Key events in developed markets next week

The eurozone's weak performance will be seen through the lens of PMIs next week. We also have some US second-tier releases but nothing which will stop the Fed hiking in December

US: On course for a December hike

We get a few second tier US data releases over the coming week, but none of them are likely to alter the outlook for the December FOMC meeting, where we have a high conviction call that the Federal Reserve will raise its main policy rate by 25 basis points for the fourth time this year.

The economy is growing strongly, inflation is above the Federal Reserve’s 2% target and the jobs market is robust, with wage pressures on the rise. Given good momentum we expect the Fed to continue hiking interest rates next year. However, they are likely to be less aggressive than in 2018 – we expect three rate moves next year. The economy is facing more headwinds with the lagged effects of higher interest rates and a strong dollar set to slow growth, while trade tensions and weaker external demand are also a threat.

Furthermore, there are some tentative signs of softness in real data, particularly the housing market and investment. The durable goods orders report is already pointing to a slower path ahead for corporate investment while higher mortgage rates are resulting in a slowdown in the housing market. Next week’s data is likely to give us more information on whether this is something that is becoming more troubling.

Eurozone weakness through the lens of confidence data

In the eurozone, confidence data will be released. After the dismal third quarter, PMIs will be closely watched to get a sense of economic performance in November. With downside risks ever present, a strong bounce back from the weak 3Q performance seems unlikely.

Canada: Energy will put upward pressure on prices

Canada’s inflation in September was -0.4% month-on-month, largely undershooting expectations. But we're unlikely to see a similar figure in October; we forecast 0.2% MoM, with the main contributor likely to be energy prices.

The oil price rally started at the back-end of September, meaning price gains only made a mild impact and were actually down on the month; the majority of the gains will be seen in October gasoline prices. And despite a high base, there should be an uptick in energy prices on the year too – though more moderate than expected; the heavy WCS discount to WTI and Brent crude will likely add some negative impetus. This should keep the headline print sitting above the Bank of Canada’s 2% inflation target; we forecast a healthy 2.3% YoY.

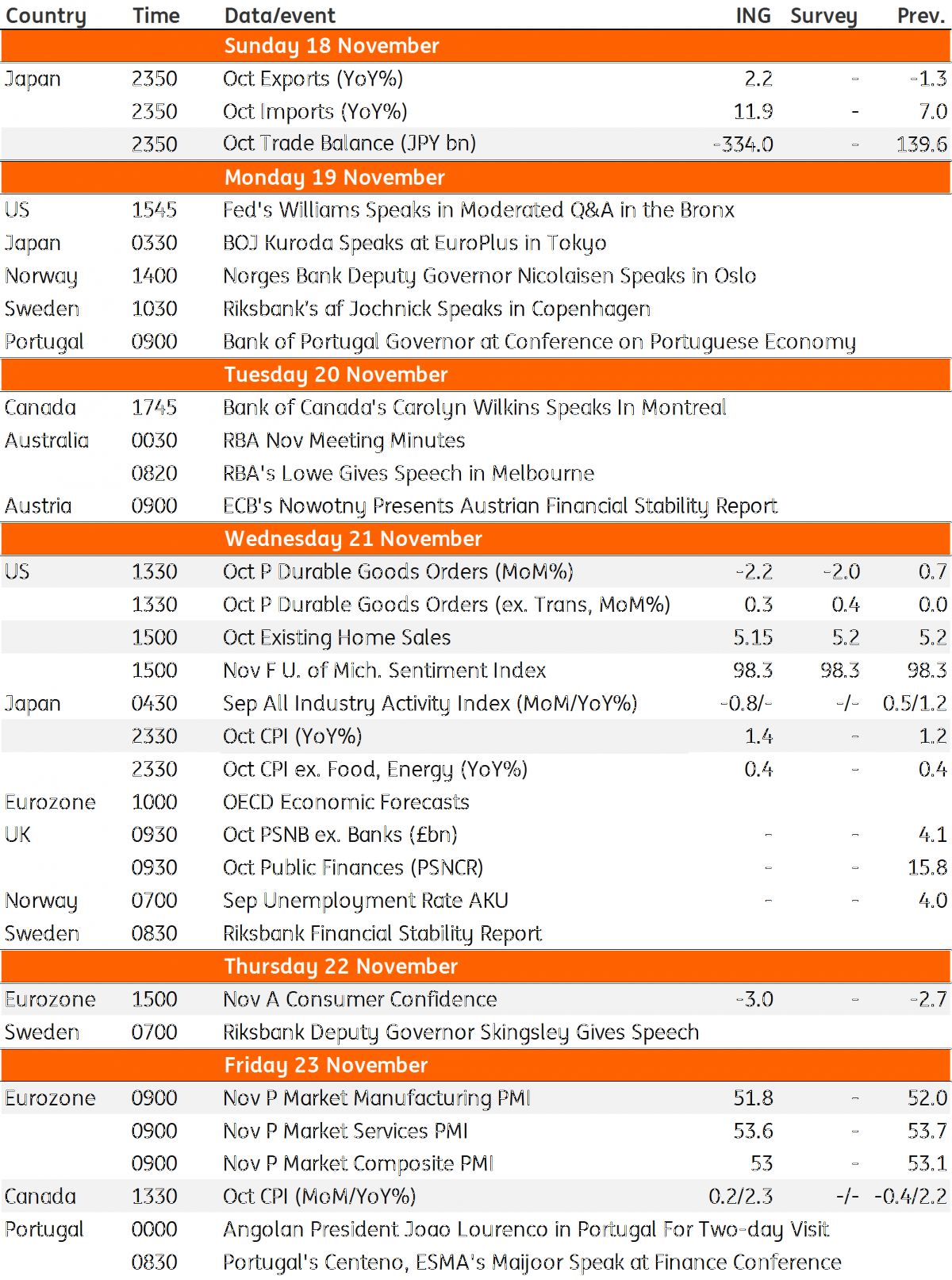

Developed Markets Economic Calendar

Download

Download article

16 November 2018

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more