Key events in developed markets next week

'Brink of recession and trade tensions mount' are both phrases we've used time and time again over the past few months' and next week isn't going to change. The US and China could be inching closer to a deal, but Trump's threats of European auto tariffs remains a concern. And with many floating the r-word in the Eurozone, PMI's will be watched closely

US: Tracking trade

Trade news will be the main focus next week. Recent comments have suggested the US and China may be inching closer to a deal that can prevent (or at least delay) additional tariffs on $200 billion of imports from China. President Trump has signalled a desire to do a deal and has proposed a summit in March, but this will require China making concessions on intellectual property and technology sharing in addition to simply buying more American products.

However, there is a clear concern in Europe that President Trump could be pivoting his attention towards them. We are awaiting the Department for Commerce’s Section 232 decision on whether importing cars is a national security issue (by harming the US auto industry). If so this could lead to additional tariffs on car imports, which would clearly hurt European automakers.

Such a development would likely be taken negatively by markets as it would risk a direct response of tariffs from the EU and a step up in tensions. Businesses and consumers will face higher prices in such a scenario along with the likely disruption to supply chains - and all of this could see a repeat of the steep equity market falls which were seen in late 2018.

Eurozone: Floating with the r-word

The Eurozone PMI will be among the most closely watched figures next week. The r-word has been used out loud already as the January PMI dropped to just 51 (anything below 50 signals contracting activity). The February PMI will give a sense of if we're going to see a turnaround in growth figures, or whether we will move even closer to stagnation halfway through the first quarter.

Over in Germany, the narrative is that confidence indicators should bring the first tentative signs of a bottoming out after the recent stretch of disappointing macro data.

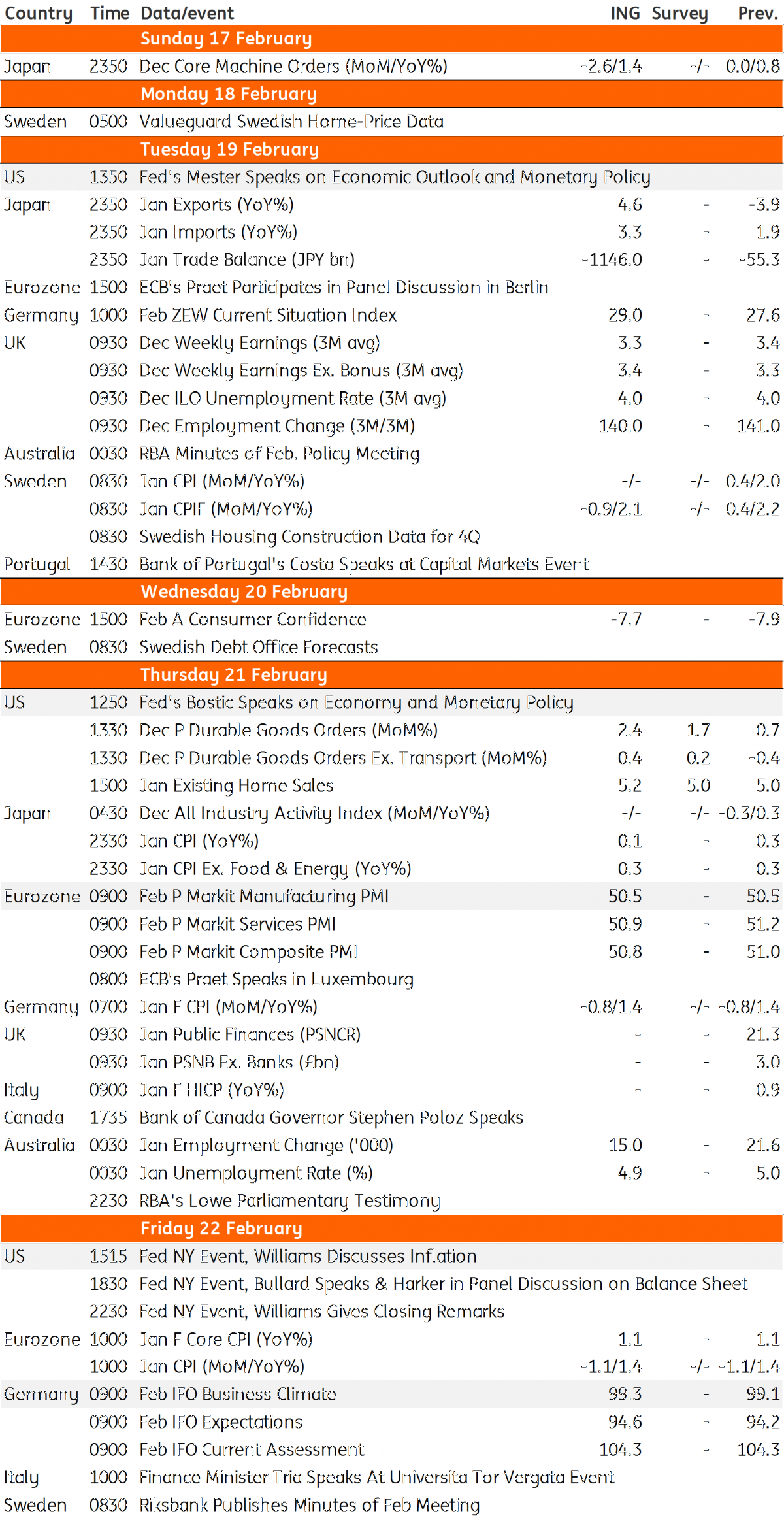

Developed Markets Economic Calendar

Download

Download article15 February 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more