Key events in developed markets next week

The advance release of 2Q18 GDP will be the big release from the US next week while German PMIs and Ifo might shed some light on the possible confidence impact from latest trade tensions. The ECB meeting should almost be a non-event except for the central bank's economic outlook

What trade worries?

The big release from the US next week will be the advance release of 2Q18 GDP. Based on high-frequency data, we think we could see growth rebound to an annualised rate of 4% after a weather-depressed 2% figure for 1Q18. This would be the strongest rate of growth since the third quarter of 2014.

Consumer spending should rebound sharply, while business surveys suggest that investment growth remains strong despite intensifying trade war worries. We also look for inventory building to make a positive contribution to overall GDP growth.

This outcome, coupled with strong jobs growth data and positive sentiment surveys, offers support to our view that the US can grow 3% this year as a whole. With headline inflation close to 3% and the Federal Reserve continuing to talk of “gradual” policy tightening we look for a rate hike in 3Q and another in 4Q with two more likely in 2019. Nonetheless, this is contingent on trade fears gradually easing after the mid-term elections in November 2018. If they don’t, then escalating tensions could have ramifications for capex and hiring in the US, which may lead the Fed to take a more cautious approach to policy tightening.

The ECB could be in a predicament in light of next week's sentiment indicators

Next week’s PMIs and the German Ifo should shed some light on the possible confidence impact from latest trade tensions. Up till now, hard economic data has been close to zero, but a negative sentiment loop cannot be excluded.

A renewed weakening of sentiment indicators at a time of stabilising and positively surprising hard data out of the Eurozone would also bring the ECB new headaches. Except for the ECB’s take on the economic outlook, next week’s ECB meeting should almost be a non-event.

ECB president Mario Draghi will probably try to downplay recent market talks about operation twist or first rate hikes in summer 2019, stressing that a non-active summer of 2019 is possible.

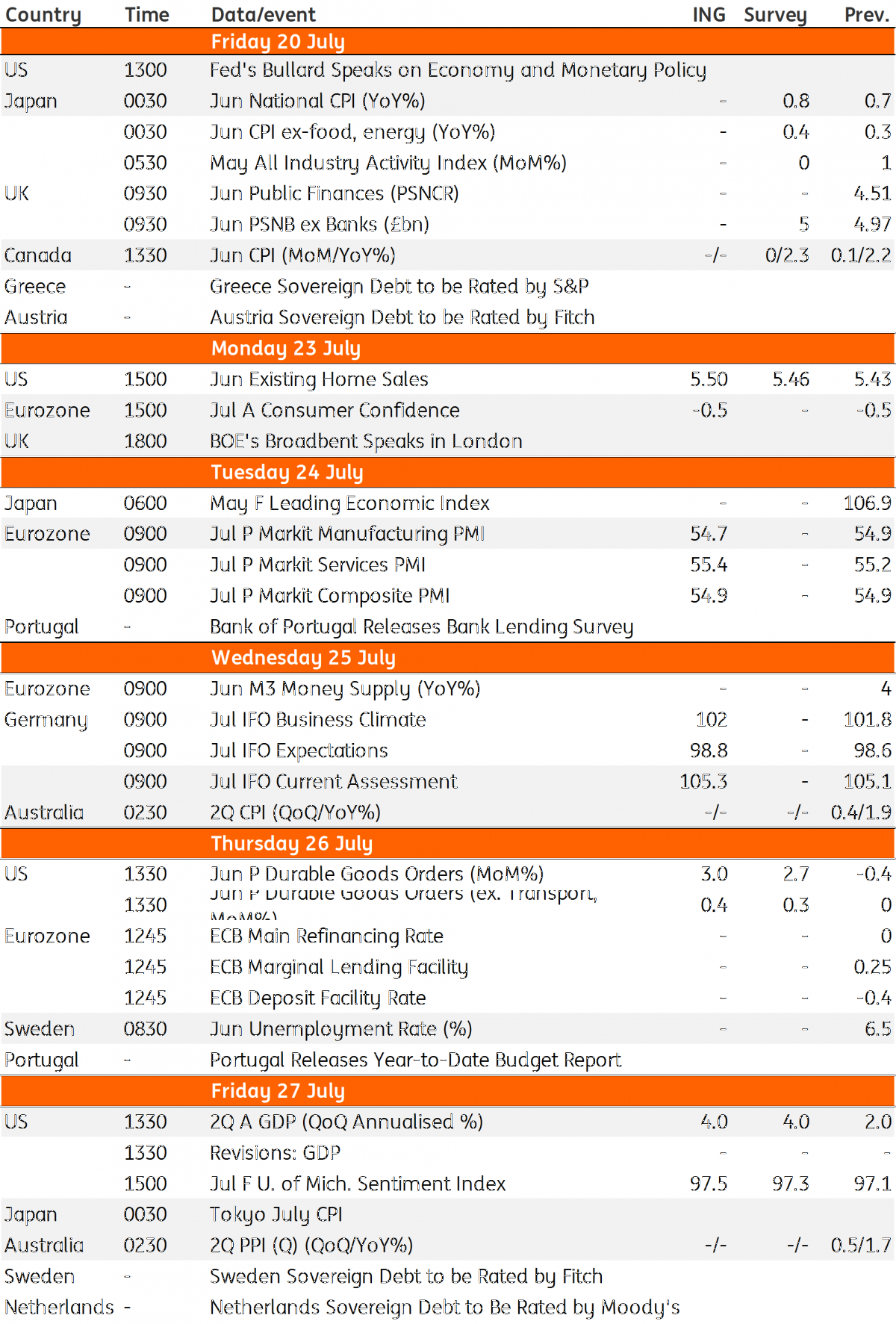

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

19 July 2018

Our view on next week’s key events This bundle contains 3 Articles