Key events in developed markets next week

Strong economic activity across developed markets is allowing central banks to end Covid containment measures and begin their tightening cycles

US: QE asset purchases to end early

The Federal Reserve meeting will be the main focus and we strongly suspect that we could see the announcement of the ending of QE asset purchases brought forward from the mid-March end-point currently signalled, to an immediate cessation. In an environment where the economy has fully recovered the lost output from the pandemic, where unemployment is back below 4% and where inflation is at near 40-year highs, it seems strange to say the least for them to continue stimulating the economy. We also expect the Bank to indicate that March is the likely lift-off point for interest rates and confirm expectations that the balance sheet will start to be reduced later in the year. However, policymakers may note some caution on near-term activity relating to Omicron, which has seen consumer caution kick in while increased worker absences on health grounds are also set to have hit the economy hard in the December-January period. Nonetheless, Covid cases appear to have peaked and a swift economic rebound in February and March should allow the Bank to hike rates by 25bp on 16 March.

4Q GDP expectations have been reduced in recent weeks on the back of the softer December activity figures and so we think GDP growth of 5.2% annualised is more likely than the 6% rate we have previously expected. December personal income and spending should back this view, with spending set to fall sharply given the steep decline already seen in the retail sales figures.

Canada: First rate hike of many expected next week

Separately, we now look for the Bank of Canada to raise interest rates 25bp at the 26 January meeting – the same day as the Fed. Activity is strong, the economy is at record employment and inflation is at 30-year highs. Covid containment measures are also set to be eased at the end of the month and this should signal the green light to hike rates. At least three more hikes are likely this year with some analysts expecting as many as five increases.

UK PMIs unlikely to give many Omicron clues

The UK’s services purchasing managers index already staged a fairly sharp fall in December on the arrival of Omicron. And since then, other data suggests the economic impact probably hasn’t been huge, and may have begun to improve in January. Worker illness will have held back production for many industries, particularly consumer services where other surveys have shown absence rates to be highest. But consumer spending, at least at social venues, appears to have begun to rebound now that individuals are less cautious about self-isolating (which was the case ahead of Christmas). We expect a flat or marginally higher PMI reading than December, though we’d note these numbers haven’t had a great track record of predicting GDP moves through the pandemic. Regardless, the Bank of England appears on track to hike rates again in February.

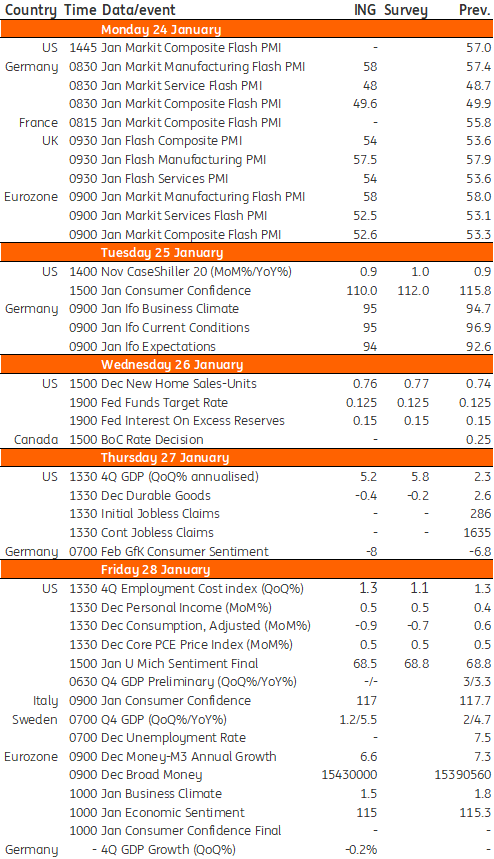

Developed Markets Economic Calendar

Download

Download article21 January 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more