Key events in developed markets next week

All eyes are on the European Central Bank meeting next Thursday, when we are expecting a hike of 25bp

Despite increasing expectations of the larger hike, we believe the Fed will repeat June's move

The market is split as to whether the Federal Reserve will raise rates by 75bp or 100bp on 27 July. The strong June US inflation print of 9.1% and the Bank of Canada’s decision to raise its own policy rate by 100bp have helped fuel expectations of a larger hike. However, the weakening economic growth outlook and the fact that two of the most hawkish FOMC members, Chris Waller and James Bullard, have hinted they favour 75bp means we think they will indeed opt to repeat June’s 75bp move.

Given there is the usual Fed blackout period starting on 16 July, there will be no additional comments from officials to provide guidance – although that doesn’t rule out someone getting in touch with the Wall Street Journal should there be a material change. In any case, the data flow is largely second-tier with an update on the housing market, which given rising mortgage rates is likely to remain under pressure.

Bank of England gearing up for 50bp August hike, despite little impetus from domestic data

On the face of it, next week’s data is unlikely to offer too much in the way of support for a 50bp rate hike in August. Another notch higher in the unemployment rate and a slight uptick in inflation will come as little surprise to the committee, which only a few weeks ago resisted pressure to step up the pace of rate hikes, opting instead for another 25bp move. However, the potential for another 75bp rate hike from the Fed, mounting worries among Bank of England hawks about GBP weakness, and earlier explicit warnings about more aggressive hikes from officials, suggest the Bank may well be tempted to join the growing number of central banks that have opted for larger rate increases. We narrowly expect a 50bp rate hike in August, though this may well be a one-off. Our central view is that the Bank of England will stop hiking when the Bank rate gets to roughly 2%.

Bank of Canada's 100bp hike was only the beginning – more to come

In Canada, we will be closely following inflation data, which will hit new highs on rising gasoline, but there will be broad gains elsewhere too. The central bank's 100bp hike on 14 July was to “front load” tightening to ensure inflation expectations remain anchored, but an upside surprise in CPI could heighten fears it repeats the move in September. Currently, we favour a 75bp hike.

ECB's first hike in 11 years: 25bp or 50bp?

It’s ECB week next week, so naturally all eyes are on the Thursday meeting. Expect the ECB to fiercely debate whether the first hike in 11 years will be just 25bp or perhaps 50bp after all. Also key out of next week’s meeting will be the anti-fragmentation tool which investors will watch closely to see how robust it can be to curb spreads in the eurozone. With Italian political problems surfacing, an additional challenge is added to next week’s meeting. While summer meetings at the ECB can be dull, this one clearly won’t be. Also important is how much the economy is cooling off in the eurozone. Next week’s PMI and consumer confidence data will give some evidence of that. This will be especially important for how much the ECB will hike in the coming cycle and we expect the economy to cool enough to keep the ECB's cycle quite limited.

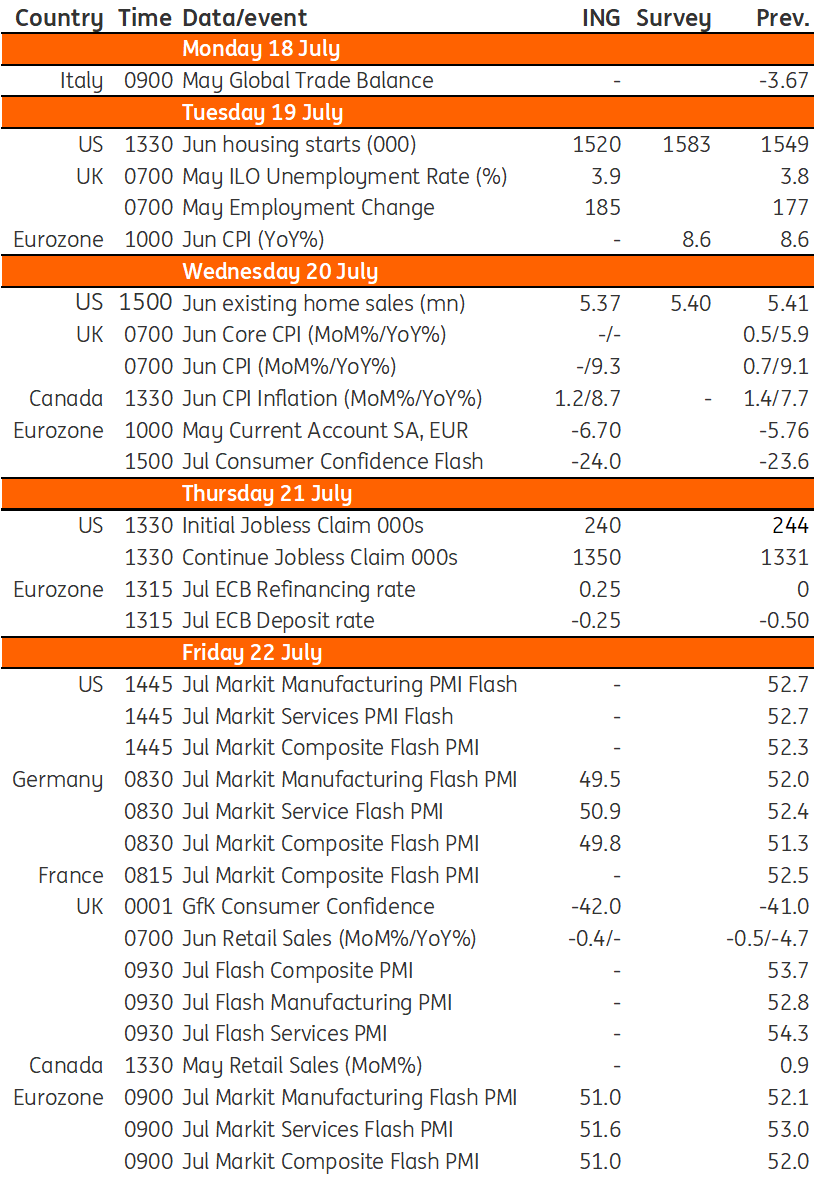

Developed Markets Economic Calendar

Download

Download article15 July 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more