Key events in developed markets next week

Brexit still a hot topic as 'Plan B' will be delivered to UK parliament on Monday, but don't expect things to fire up in the US as the government shutdown is set to continue. Norges Bank meets on Wednesday too, but will they signal a March hike? If so, they could be the only G10 central bank to hike in the first quarter

US: Shutdown strains continue

The record US government shutdown seems destined to enter its fifth week on Saturday with the financial strain it is placing on the 800,000 workers who aren’t receiving their paychecks undoubtedly increasing.

While they represent less than 1% of total US employment, it will mean lower consumer spending in localised areas with high proportions of federal workers, but with nearly half of them not actually turning up to work (furloughed employees), there are broader implications for the US economy. The Department of Commerce, the Department of Housing and Urban Development, the Department of Transportation and the Department of the Treasury are severely impacted, which means a delay in new business permits, processing of federal loans for things such as home purchases and visa applications. This will stifle business activity and weaken economic growth at the margin.

The 420,000 federal employees working without pay include federal law enforcement officers and Transport Security Administration staff. There are already reports that security lines are lengthening at airports as some of those workers affected fail to turn up to work. Indeed, with people struggling to make payments on bills and rent some are taking jobs elsewhere to get some cash. The longer the shutdown lasts, the greater the risk of walkout and disruption at airports and crime agencies, as staff seek paid employment elsewhere -this too will have negative economic implications.

Another implication is that we are not getting the usual data flow from the US, as statisticians have also been furloughed, which makes gauging the performance of the US economy very challenging. In combination to the economic headwinds the shutdown has generated, this only heightens the likelihood of a first-quarter pause from the Federal Reserve.

‘Plan B’ goes to parliament in the UK– but too early for real cross-party progress

Markets have taken comfort in the apparent willingness of the UK government to seek cross-party consensus on Brexit, and that will be the focus when the government returns to parliament on Monday with details of ‘Plan B’.

But in the short-run, hopes for significant cross-party progress may be overdone. The government appears very reluctant to water down its existing red lines, despite suggestions it may inch closer to endorsing a permanent customs union. Doing so would likely raise the hackles of Conservative Brexiteers, which as we noted in more detail, the Labour Party may use as an opportunity to put forward a second motion of no-confidence over coming weeks in the hope some disgruntled Conservative lawmakers decide “enough is enough”. There are no guarantees this strategy would prove successful of course, but this may partly explain why Labour Party leadership are reluctant to endorse a second referendum at this stage, despite pressure from Labour MPs.

In other words, while some cross-party compromise, and in turn an application to extend Article 50 is getting more likely, we aren’t there just yet. In the meantime, the countdown to March 29 continues, and with no imminent resolution in sight, the economy is likely to remain turbulent.

Nothing new from the ECB, but we'll get an insight into Eurozone sentiment

Next week will bring insight into Eurozone sentiment in January. 2018 saw confidence indicators contract by the month, but perhaps the start of the year brings hope. For consumers, there is more to like than last year with lower oil prices and a strong labour market, although downside risks bring ample reason for concern about the global economy. The PMI will bring insight into whether orders continue to weaken, which would fuel worries about a prolonged slowdown in growth.

We don't expect any significant changes at the ECB meeting. ECB president Mario Draghi will probably try to sound somewhat more dovish without giving away any hints at possible changes in the ECB’s stance. Obviously, the downside risks to the growth outlook already signalled in December have not receded, but at the same time, it is still too early to sound the alarm bells. Unless there is a huge accident in financial markets or the economy, we expect the ECB to sit tight and stick to its current forward-guidance and communication until the June meeting.

German Ifo's: Don't expect a miracle

As regards Germany, the Ifo index will not yet show any turnaround in sentiment. Instead, rather expect another weakening on the back of increased uncertainty.

Norges Bank to signal a March rate hike

The key event in the Nordics next week is the Norges Bank (NB) meeting. While we don’t expect a change in policy this time around, the central bank is likely to confirm its intention to raise rates in March.

While a downward revision may temper this hawkish signal to the forecast for interest rates and increased concern about momentum in the global economy, the likelihood is that the NB will be the only G10 central bank hiking rates in the first quarter. This underlines the relative strength of the Norwegian economy and remains a key reason why see NOK as likely to outperform peers this year.

Meanwhile, Sweden looks likely to finally have a new government after four months of stalemate ended this week with a complicated accord among four centrist parties that will support a minority government led by the Social Democrats. This removes the risk of new elections in the near term, though the new government will face a continuous balancing act between pushing through market-friendly reforms demanded by the Centre and Liberal parties and placating the Left. On balance, the new government’s policy mix – somewhat lower taxes, increased spending, and reforms to the labour and housing markets – should help a slowing economy over the next couple of years.

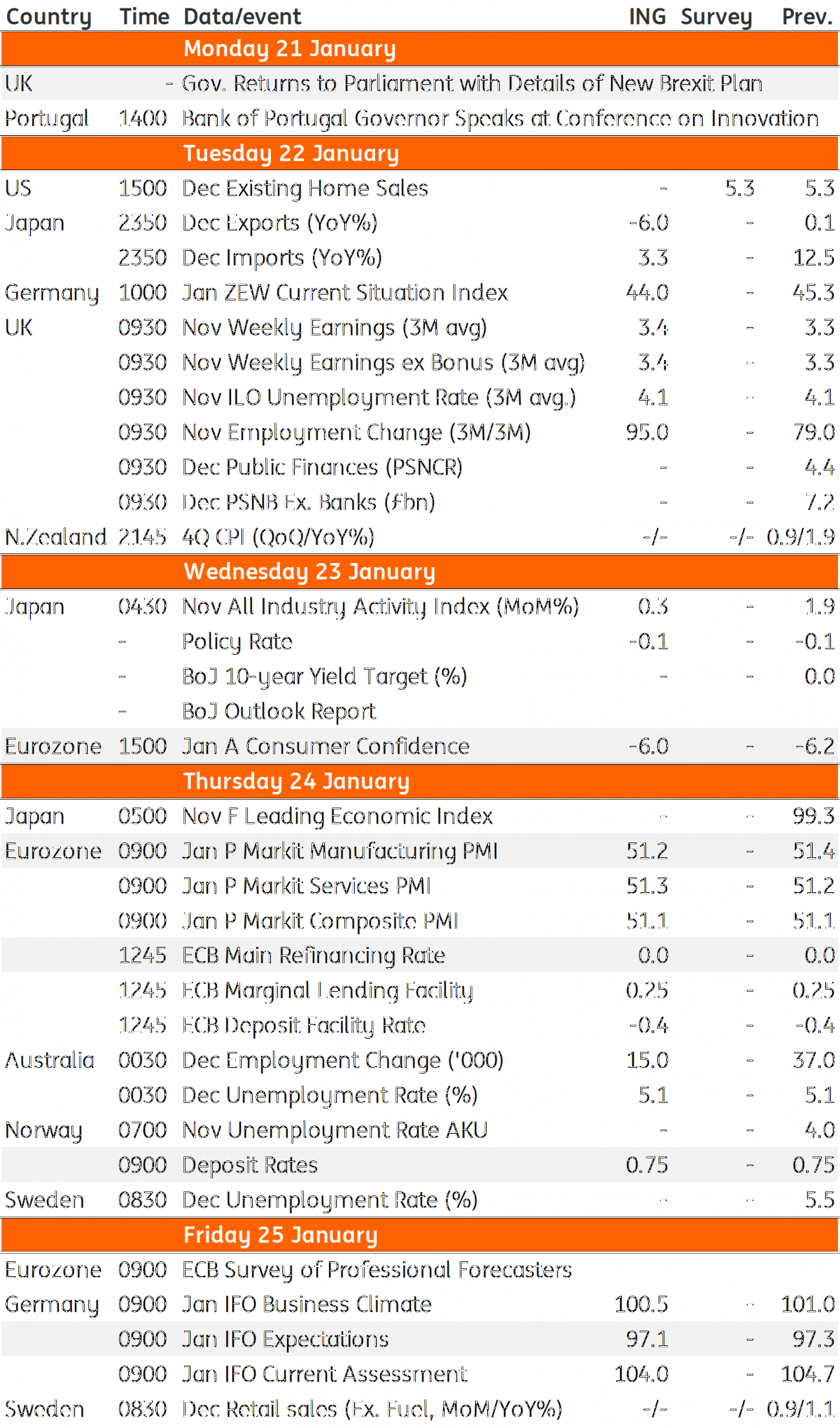

Developed Markets Economic Calendar

Download

Download article18 January 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more