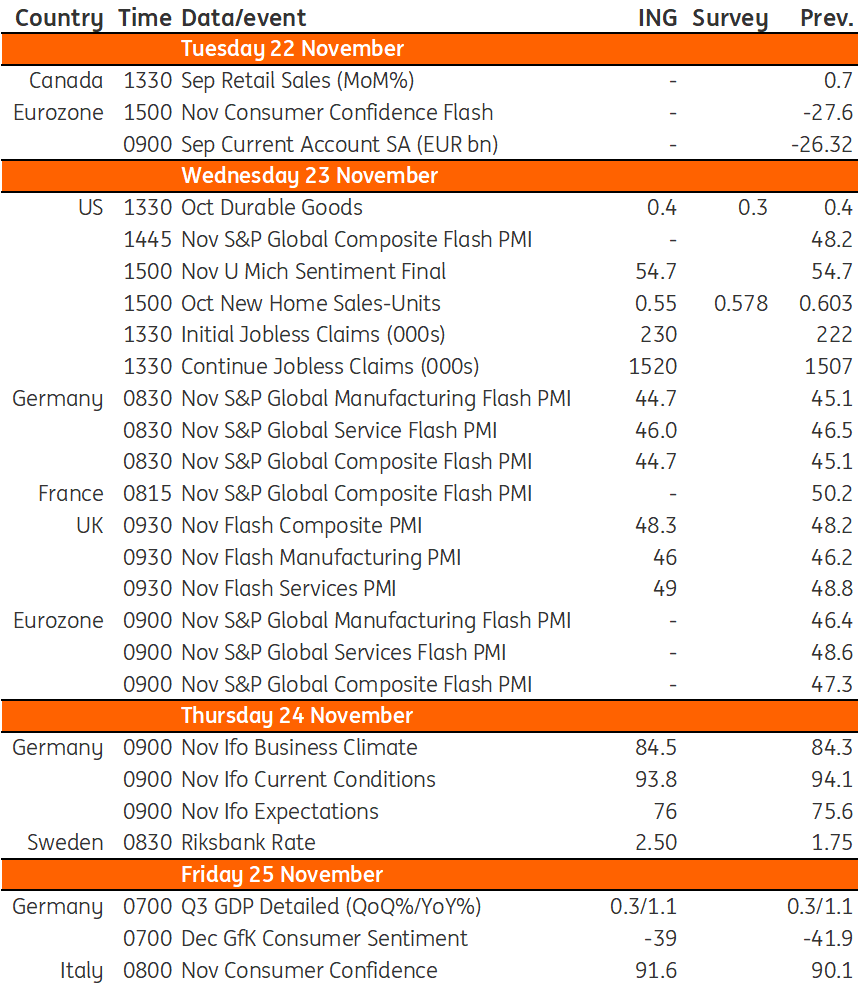

Key events in developed markets next week

With the UK's Autumn Statement out of the way, attention turns back to the economic data which are deteriorating – UK PMIs are likely to re-emphasise the worsening condition and that a recession is coming. In Sweden, the Riksbank is expected to hike by 75bp next week, raising the policy rate to 2.5%

US: Ongoing weakness in housing data

Thanksgiving means a holiday-shortened week in the US with the focus set to remain on the outlook for Federal Reserve policy. Market pricing has switched markedly since the surprisingly soft October CPI print but Federal Reserve officials continue to suggest there is more work to be done to ensure the inflation front is defeated. Indeed, we continue to hear comments suggesting the risk of doing too little outweighs the consequences of doing too much in terms of interest rate increases. Expect more next week.

Data-wise we are looking at ongoing weakness in housing data, but durable goods orders should rise given firm Boeing aircraft orders. Nonetheless, it is doubtful this will be market moving in a meaningful way. The November jobs report on 2 December and the November CPI print on 13 December are the big releases to watch.

UK: Focus switches back to the data and Bank of England

The key takeaway from the UK’s Autumn Statement was that much of the anticipated fiscal pain has been pushed back until after the next election. Chancellor Jeremy Hunt has calculated that calmer financial markets and the announcement of certain tax rises today means he can push back some of the tougher spending decisions, without sparking a fresh crisis of confidence in UK assets. No doubt the Treasury is banking on less aggressive Bank of England rate hikes to lower future debt interest projections, giving scope to water down some of the cuts further down the line. Read more about the Budget announcements here.

With the fiscal event out of the way, attention turns back to the economic data which is clearly deteriorating. Next week’s PMIs are likely to re-emphasise that more companies are seeing conditions worsen than improve right now, the latest sign that a recession is coming. There’s also the question of whether the Bank of England will pivot back to a 50bp rate hike in December, and we think it will, despite some mildly hawkish inflation data in recent days. We’ll hear from a couple of rate-setters next week to help shape expectations ahead of that meeting in a few weeks' time.

Sweden: Riksbank expected to hike by 75bp

Back in September, the Riksbank hiked the policy rate by a full percentage point but signalled that it expected to pivot back to a 50bp rate hike in November. Since then, core inflation has exceeded the central bank’s forecasts by half a percentage point, while the jobs market has remained relatively tight. Given that the ECB has continued with its 75bp rate hikes – and the Riksbank has been vocal about staying out in front of the eurozone’s interest rate policy – we expect further aggressive tightening by Swedish policymakers next week. Remember this is the Riksbank’s last meeting before February, and we therefore expect a 75bp hike on Thursday. We’d expect the new interest rate projection published alongside the decision to pencil in at least another 25bp worth of tightening early next year, but ultimately there are limits to how far it can go given the fragile housing market.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 November 2022

Our view on next week’s key events This bundle contains 3 Articles