Key events in developed markets next week

Markets to continue digesting the ECB's latest decision, the Bank of England to hold with questions surrounding an August rate hike and Norges Bank to become relatively more hawkish. All in all an exciting week for developed markets

ECB speeches and Eurozone data

Markets will further digest the latest ECB decision and central banker speeches will be in focus as the ECB organizes their annual getaway to Sintra again. But watch Eurozone confidence data as it will give a read on whether June has marked the end of the Eurozone soft patch.

Bank of England in focus as markets increasingly doubt summer rate hike

Has the UK economy done enough to give the Bank of England sufficient conviction to hike rates over the summer? That’s the question investors will be trying to answer as the Bank meets next week, and the answer is still very unclear. The BoE was pretty blasé about the first quarter slowdown when it met in May, noting that it was largely weather-related. The data since then has been pretty mixed, and markets have tempered their expectations for the August meeting.

With wage growth picking up, we suspect policymakers would like to hike rates then if they can. Purely based on recent policymaker commentary, we still feel an August hike is slightly more likely than not – but there’s still a long way to go before then. We doubt the Bank will want to pre-commit to anything next week – after all, there are still plenty of risks, not least in the retail sector, that could yet force the Bank of England to put its tightening plans on ice for a little while longer.

Norges Bank to project September rate hike

The key event in Scandinavia next week is the Norges Bank (NB) policy meeting on Thursday. We expect the NB will stick to projecting a first rate hike in September, making the Norwegian central bank a relatively hawkish outlier among European central banks.

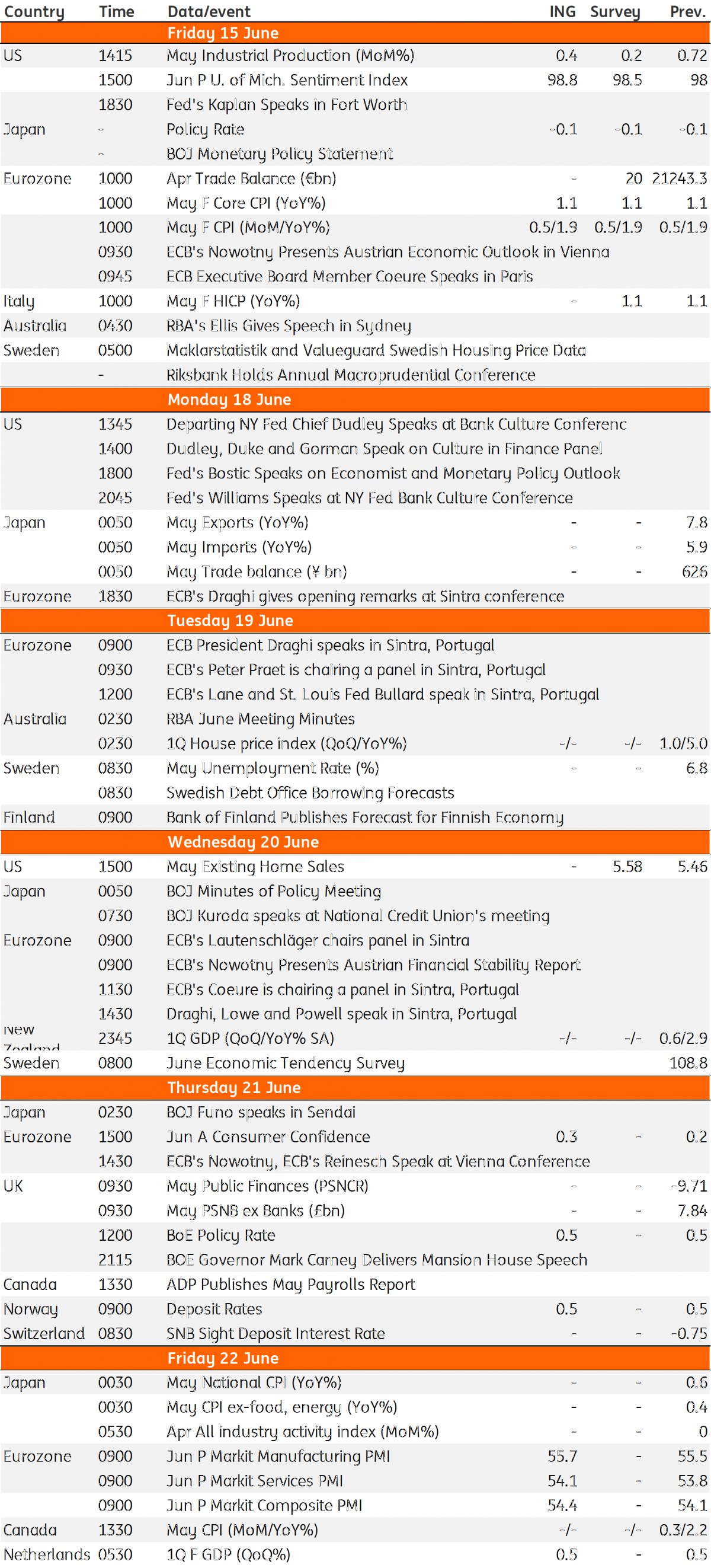

Developed Markets Economic Calendar

Download

Download article15 June 2018

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more