Key events in developed markets next week

A third-quarter reading on US GDP and a flurry of central bank policy meetings top the agenda next week. The European Central Bank is not expected to deviate from its plan to unwind quantitative easing by the end of the year and we're not expecting any big moves from the Scandi banks. But Canada will likely raise rates and could signal more to come

US: Still going strong

The US data highlight will be 3Q GDP, with another strong outcome looking likely. Consumer spending continues to be supported by massive tax cuts and a robust jobs market, whilst healthy corporate profitability and a positive economic outlook are encouraging investment. Net trade is likely to swing back sharply after providing huge support to growth in 2Q, but this will at least be partially offset be some rebuilding of inventories. As such, we look for US growth to come in at an annualised 3.6% rate versus the 3.2% consensus and the 4.2% outcome from 2Q18.

Durable goods orders for September should also be good once the volatile aircraft component is stripped out, so this should be more than enough to keep the Federal Reserve in tightening mode. We continue to look for a December interest rate rise followed by three more in each of the first three quarters of 2019.

ECB still set to end QE by December

Despite increased downside risks to the eurozone’s growth outlook, the ECB will not divert from its chosen course to bring QE to an end in December. Expect a slightly more dovish, but still highly determined Mario Draghi at next week’s ECB meeting.

Eurozone confidence data should also prove to be interesting. Readings on consumer confidence and PMI surveys for October may offer clues about the impact of political uncertainty over the Italian budget and Brexit.

Scandi central bank meetings in focus

Both the Riksbank (Wednesday) and Norges Bank (Thursday) hold policy meetings next week. With both having delivered material policy shifts in September, we don’t expect all that much news from either this time around. The Riksbank is likely to confirm its intention to hike rates in either December or February. The improvement in core inflation in September could shift the balance of probability in favour of December. The NB is not delivering new forecasts or holding a press conference, and its statement is likely to remain largely unchanged. But the continued solid price pressure evident in the September figures, combined with a weaker than expected exchange rate and rising oil prices, suggest upside risk to the NB policy stance.

All German Ifo figures are expected to weaken

Given the latest market turmoil and political uncertainty in Germany, it's difficult not to expect a weakening of all three October Ifo measures released next week.

Little reason for the Bank of Canada to keep tightening on hold

The Bank of Canada is likely to continue its gradual tightening path and provide a 25 basis point rate hike when it meets on 24 October. This should be no surprise, as headline inflation has been out of the BoC’s comfort zone for some time now, hitting what it sees as its upper threshold of 3% YoY in July. And with all three of the main core measures floating around the 2% target, there is little reason for the BoC to hold off on pushing policy rates higher.

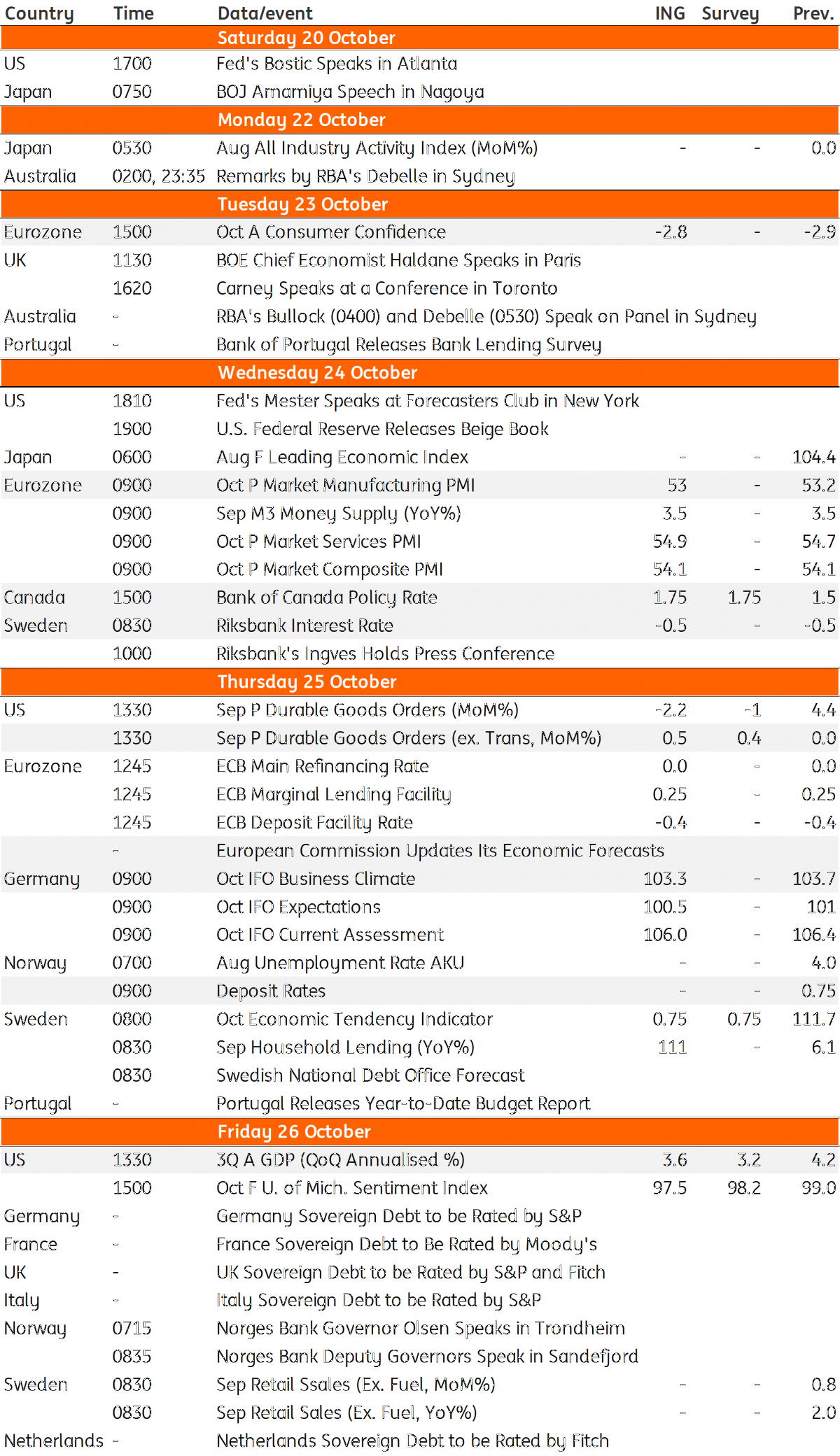

Developed Markets Economic Calendar

Download

Download article19 October 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more