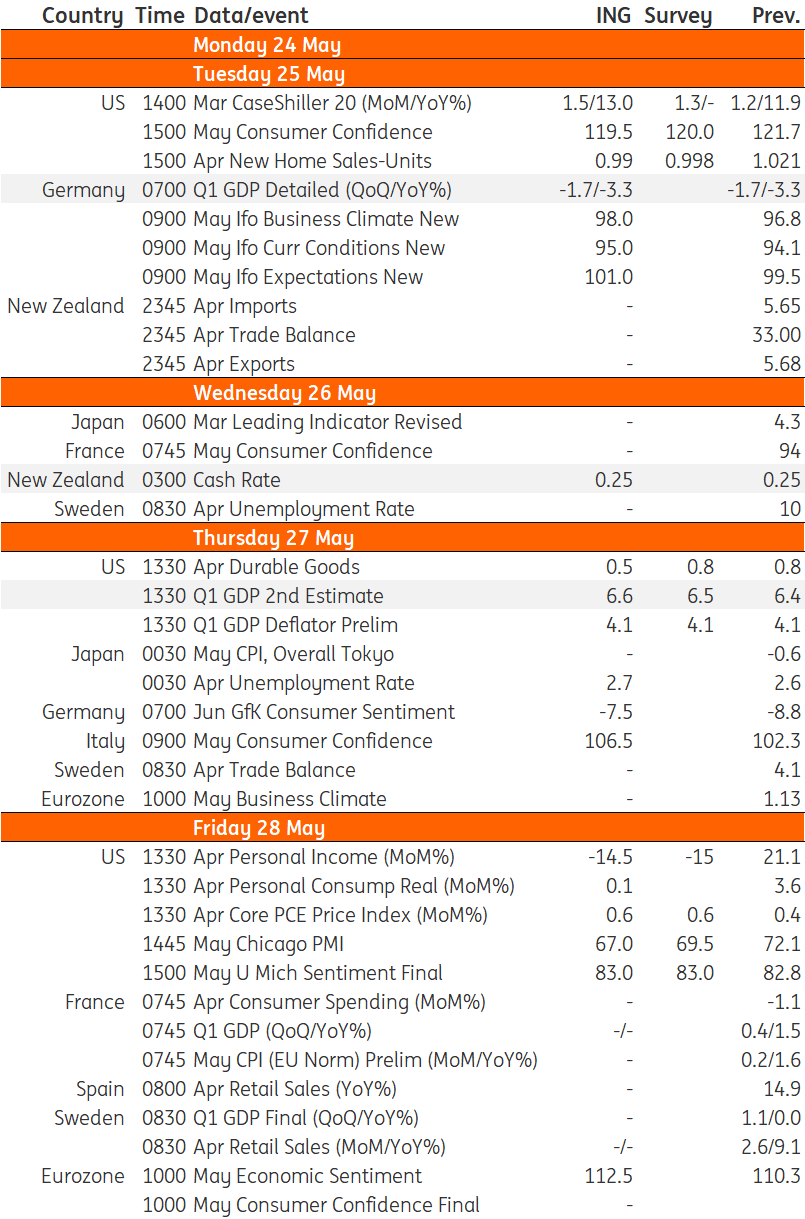

Developed Markets Economic Calendar

Download

Download article

21 May 2021

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more